Content

While at law school, I interned at the estates attorney division of the IRS. At IRS, I participated in the review and audit of federal estate tax returns. At one such audit, opposing counsel read my report, looked at his file and said, “Gentlemen, she’s exactly right.” I nearly fainted.

These are all reasons and I hope that it has helped.God bless you. You can put as many dependent a down but while claiming children you only get money back for 3 so you should allow your sons father to claim him. Childcare is expensive, but Uncle Sam can help you out with the cost. If you are working or actively seeking work, and you pay childcare for your dependent who is under the age of 13 , you can claim the Child and Dependent Care Credit. Even though the dependency exemption was eliminated under tax reform, there are still some tax benefits you can take advantage of to maximize your tax refund if you have kids and other dependents.

You must provide at least half of the child’s financial support during the tax year. In other words, the child cannot have provided more than half of his/her own financial support. The IRS uses the Consumer Price Index to calculate the past year’s inflation and adjusts income thresholds, deduction amounts, and credit values accordingly. This includes self-employment tax, alternative minimum tax, and household employment taxes.

What Is The 2013 Child Tax Credit & Additional Child Tax Credit?

By doing so, it should also boost their Social Security retirement benefits, which are based on a person’s work history. Higher Social Security benefits, in turn, reduce the extent and severity of poverty among seniors.

If you made LESS money than before it could lessen your refund as easily as earning MORE income this tax year. If you had more income that you did not report, you have 3 years to file an amended return to include all income earned. 1) The Child and dependent care credit is not dollar-for-dollar what you paid.

You receive an exemption for yourself, your spouse and one for each of your dependents. The number of children you claim as dependents is not always the same number of children who qualify you for the EITC. If the time is equal, the parent with the higher adjusted gross income takes the credit. The refundable tax credit you can receive ranges from a maximum of $6,660 if you have three or more children, to $538 if you have no children for tax year 2020.

Search Turbotax Support

Adjusted gross incomeAdjusted gross income is calculated by subtracting all deductions from lines 23 through 33 from your total income. AGI is used to calculate many of the qualifying amounts if you itemized your deductions. Your child must not have filed a joint return with his or her spouse unless it was only filed to claim a refund and he or she was not required to file a return. However, you must file a tax return to qualify for the credit, even if you otherwise would not need to file. Thanks to the EITC, you can get money back even if you didn’t have income tax withheld or pay estimated income tax.

The deduction worksheet shall be prepared by the Department of Human Services and shall be published by the Administrative Office of the Courts. The IRS sent a deficiency notice to Ms. Sharp, disqualifying her child-related tax deductions and head of household filing status. If you turned 65 on January 1, you are considered to be 65 as of December 31 of the previous tax year.

The Obama proposal would benefit about 1.5 million noncustodial parents, the Treasury Department estimates. By helping them succeed in the labor market, a larger EITC can also help them meet these other responsibilities, including serving as a role model to their children.

If you employ one, you may be required to allocate Social Security, Medicare and unemployment taxes; and may need to report the wages you paid to the IRS via a W-2. If you hired a caregiver through an outside agency, you might be off the hook for those responsibilities. Talk to your tax attorney or accountant for more information about nannies and caregivers. The qualifying child and qualifying relative tests are available by clicking the IRS link above. Special rules apply for people receiving support from two or more people.

Ii Credits Promote Work, Reduce Poverty, And Support Childrens Development

Before these changes, the American Taxpayer Relief Act of 2012 had increased the CTC from $500 per child, its pre-2001 level, to $1,000 per child. It also temporarily extended the provisions of the American Recovery and Reinvestment Act of 2009 (the anti-recession stimulus package) that reduced the earnings threshold for the refundable CTC from $10,000 to $3,000 . The Bipartisan Budget Act of 2015 made the $3,000 refundability threshold permanent.

- It was a short jump from there to practicing, teaching, writing and breathing tax.

- By doing so, it should also boost their Social Security retirement benefits, which are based on a person’s work history.

- These figures do not count working spouses who are not part of the relevant demographic group , or spouses who are part of the relevant demographic group but who do not work.

- There are exceptions and additional rules that can impact whether a particular business or investment income is subject to the NIIT.

- Like the earned income amount for the EITC, the $10,000 earnings threshold was indexed for inflation.

At the end of the filing year, the child was under age 19, or younger than 24 and a full-time student for at least 5 months of the year. The child must be younger than you (or your spouse if you file a joint return.) He or she can be any age if permanently and totally disabled.

For instance, if you paid $6,000 for childcare for one child for the year you may expect to get a $6,000 credit, but you get up to 35% of $3,000($1,050) and the percentage depends on your income. This tax benefit may also be phased out at certain income levels. LITTLE ROCK — When children arrive, so do parental responsibilities — and tax deductions. The Child Tax Credit helps working families offset the cost of raising children. Late last year, Congress approved nearly $11 billion to fund the Internal Revenue Service for fiscal year 2015 – the lowest allotted amount since 2008, according to CNN Money. As a result, the IRS announced delays in processing refunds, particularly for those who file paper returns – all the more reason to do your taxes sooner rather than later if you’re expecting money back from the government.

Other dependents—including children ages 17–18 and full-time college students ages 19–24—can receive a nonrefundable credit of up to $500 each. While her boyfriend’s grandchildren were living with her, Ms. Sharp incurred expenses for their care, including clothing, school materials and activities.

2) The additional self-employment tax of 15.3% may also be impacting your taxes. I been working at my job for over a year and this year im having my first child will i be able to claim her an if so how much do u think ill get back. I went from working hour a week to because im pregnate an she is due dec 3. How much can i get back for claiming one dependent whose 2 years old and i made only in 2014.

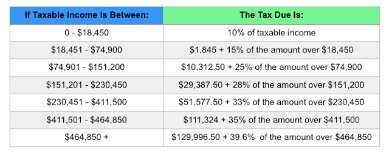

Families receive a refund equal to 15 percent of their earnings above $3,000, up to the credit’s full $1,000-per-child value. For example, a mother with two children who works full time at the federal minimum wage — earning $14,500 in 2016 — will receive a refund of $1,725 (15 percent of $11,500). As the figure below shows, the credit phases out at higher income levels. The amount of the EITC depends on a recipient’s income, marital status, and number of children.

Tax Deal Makes Permanent Key Improvements To Working

Enter your filing status, income, deductions and credits and we will estimate your total taxes. Based on your projected tax withholding for the year, we can also estimate your tax refund or amount you may owe the IRS next April. The Tax Court also found that Ms. Sharp was not the common law wife of Mr. Griffin, which would make Mr. Griffin’s children her step-grandchildren, as she argued. The Tax Court held that the boyfriend’s grandchildren were not qualified as dependents of the taxpayer. The added income from these credits also has been linked with significant increases in college attendance by making college more affordable for families with high-school seniors. Recent ground-breaking research suggests that the EITC and CTC help families at virtually every stage of life.