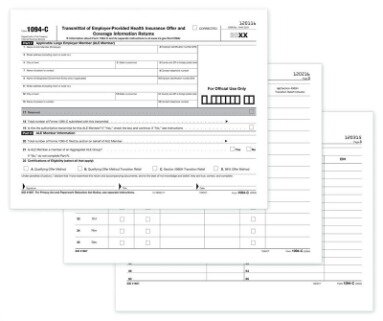

However, the tax reform bill passes in December of 2017 removes the penalty for not having insurance beginning in 2019. Recipients of Form 1095-B do not have to submit the form itself; they simply tick off a box on their returns, indicating how long they had health insurance coverage throughout the tax year. While the individual mandate penalty is now zero, employers still have to report the 1095-B information to the IRS. Employers report whether they provide minimum essential coverage, whom was offered coverage and what coverage employees enrolled in. The IRS uses this information to determine if the employer owes penalty payments and it can impact the availability for premium tax credits if an employee seeks coverage through an exchange.

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

Additional state programs extra. Emerald Cash RewardsTMare credited on a monthly basis.

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. All tax situations are different. Fees apply if you have us file a corrected or amended return.

Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator .

Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.

Tax Bracket Calculator

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. One personal state program and unlimited business state program downloads are included with the purchase of this software.

Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge.

Financial Services

Only employees who is offered coverage under a policy through an Applicable Large Employer and who were full-time for one or more months of the calendar year receive Forms 1095-C. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply.

Having a 1095-B in hand is proof that you had the type of coverage required by the Affordable Care Act. Gaps in coverage of three months or less are exempt from the penalty. If you were uninsured for part of the year, the check boxes in Part IV will help you calculate the penalty that applies, if any. Beginning in 2019, there is no longer a penalty for not having minimum essential coverage. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. You’ll receive Form 1099-H if you get help paying your health insurance premiums as a TAA, ATAA, RTAA, or PBGC recipient. Find out how to read Form 1099-H.

CAA service not available at all locations. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, legal or tax advice. If you have any legal or tax questions regarding this content or related issues, then you should consult with your professional legal or tax advisor. If you had coverage from multiple carriers, you will receive more than one Form 1095-B.

Does Your Company Need To File Form 1095

Centers for Medicare & Medicaid Services. A digital copy of the document will be available in your Justworks document center by March 2nd, 2021. You can expect to receive a physical copy in the mail, postmarked by March 2nd, 2021. If you worked for one or more or ALEs within a calendar year, you will receive more than one 1095-C. The IRS deadline requires that insurance carriers furnish enrolled members with Form 1095-B by March 2nd, 2021. The insurance carrier holding the policy issues Form 1095-B. Most carriers will mail a physical copy of Form 1095-B to you and will also upload a digital copy to your member portal. Southern New Hampshire University is a registered trademark in the United State and/or other countries.

Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Offer valid for tax preparation fees for new clients only. A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers.

- he Rapid Reload logo is a trademark owned by Wal-Mart Stores.

- An ITIN is an identification number issued by the U.S. government for tax reporting only.

- Fees apply for approved Money in Minutes transactions funded to your card or account.

- Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office.

- Additional qualifications may be required.

The IRS mandated that your employer provide the form to an employee upon request. Unless an employee is seeking coverage through an exchange, there is no reason to request the form. Employers and American taxpayers need to understand the ABC’s of the Affordable Care Act coverage reporting forms. A Taxpayer is not required to have a 1095-B to complete the tax return.

Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account.

As part of the Tax Cuts and Jobs Act , the penalty for not having health insurance was eliminated. This also means that an exemption is no longer required.

Only you, as the subscriber, will receive Forms 1095-B for your coverage. Any dependents that need to furnish proof of health insurance coverage may request a copy of the form from the subscriber. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply.

You also don’t need to wait to receive the forms before filing your return if you’re sure of the health insurance coverage you received throughout the year. The IRS created Form 1095-B to fulfill the requirements of the Affordable Care Act, also known as Obamacare. That law requires Americans to have basic level of health insurance in place, referred to as minimum essential coverage. Those who don’t have such insurance may be required to pay a penalty.

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

About Form 1095

When filing without Form 1095-B or C, you should make a good faith effort to accurately report their insurance coverage status on their tax returns. You can do this by gathering info from other sources. If you’re not sure or have more questions about the health insurance information you need for your tax return, continue reading for more details. Due to tax law changes, beginning Jan. 1, 2019, you’ll no longer be required to have minimum essential coverage. Each January you’ll still get an IRS Form 1095 from your pay center listing the coverage you had during the previous tax year. If that’s you, give copies to your adult children and any other people covered under your plan but file their own tax returns. The IRS receives a separate copy of any forms sent to you by your employer and/or the insurance provider.

Your selected PDF file will load into the DocuClix PDF-Editor. There, you can add Text and/or Sign the PDF. If that person wasn’t covered for the full year, there is a box for each month; the months the person was covered will be checked.

Any plan sponsored by an employer. This includes employer-sponsored coverage for retirees and “COBRA” coverage for former employees.