The IRS tends to take a closer look at S-corporation returns since the potential for abuse is so large. For example, if you make $500,000 in one year but only designate $20,000 of that as salary income, you might trigger an IRS inquiry, since you are avoiding so much self-employment tax.

Your situation is probably different, and WCG spends a lot of time with small business owners determining reasonable shareholder salary and officer compensation. “I personally like the flexibility that LLCs offer business owners,” Viola said. “Yes, there’s the downside of having to pay self-employment taxes, but in an S-corp, the owners are required to take salaries under the IRS’s reasonable compensation regulations.” Like other pass-through businesses, S corporation owners may be eligible to take a Qualified Business Income Deduction to deduct up to 20% of their business income . This deduction is in addition to the normal business expense deductions the S corporation can use to reduce its taxes The QBI deduction is taken off the owner’s tax return, not the business return. You may have been advised that you could become an S corporation and save the “double taxation” problem of being a shareholder in a corporation.

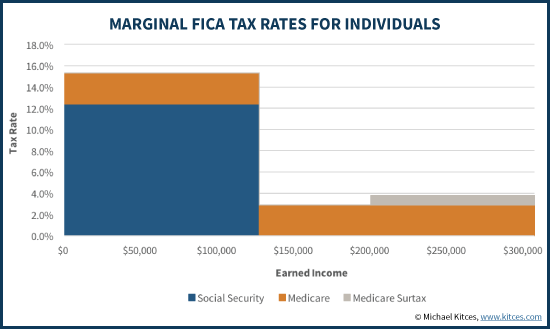

You’ll still be liable for self-employment taxes on the salary portion of your income, but you’ll just pay ordinary income tax on the distribution portion. Depending on how you divide your income, you could save a substantial amount of self-employment taxes just by converting to an S-corporation. If you’re self-employed, you’ll usually have to pay higher Social Security and Medicare taxes, collectively known as self-employment taxes, than if you were an employee of a company. One way to help avoid these higher taxes is to organize your business as an S-corporation.

Form 1120S is the form used for an S-corporation’s annual tax return. (This makes sense, given that Form 1120 is used for a regular corporation’s annual return.) As with a partnership, Schedules K and K-1 are used to show how the business’s different types of income and deductions are allocated among the owners.

State Taxation Of S

If you are taxed as a standard LLC , you have to pay employment tax on your entire salary. To understand why getting taxed as an S Corporation is more tax effective, it’s useful to understand the types of taxes you will need to pay. none of the entity’s shareholders are other corporations or partnerships. This is intended to prevent highly compensated employees who provide personal services—lawyers, for example–from having their employers reclassify them as independent contractors so they could benefit from the pass-through deduction.

It protects your personal assets, gives you more financial visibility, and can make it easier to manage your taxes. If you choose the right type of corporate structure, you can significantly lower your yearly tax bill. But electing to be taxed as an S corporation can have tax advantages. This can be especially true as a result of the new pass-through tax deduction created by Tax Cuts and Jobs Act. A limited liability company is a legal entity formed under state law to run a business.

Small business owners often choose to structure as an LLC because it offers more freedom than corporation structures. But before making this critical decision, it’s important to know the differences between the LLC and S-corp. An S corporation, also referred to as an S-corp or S subchapter, is a tax election that lets the IRS know your business needs to be taxed as a partnership. It also prevents your business from incurring corporate-level double taxation.

Rather, it’s an elected method of determining the way your business will be taxed. With an S-corp tax status, a business avoidsdouble taxation, which is when a corporation is taxed on its profits and then again on the dividends that shareholders receive as their personal earnings. Some S-Corporation owner-officers may feel tempted to issue themselves a salary of $0 for the sake of minimizing employment tax, collecting their entire income as an owner of the business instead. Instead, according to My Money Blog, the rule of thumb that most accountants suggest is for an S-Corp owner-officer to collect 40 percent of his income as profit disbursement to owners and 60 percent of his income as an employee’s salary. The purpose of this is to ensure that the S-Corp abides by the IRS’s “reasonable salary” requirement. An S corporation must pay employment taxeson employee pay, including withholding and reporting federal and state income taxes, paying and reporting FICA taxes, worker’s compensation taxes, and unemployment taxes.

To qualify as an S-corp, your business can have one to 100 shareholders. Your business must also be located in the U.S., and you must file with the IRS as an American corporation. An LLC, which stands for “limited liability company,” is a business structure that protects the personal assets of the business’s owners (referred to as “members”).

We have a handful of clients with over 30 rentals; their individual tax return is north of $2,500. We also are assuming one state; if your business spans the galaxy then additional fees will be discussed with you prior to payroll setup or tax preparation. Typically each state is around $250 for tax preparation since it affects both your business and individual tax returns (frankly, state apportionment is a pain in the butt, but it is our pain… and states, especially California, are crazy about it). The following are additional business services to get your venture launched and on the way. They are teased out separately as one and done fees like formation and onboarding stuff.

Thus, by using an S corporation, you may be able to avoid self-employment income tax. Similarly, if you conduct your business as a partnership in which you’re a general partner, in addition to income tax you are subject to the self-employment tax on your distributive share of the partnership’s income. On the other hand, if you conduct your business as an S corporation, you’ll be subject to income tax, but not self-employment tax, on your share of the S corporation’s income. Do you conduct your business as a sole proprietorship or as a wholly owned limited liability company ? If so, you’re subject to both income tax and self-employment tax. There may be a way to cut your tax bill by using an S corporation. Some states levy franchise taxes, state income taxes, or gross receipts taxes on S corporations each year.

Before then, it’s best to accept the money as personal income and fileForm 1040on your personal return. Having your LLC taxed as an S-corp once you hit the $60,000-a-year mark is a great decision, according to Scott Royal Smith, founder and CEO ofRoyal Legal Solutions. Shareholders own more than 2% of the company’s stock and can’t claim employee health insurance as a tax-free benefit as they could with a C-corp. Baker stated that S-corps generally have directors and officers; a board of directors oversees corporate formalities and major decisions. The directors elect officers who manage daily business operations. “When members manage an LLC, the LLC is much like a partnership, or a sole proprietorship if there’s only one member,” said Baker.

Check with your state department of revenue to see if your state requires these taxes. Of course, each state has its own rules regarding S-corp taxation. Some work like the federal income tax in which shareholders pay taxes on their share of the income.

When it comes to owners in particular, a key distinction is that with a partnership, any/all income allocable to an active partner in the business is automatically and fully treated as self-employment income, subject to FICA self-employment taxes . While an S-corporation may save you in self-employment taxes, it may cost you more than it saves. As with larger corporations, an S-corporation has both start-up and ongoing legal and accounting costs. In some states, S-corporations must also pay additional fees and taxes. For example, in California, an S-corporation must pay tax of 1.5 percent on its income with a minimum annual amount of $800. If you organize your business as an S-corporation, you can classify some of your income as salary and some as a distribution.

These tax rates change on an annual basis, but the self-employment income tax rate in 2020 is 12.4% for Social Security and 2.9% for Medicare, according to the IRS. An LLC can be an S-corp – or even aC corporation – depending on how the business owner chooses to be taxed. An LLC is a matter of state law, while an S-corp is a matter of federal tax law.

How To Pay Yourself In An Llc

Half the total tax is deducted by the employer from the employee’s pay, and half is paid by the employer itself. When you own the business that is paying these taxes, it makes no practical difference that half is paid by the employer—you are the employer. If you own an LLC and have elected to be treated as an S corporation for taxation, the business now files a corporate tax return on Form 1120S. What’s the big deal? These are based on using a salary of 40% of net business income for incomes up to $500,000 and then decreased incrementally to 30% for the millionaire at $2,500,000 below . If you are a sole proprietor, a partner in a general partnership, or a member of an LLC that is taxed as a disregarded entity, you will pay self-employed tax.

The Internal Revenue Service may take a close look at your taxes if you choose this route, as you could end up lowering your overall tax liability while generating the same net income. The Social Security and Medicare tax rate for an employee is the same as for a self-employed business owner; however, it’s paid differently.

Turbotax Guarantees

So does that mean you can pay yourself a salary of $1 for the year and avoid Social Security and Medicare tax altogether? You must pay yourself a reasonable salary for the work you perform. If you don’t you can be audited or be subject to other actions by the IRS. Generally, no, but there are loopholes in business and finance. The ownership stake of an LLC member is called amembership interest, and owners of an S-corp are called shareholders. You must establish reasonable compensation for owner-employees.

To become an S-corp, your business first must register as a C corporation or LLC. Self-employment tax applies to sole proprietors, but not to S-Corp officers, even if they are employed by the company. However, even if they own stock in the company, officers must pay normal employment tax for employment income, which includes Medicaid, Social Security, unemployment insurance tax and any other income taxes, such as state income tax.

- To take an entity and have it be taxed as an S corporation by the IRS and your state, paperwork must be completed and submitted.

- A good rule of thumb is to look at the “average” salary for the position and pay that as salary, with any excess being paid as a distribution.

- One way to help lower your self-employment tax is to organize your business as an S-Corporation.

- For more on whether C corp or S corp status is right for you business, check out our breakdown of S corps vs C corps.

- LLCs and S corporations are popular options, but they differ in many ways, from taxes to management structure.

To understand LLCs and S-corps, it helps to understand C corporations. Taxed under Subchapter C, C-corps are separate taxable entities that file Form 1120. An LLC or C-corp may be converted into an S-corp by filing theForm 2553with the IRS, as long as it meets all Subchapter S guidelines.

You must calculate self-employment tax and income tax and make quarterly estimated tax payments to the Internal Revenue Service, or you could be subject to fines and penalties. New business owners, freelancers and consultants are often shocked at how much of their income is eaten up by the self-employment tax. These taxes include Medicare and Social Security taxes, and they apply both to employees and self-employed individuals. People who are essentially self-employed can organize their professional efforts under an S-Corp structure and thereby reduce the amount of money they must pay in self-employment taxes.

An owner/employee must be compensated for his or her services with a reasonable salary and any other employee compensation the corporation wants to provide. The owner/employee must report any S corporation’s earnings on his or her personal income tax return, and pay his or her share of Social Security and Medicare taxes on any employee salary paid. The corporation must withhold federal income and employment tax from the owner/employee’s pay, and pay state and federal unemployment taxes and Social Security and Medicare taxes on the employee’s behalf. Unlike a C-Corp, which is a more conventional type of corporation, an S-Corp is a “pass-through” entity, meaning that it does not pay any income taxes on the corporate level. Instead, it passes the income tax responsibility on to employees and shareholders who receive their income through the company.

For instance, in Illinois, S-corporations pay a 1.5% tax on the S-corp’s Illinois income. This tax is in addition to the income tax that shareholders pay on their share of the S-corp’s income.

How Corporations And Llcs Are Taxed

The Income section will ask you about all of your company’s revenues for the year, which is information you’ll get from your income statement. The top third of the form containing fields A-F is where you’ll input your contact information, dates of incorporation and S corp election, your assets, etc. Then each shareholder’s share of the profit or loss of the corporation is recorded on a Schedule K-1. Click here to read more, or enter your email address in the blue form to the left to receive free updates. For tax years , you can claim a deduction equal to 20% of your share of an S-corporation’s profit, subject to limitations. I write about financial planning strategies and practice management ideas, and have created several businesses to help people implement them.