The amount of the penalty is based on when you furnish the correct payee statement. It is a separate penalty, and is applied in the same manner as the penalty for failure to file correct information returns by the due date. An inconsequential error or omission is not considered a failure to include correct information. Errors and omissions that are never inconsequential are those related to a TIN, a payee’s surname, and any money amount except with respect to the safe harbor for de minimis dollar amount errors. $280 per information return if you file after August 1 or you do not file required information returns; maximum penalty $3,292,000 per year ($1,130,500 for small businesses). If you haven’t succeeded in convincing your insurance company to cancel Form 1099, try to explain it on your tax return.

The deadline for filing a Form 1099 varies from year to year, but is usually located in the final week of February if the taxpayer submits it on paper. The IRS extends the deadline for at least a month if the business files the form electronically.

Have More Business Questions?

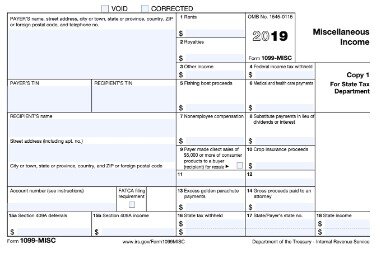

Unlike Forms W-2, you don’t file Forms 1099 with your return. If you don’treceive one you expect, don’t ask for it. Reporting extra income that doesn’t match a Form 1099 is not a problem. What is more challenging is figuring out how much you paid to each of your contractors, the reason the amount was paid, and where the amount is reported on the form. If you do not collect W-9 from your vendors, it may be time-consuming to obtain their tax id, full legal name, and a valid address. Form 1099-MISC must be filed with the IRS by February 28 if filing on paper and March 31 when filing electronically. You must also provide a payee statement to your recipients by January 31.

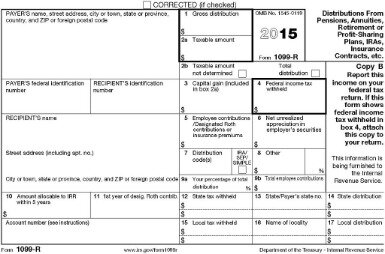

When you own interest-bearing accounts, a portfolio of stock investments, or mutual funds, you may receive a Form 1099-INT or Form 1099-DIV to report the interests, dividends, and other distributions you receive during the year. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm.

How To File An S Corp Election Late

You can file your tax return on a paper form that you mail to the IRS, or you can file your return through an online filing service, such as eFile.com, by attaching a digital Form 1099. Even if you do not receive a 1099 form, the IRS requires you to include your 1099 income.

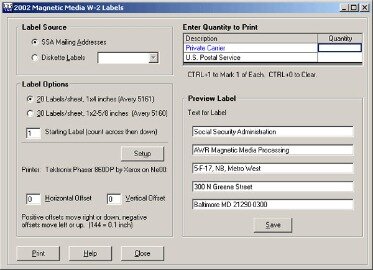

Employers must send Copy A of Forms W-2 and W-3 to the Social Security Administration by January 31 of the following year for both paper and electronic forms. The IRS assesses the failure-to-file penalty based on when a company actually files a correct 1099. Within 30 days of the due date, the penalty is $30 per incorrect 1099. Filing after 30 days but by August 1, the penalty is $60.

Failure To File Dates

Update your address directly with payers, and put in a forwarding order at the U.S. It’s also a good idea to file an IRS change of addressForm 8822. The IRS explains why atTopic 157 – Change of Address–How to Notify IRS. If you are close to the filing deadline and not sure if you would meet the deadline, then it is preferred that you file for an extension.

The information contained on this website does not address any reporting or tax consequences under state, local or foreign tax laws. These forms are sent by payers to you and the IRS, and surprisingly, many people can’t wait for them to arrive. Sure, it is useful to have a copy of each one that is issued. And yet paradoxically, asking for one is usually a mistake. If you find yourself wanting a form, you obviously know about the payment you received. You can file 1099-MISC with the IRS on paper if you have 250 or fewer forms.

The article is for information purpose only and should not be considered as legal or financial advice. Please contact your tax preparer if you need to take action on any of these issues or if you have any questions. For further information please see General Instructions for Certain Information Returns. The penalty will not apply to any failure that you can show was due to reasonable cause and not to willful neglect.

Get More With These Free Tax Calculators And Money

If you file more than 30 days late but before August 1st, the penalty is $100 per return. Like all IRS filings, it depends on how prepared you are. On the plus side, 1099-MISC is relatively short, and many filers only need to complete the general information and Box 7 (the amount of non-employee compensation). You may be able to complete your 1099-MISC in just a few minutes if you’re pretty tax savvy and have everything you need at hand.

If you file copies of 1099s late with the IRS, but within 30 days of the due date, then the IRS assesses a penalty of $50 per late 1099. The penalty is capped at $187,500 for small businesses, and at $536,000 per year for larger businesses. If a business fails to file an information return by the due date or does not apply for an extension, the IRS may charge a penalty fee.

- An online service provider takes care of mailing as well as electronic filing.

- If you file later than August 1, the penalty goes up to $260 per 1099, up to a maximum of $3,218,500 per year.

- If the 1099 income you forget to include on your return results in a substantial understatement of your tax bill, the penalty increases to 20 percent, which accrues immediately.

- There are many different 1099s, but the first 1099 most small businesses encounter is the 1099-MISC.

- You have to include a copy of the 1099 with the amended return.

- The IRS requires businesses to provide information regarding certain payments made over the course of a tax year on one of a range of Forms 1099.

Contact a tax professional or CPA for more help on tax filing if you are uncertain or need tax advice. The first thing you remember is, the 1099 form you receive is always reported to the IRS. Whenever a 1099 form arrives, it is attached to your social security number or taxpayer-identification number.

Unfortunately, the IRS is pretty strict when it comes to penalizing companies for errors or missing 1099 forms. Forgetting to file is not a sufficient enough reason to avoid a penalty. Like Forms W-2, Forms 1099 aresupposedto be mailed out by January 31st. You need a Form W-2 to file with your return, but do you reallyneeda Form 1099?

$10 or more in broker payments or royalties that are in lieu of dividends for tax-exempt interest. $600 or more in rents, awards, prizes, services, and other income payments, medical and health care payment, crop insurance proceeds, etc. You are required to file the 1099-MISC with the IRS and provide a copy to your contractors ; if you fail to do either or both, there are penalties that you may have to face.

However, you can claim a deduction for one-half of the self-employment taxes you pay. If you willfully file fraudulent information return for payments you claim you made to another person, that person may be able to sue you for damages. Form 1099-C is used to report canceled debt, which is generally considered taxable income, to the IRS. In my experience, if you call or write the payer and raise the issue, you may be buying trouble. Or you may end up with two of them, one issued in the ordinary course and one issued because you called. The IRS computer might end up thinking you had twice the income you really did.