Content

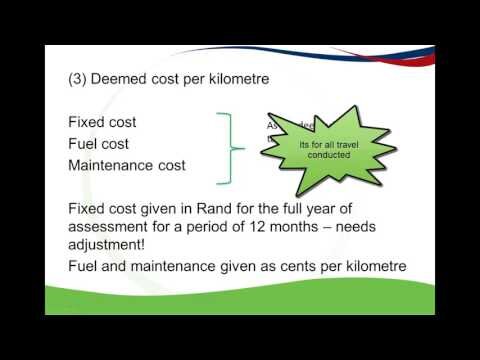

For a vehicle you own or lease, you can deduct either the actual expenses or the standard rate per mile driven. If the car is leased and you use the standard mileage rates, you must use the standard rates for the entire life of the lease. If you itemize the deductions, you can deduct these amounts from your taxable income. These mileage rates are optional and you can use the actual vehicle expenses instead of the standard mileage rate as your deduction if you kept detailed records . Taxpayers always have the option of calculating the actual costs of using their vehicle rather than the standard mileage rates. Revenue Procedure (Rev. Proc.) provides the rules for computing the deductible costs of operating an automobile for business, charitable, medical, or relocation expenses; and for substantiating the expenses under Code Section 274 and Treas.

You may deduct business mileage only if you are traveling to and from a temporary work location, from one work location to another, to meet with a client, to a conference, etc. You can’t use standard mileage deduction to calculate mileage if you used MACRS accounting or if you claimed a Section 179 deduction on the vehicle. If you are taking the IRS standard mileage deduction, you will need to provide a listing of all business trips, reason, dates, and mileage. The maximum allowance for 2021 a fixed and variable rate plan is $51,100 for automobiles, trucks, and vans. The FAVR allowance is applicable for driving for business purposes, not personal driving. The maximum allowance for 2020 a fixed and variable rate plan is $50,400 for automobiles, trucks, and vans.

If you like, you can manually track your expenses, which may call for a higher deduction. However, many businesses find using these estimates balances out with the cost of calculating their actual fleet expenses. If you use your vehicle for both business and personal use, make sure to carefully track your mileage. At tax time, simply subtract your personal mileage from your total yearly mileage and multiply this result by the appropriate rate. The Internal Revenue Service recently released its inflation-adjusted standard mileage allowances for 2017, as well as maximum vehicle value thresholds to be used in calculating fixed and variable rate allowances. Driving for medical or moving purposes may be deducted at 17 cents per mile, which is two cents lower than for 2016.

Standard Mileage Rate For Business Driving

Additionally, you use this van to move into a larger, nicer house with a beautiful view of the ostrich pastures. Traveling across town many times, you rack up another 100 miles. You put 250 miles on this vehicle when transporting animals, feed, and equipment for the local animal shelter. You also use it to visit your family in another state, carefully tracking your personal mileage. In the appropriate tax year , you use your van for certain business purposes, such as transporting eggs to market in inclement weather. The rate revisions reflect fluctuations in costs related to driving, such as gasoline and auto insurance, as well as changes in vehicles’ depreciation rate. If you use your automobile for business ― whether you are self-employed or an employee ― you are allowed a deduction for the unreimbursed cost of operating it.

These rates apply to businesses, charities, health care organizations, movers, etc. and should be used for cars, pickup trucks, vans, and panel trucks. To calculate your deduction, you can use the standard mileage rate. Multiply your business miles by the standard mileage rate for your deduction. If you drove 10,000 miles in 2017, you’d have a deduction of $5,350 (10,000 x 53.5 cents). Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates. The business mileage rate decreased half a cent per mile and the medical and moving expense rates each dropped 2 cents per mile from 2016. Some employees may be entitled to an amount above the IRS mileage rates under certain circumstances as outlined in collective bargaining agreements.

Named for the company that markets many of these plans, Runzheimer plans allow employers to reimburse employees for the use of their cars with a fixed periodic payment, plus a periodic cents-per-mile allowance. Use your vehicle to provide unpaid services to a charitable organization and you can deduct the costs of doing so. The mileage rate you use to compute the federal charitable contribution deduction is set by statute. The 2017 rate is a dip from the 2016 standard mileage rate of 54 cents per mile. While the business mileage rate gets most of the attention, you can also write off miles for charity, medical or moving purposes. The 2017 mileage rate is essential for those who take driving-related deductions.

No Business Mileage Deduction For Employees

Remember to include parking and tolls under deductible expenses for the business use of you car. Below are the optional standard tax deductible IRS mileage rates for the use of your car, van, pickup truck, or panel truck for Tax Years . We will add the 2021 mileage rates when the IRS releases them.

- If you use your personal vehicle for medical/moving purposes, the IRS allows you to claim a deduction for only the variable transportation costs.

- To learn more, find the details and explanations about deductible mileage rates and expenses below.

- FAVR reimbursement plans provide a more accurate and in-depth reflection of driving costs than the IRS standard mileage rate does.

- By adhering to this allowance, reimbursements for mileage are not taxable to the employee.

- A taxpayer may not use the business standard mileage rate for a vehicle after using any depreciation method under the Modified Accelerated Cost Recovery System or after claiming a Section 179 deduction for that vehicle.

Let’s say you’re a construction foreman, and you have a desk in a corporate office that you check into each day. After checking in, you drive to the work site in your personal car. You can deduct the business mileage of driving from the office to the work site and from the work site home as long as your employer doesn’t reimburse you and it is a temporary work site where you are expected to work less than one year. If you are self-employed any driving you do directly related to your business like meeting with a client or going to a networking event may be deductible business mileage. It’s pretty simple to use the 2017 mileage rate to calculate your deduction.

Irs Releases Standard Mileage Rates, Favr Allowances For 2017

The IRS will sometimes even change the mileage rate mid-year if gas prices are volatile enough. Not only is Everlance Teams easy to use; it takes almost no time to set up. You can sign up for the app in seven minutes or less to get started on tracking your company mileage reimbursement today.

For federal tax purposes, standard mileage rates apply to all vehicles — including cars, SUVs, pickup trucks, vans, and panel trucks. If you use your vehicle for business, charitable, medical, or moving purposes, you may use these mileage rates to calculate your federal income tax deductions. For all miles of business use, the standard mileage rate for transportation or travel expenses is 53.5 cents per mile , according to IRS Notice . The standard rate is 14 cents per mile if an automobile is used to render gratuitous services to a charitable organization, or 17 cents if used for medical care or a deductible move (a 2-cent reduction from 2016).

You are not allowed a deduction for any portion attributable to personal use, which includes commuting to and from work. The IRS allows you to deduct miles driven for charity purposes. Agencies should use expense type Bulkload for the standard mileage and the expense type Bulkload for the supplemental mileage.

If you have employees whose responsibilities require them to be on the road, they’ll need to be compensated for the expenses associated with driving. The IRS outlines which workers qualify for reimbursement through the standard business mileage deduction rate in their commuting mileage rules. Set annually by the IRS, taxpayers can use the standard mileage rates to calculate the deductible costs of operating an automobile. Optional standard mileage rates for use of a vehicle will decrease for business, medical, or moving purposes in 2017, the IRS announced on Dec. 13. Businesses that operate fleets of vehicles can claim higher mileage rates because they use these vehicles primarily for business purposes.

Simplyprepare and e-File your 2020 Tax Return on eFile.com and the eFile app will not only determine whether or not you can deduct your mileage, it will also calculate and report the deductible mileage on your return. To learn more, find the details and explanations about deductible mileage rates and expenses below.

However, they didn’t extend this deductible to include the fixed expenses associated with your daily commute. The cost of operating your vehicle to obtain medical care or as part of certain moves related to work at a new job or business location is deductible for federal tax purposes. The portion of the business standard mileage rate that is treated as depreciation will be 25 cents per mile for 2017, one cent higher than for 2016. With business mileage, your commute to work cannot be deducted. Any driving related to business that isn’t part of the “leg” home can be included.

Under a FAVR plan, a standard amount is deemed substantiated for an employer’s reimbursement to employees for expenses they incur when driving their vehicle in performing services as an employee for the employer. The portion of the business standard mileage rate treated as depreciation is 25 cents per mile for 2017, up from 24 cents per mile for 2016. The medical and moving expense rates are based on the variable costs, such as gas and oil. In this document, the IRS describes the various standard mileage rates and their appropriate use with many caveats and addendums. Likewise, the lawmakers who created the charitable use statute didn’t want to tax you for using your vehicle to help the community.

Everlance Teams uses GPS tracking to monitor your employees’ driving, separating business trips from personal trips, to keep accurate logs of deductible miles. The team admin dashboard allows you to view this information, along with individual and team expenses and receipts, all in one convenient place. We’re proud to boast that this organizational system saves the average user a whole two hours a month on accounting. When trying to understand the change in the IRS Mileage Reimbursement Rate for 2021, the first question you should be asking is, “What is the standard mileage rate in 2020? ” As you can see from the chart at the bottom of this page, which documents information officially provided by the IRS, the standard business mileage rate is 57.5 cents per mile this year.

If the substantiated miles are less than the assumed average miles used to calculate the FAVR allowance, the employee must repay the portion of the variable allowance that corresponds to this discrepancy. If the employee does not repay this amount, then it must be included in the employee’s income and subject to withholding and reporting. Despite rising costs of fuel and vehicle maintenance, the mileage allowance for charitable driving remains at 14 cents per mile, which it has been fixed at for decades. Meanwhile, mileage for medical, business and other uses is reviewed every year, and consistently goes up. Increasing the mileage allowance for charitable volunteers so that it is more reflective of the costs of such driving might go a long way towards encouraging more Americans to give their time to help others, which has been declining in recent years. Also, businesses often reimburse mileage to attract and maintain employees. They often peg their reimbursement rate to the standard mileage rate.

Use the standard mileage rate for the year of the tax return, not the year you’re filing the return. For example, you’ll use the 2020 mileage rate for your 2020 tax return, even though you’re filing it in 2021.