Content

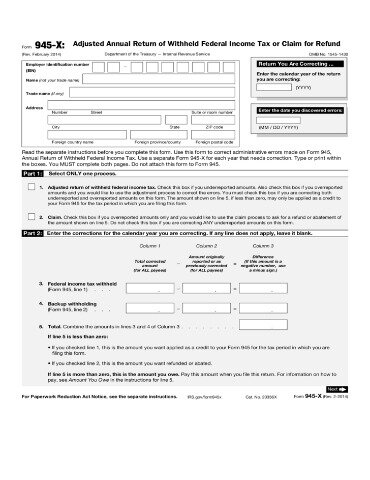

Most people have a portion of their paycheck withheld to pay the federal income tax and, in some cases, a state tax as well. After deductions and tax credits are figured in, the amount paid often exceeds the actual amount owed, and a tax refund is issued. If you didn’t have any federal taxes withheld from your paycheck you may still get a refund, but there is a chance you could owe taxes instead. The W4 is a form that you complete and give to your employer for federal tax and the equivalent form for state tax withholding. The W-4 communicates to your employer how much federal and/or state tax you – and your spouse if s/he works – wish to have withheld from each paycheck in a pay period.

Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. OBTP# B13696 ©2020 HRB Tax Group, Inc.

If I Dont File My Taxes, Can I Still Claim My Refund?

Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Description of benefits and details at hrblock.com/guarantees. Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. You’ll need to file a Schedule C to report the income and any expenses related to that income.

- Plug your newly calculated withholding information into apayroll calculator.

- The eFile tax app will report your situation on your return based on your answers to straightforward tax questions.

- Small Business Small business tax prep File yourself or with a small business certified tax professional.

- There’s no way around that requirement.

- Find additional resources on eFile.com below.

As with the changes for multiple jobs and working spouses, the new W-4 form makes it easier to adjust your withholding to account for tax credits and deductions. There are clear lines on the revised form to add these amounts—you can’t miss them. Including credits and deductions on the form will decrease the amount of tax withheld—which in turn increases the amount of your paycheck and reduces any refund you may get when you file your tax return. The IRS had plenty of unhappy customers during the 2019 filing season.

Understand Tax Withholding

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Line balance must be paid down to zero by February 15 each year.

If you made any estimated tax payments during the year and they are more than your tax, you would receive a refund. There are also cases where even if you filed exempt you may receive a tax refund if you are eligible for refundable tax credits like the Earned Income Tax Credit. All employees are supposed to pay them via federal withholding, unless an exception applies.

Refundable tax credits, on the other hand, can result in cash back. These are tax credits that can create negative tax liability resulting in a tax refund, even if you haven’t paid taxes. You might have claimed to be exempt from withholding on your Form W-4.

Known as the saver’s credit, this non-refundable credit allows the lesser of either $1,000 or the tax amount you would have had to pay without the credit. If you’re eligible for one of these six tax credits, it’s definitely worth filing your federal income taxes. However, if you had any tax liability at all in the previous year, or you expect to owe for the current year, you can’t be considered exempt. Those who are exempt, though, won’t have taxes taken from their paychecks.

Why Was No Federal Income Tax Withheld From My Paycheck? Why Would My Employer Do That?

A tax credit is an amount of money that people are permitted to subtract, dollar for dollar, from the income taxes that they owe. Don’t assume that just because you didn’t make enough money to file a return you shouldn’t file. Many tax credits are available to you even if your tax bill will be essentially zero this year. Some of the credits are more than $1,000, so taking the time to read about the credits available to you could result in a healthy refund check this year. The American Opportunity Tax Credit reimburses taxpayers up to $2,500 a year for qualified education expenses. This credit was recently expanded to allow those who do not owe any taxes to still qualify for a refund even if they wouldn’t have normally filed a return.

And the IRS doesn’t save or record the information you enter in the tool. If you have multiple jobs or a working spouse, complete Step 3 and Line 4 on only one W-4 form. To get the most accurate withholding, it should be the form for the highest paying job. Figuring out how many allowances to claim was a big headscratcher for a lot of employees, so they probably won’t be missed.

Bear in mind that you need to have enough tax withheld throughout the year to avoid underpayment penalties and interest. You can do that by making sure your withholding equals at least 90% of your current year’s tax liability or 100% of your previous year’s tax liability, whichever is smaller.

Use A Tax Withholding Estimator

As a wage earner, you determine the amount of money you ask your employer to take out or withhold from each paycheck or pay period as taxes or tax withholding with the W-4 Form. This amount is an important factor on whether you will owe taxes or get a tax refund when you e-File your next tax return. The point of a tax refund is for the government to return some of the money that you have overpaid.

Ideally, you want your annual withholding and your tax liability for the year to be close, so that you don’t owe a lot or get back a lot when you file your return. If your tax withholding is off kilter, go ahead and submit a new W-4 as soon as possible. This is especially important if you have a major change in your life, such as getting married, having a child, or buying a home. Even if you don’t have to pay taxes on the income you’ve earned, there are still several reasons why filing a return may indeed be worth it.

You will notice on the new W-4 Form that the concept of Allowances to control your paycheck IRS tax withholding has been eliminated. Use the eFile.com PAYucator to calculate your IRS Tax Withholding Amount for your paycheck. Plus, you can use the WITHHOLDucator to estimate your next return based on your personal tax return goals.

Calculate your income and deductions based on what you expect for this year and use the current tax rates to determine your projected tax. The tax refund you may receive at the end of a tax year is not free money. When you receive a check or your direct deposited refund, you are receiving money that was rightfully yours to begin with. Optimize your withholding using our free calculators and keep more of your paycheck each pay period. Use that extra money to pay off any debts instead of relying on a big check in April. Changes to federal taxes enacted under the Tax Cuts and Jobs Act means many people who didn’t update their W-4 form likely had less tax withheld from each paycheck in 2020. The old W-4 form and instructions didn’t mention income from self-employment.

Here’s How To Choose Diy Tax Software According To Tax Expert Kathleen Delaney Thomas

Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.