Content

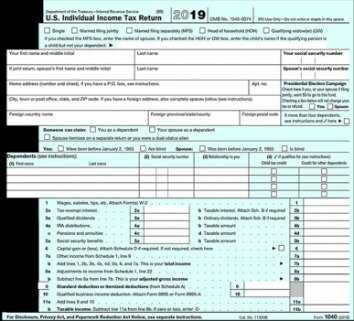

Most filers’ standard deduction can be found on form 1040 in the box to the left of line 40.Compare the amount on line 39 of Schedule A with your standard deduction. While there are a limited number of circumstances in which a person would want to itemize deductions, even if the standard deduction is greater, most filers should take whichever deduction is greater. Contact a CPA, tax attorney, or IRS enrolled agent for more information on itemizing your deductions when the standard deduction is greater. Enter income included on your W-2 forms on line 7. This will include income from wages, salaries, and tips, as well as other income included on a W-2 by your employer. Most filers will need to enter information from at least one W-2, if not several.You will also need to attach a copy of your W-2s to your return.

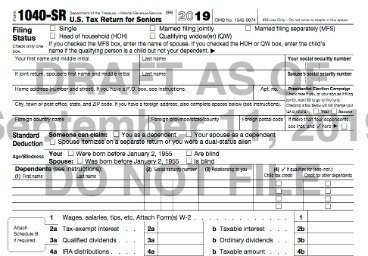

Form 1040-SR can be filed electronically, just as Form 1040 can. The IRS will pursue you if anything on your return seems fraudulent. If they bring an error to you attention, just correct it and follow it through. File a 1040X Amended form as soon as possible to correct the error. It’s a correction process that’s there to help you amend an error. The only thing you can really do wrong is to ignore it or run from it. Alan Mehdiani is a certified public accountant and the CEO of Mehdiani Financial Management, based in the Los Angeles, California metro area.

Where’s My Refund? How To Check The Status Of My Tax Return

H&R Block employees, including Tax Professionals, are excluded from participating. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2019 individual income tax return . It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.

You need to file federal tax form 1040 or 1040-SR for 2020 to claim your Recovery Rebate Credit. You’ll also need your IRS Notice 1444, the letter the IRS should have sent to you a few days after you got your first stimulus check, and IRS Notice 1444-B, which you would have gotten after your second stimulus check.

You are leaving AARP.org and going to the website of our trusted provider. The provider’s terms, conditions and policies apply. Please return to AARP.org to learn more about other benefits. The worksheet for the credit will tell you whether you’re eligible, and how much more you’re entitled to if you didn’t get the full amount. Although the one-page, 21-line worksheet looks intimidating, it essentially walks you through calculating whether you’re entitled to a stimulus credit, and how much that credit is.

Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Form 1040-EZ was repealed effective 2018 when the IRS revamped the standard Form 1040 tax return. Even seniors who met the 1040-EZ income requirements no longer had that option. If you prefer not to e-file, the mailing address for your completed tax return depends on the state in which you live and whether you’re enclosing a payment.

When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations.

The 1040EZ was used for tax years . Its use was limited to taxpayers with no dependents to claim, with taxable income below $100,000 who take the standard deduction instead of itemizing deductions. With the Current Tax Payment Act of 1943, income tax withholding was introduced. The Individual Income Tax Act of 1944 created standard deductions on the 1040. For 1916, Form 1040 was converted to an annual form (i.e., updated each year with the new tax year printed on the form).

If they still do not provide one, the IRS can do it for you, assuming your employer reported your income and paid their payroll taxes. If you were expecting a federal tax refund and did not receive it, check the IRS’ Where’s My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund.

Print Federal Income Tax Forms And Instructions Booklet From List (irs)

Initially, the IRS mailed tax booklets to all households. As alternative delivery methods (CPA/Attorneys, Internet forms) increased in popularity, the IRS sent fewer packets via mail.

Fees apply when making cash payments through MoneyGram® or 7-11®. Year-round access may require an Emerald Savings® account. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

Where To Get Form 1040

You and your spouse, if applicable, should both sign your names as they appear at the top and as match the records for both the Social Security Administration and the IRS tax database. You should each date it the same date as you signed it. Each of you should list your occupations.A daytime telephone number should be listed in the space provided. Calculate the formula on for exemptions, which is listed on line 42. Then enter the result in line 42. Next calculate your taxable income by subtracting line 42 from line 41 and entering the result on line 43. If the result is a negative number, enter zero .

- Be sure to let your third party designee know this number.

- If you don’t qualify, leave the line blank.

- H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated.

- Most US citizens are required to file an individual tax return to the federal government using IRS Form 1040.

- estern Governors University is a registered trademark in the United States and/or other countries.

(From this was called Form 8812 rather than Schedule 8812.)52, 67In 2014 there were two additions to Form 1040 due to the implementation of the Affordable Care Act—the premium tax credit and the individual mandate. If one is not eligible for IRS Free File, it might cost hundreds of dollars to file electronically, whereas paper filing has no costs beyond those of printing and mailing. Filing electronically also exposes the taxpayer’s data to the risk of accidental loss or identity theft. The IRS accepts returns that are stapled or paperclipped together. However, any check or payment voucher, as well as accompanying Form 1040-V, must not be stapled or paperclipped with the rest of the return, since payments are processed separately. Paper filing is the universally accepted filing method. Form 1040, along with its variants, schedules, and instructions, can be downloaded as PDFs from the Internal Revenue Service website.

Federal legislation passed in 2018 provided for a Form 1040 tax return designed specifically to meet the needs of senior citizens. Many seniors were forced to file the more complicated Form 1040 in past years simply by virtue of the nature of their retirement incomes. The IRS provided Form 1040-EZ through 2017 to make the process easier, but this form limited overall income to $100,000 and interest income to $1,500 annually. Another nice feature of Form 1040-SR is the large typeface designed to be easier on the older eyes of taxpayers who prefer to print out the return and fill it in by hand.

If you didn’t get a stimulus check, you don’t need either notice. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

The top of the first page is where you enter personal information, such as your name, address, Social Security number, and filing status. Lea D. Uradu, JD is an American Entrepreneur and Tax Law Professional. Professionally, Lea has occupied both the tax law analyst and tax law adviser role. Lea has years of experience helping clients navigate the tax world. Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law.

When To Expect Your Refund

En español | The Internal Revenue Service issued about 160 million stimulus checks to eligible Americans for the first round of economic impact payments that began in April. Millions more payments, dubbedEIP 2, started going out in late December for the second round of stimulus. Nevertheless, some people never got their first-round stimulus checks, while others didn’t receive the full amount to which they were entitled. The same will be true for the second round of stimulus payments. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.