Content

A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited.

A financial advisor can help you limit your tax liability in a variety of ways. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now. Still, if you’re eligible for both a tax credit and a deduction for the same expenses, crunching some numbers can help you determine which one will offer the biggest break at tax time. Here are some examples of deductible expenses for tax year 2017.

TurboTax Live CPAs and Enrolled Agents are available in English and Spanish, year round and can even review, sign and file your tax return. Just about everyone qualifies for the standard deduction. Finally, the recovery rebate is not taxable. It will not add to taxable income in 2020 . It was based on either the taxpayer’s AGI for 2018 or 2019 . But it technically applied to 2020 AGI (for which a return couldn’t have been filed yet), so there may be some discrepancy. At Bankrate we strive to help you make smarter financial decisions.

Baby Tax Write

Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

- A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax the taxpayer owes.

- The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

- Since this is income that would’ve been taxed in the 22% tax bracket, the deduction would save you $440.

- Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

Christina founded her own accounting consultancy and managed it for more than six years. She co-developed an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s in business administration/accounting from Baker College and an MBA from Meredith College. For tax years between 2018 and Dec. 31, 2025, there is no overall limit on itemized deductions. The Tax Cuts and Jobs Act of 2017 repealed previous limitations that applied to upper-income taxpayers.

Tax Exclusions Vs Tax Deductions Vs. Tax Credits In Healthcare

Please be aware that you are linking to a website not affiliated or operated by the credit union. Rivermark is not responsible for the content of this website.

You subtract deductions from your income before calculating how much taxes you owe. How much a deduction saves you depends on your income tax bracket. Tax deductions lower your taxable income for the year.

App Store is a service mark of Apple Inc. Residential energy-efficient property credit — As a homeowner, if you’ve invested in making your home more energy efficient, then you may be able to deduct those investments.

Refundable Vs Nonrefundable Tax Credits

Contributions to a health savings account — If you have a high-deductible health plan and contribute to an HSA in conjunction with that plan, your HSA contributions are generally tax deductible. This article was fact-checked by our editors and Christina Taylor, MBA, senior manager of tax operations for Credit Karma Tax®. Portions of this article have been updated for the 2020 tax year. Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. We believe everyone should be able to make financial decisions with confidence.

These are known as “refundable” tax credits. Tax credits are always refundable or nonrefundable. Tax credits and tax deductions are two quite different things.

Deductions For Individuals

How much you can deduct depends on your filing status. The largest standard deduction is set aside for married couples filing a joint tax return. Tax Calculator by Chris Hutchison Estimate how much you’ll owe in federal taxes, using your income, deductions and credits — all in just a few steps. Just as with tax credits, taking certain deductions requires meeting certain qualifications based on your filing status, current life events and the amount of your income that’s taxable. Be sure you meet IRS criteria to qualify for both tax credits and deductions. Refundable credits can offset certain types of taxes that normally can’t be reduced in other ways. Tax liabilities can be reduced by tax credits.

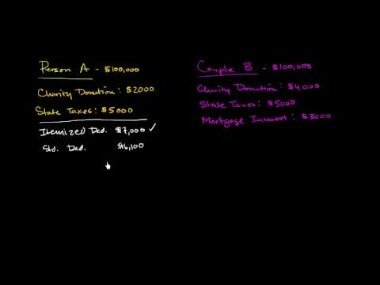

If you have a total IRS bill of $1,000 and get a $1,400 refundable credit, you could actually get back $400 more than you paid in. Say you’re a single tax filer with $50,000 in taxable income. If you’re eligible for an additional $2,000 tax deduction, the deduction would reduce your income from $50,000 to $48,000. The savings would come from not paying taxes on the $2,000 that you were allowed to deduct.

Keep in mind that your ability to claim certain deductions may be limited depending on your filing status and household income. Another thing to remember is that you can’t claim a credit and a deduction for the same qualified expense. If you paid out-of-pocket to go back to school for a graduate degree, for example, you couldn’t claim the tuition and fees deduction and the Lifetime Learning Credit. A refundable tax credit, on the other hand, can help boost your tax refund. The Earned Income Tax Creditis a refundable tax credit. There are also partially refundable tax credits, like theAmerican Opportunity Tax Credit.

With deductions, you can take either the standard deduction or you can itemize, but you can’t do both. If itemized expenses, such as medical bills, home mortgage interest and charitable donations, are higher than your standard deduction, you will save more money by itemizing. If a refundable credit is greater than your total tax obligation, the IRS will send you the difference in the form of a tax refund. Bankrate.com is an independent, advertising-supported publisher and comparison service.

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

Some tax credits are only partially refundable. The Child Tax Credit became refundable (up to $1,400 per qualifying child) in 2018, as a result of the Tax Cuts and Jobs Act . If a taxpayer has a large enough tax liability, the full amount of the Child Tax Credit is $2,000. However, up to $1,400 is refundable even if it is more than the taxpayer owes. Refundable tax credits are the most beneficial credit because they’re paid out in full. This means that a taxpayer—regardless of their income or tax liability—is entitled to the entire amount of the credit. If the refundable tax credit reduces the tax liability to below $0, the taxpayer is due a refund.