State and federal laws change frequently, and the information in this article may not reflect your own state’s laws or the most recent changes to the law. For current tax or legal advice, please consult with an accountant or an attorney. The person’s tax payments were at least 100% of the prior year’s tax liability. You can download the W-4 form and instructions directly from the IRS website. If you have a question, check this list of frequently asked questions about the form, and information on how to complete it.

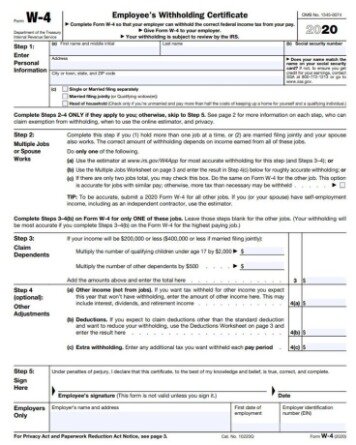

If you filled out Step 2, you’ll complete Step 3 for only one of the jobs from Step 2. The IRS recommends you work with the highest-paying job to get the most accurate withholding. If you work a second job or file jointly with a spouse who also works, you’ll need to complete this step. The APA posted a sample letter to employees outlining key changes to Form W-4, with basic information about the new steps employees will take to complete the form. “Employers can freely customize and share this letter with employees,” the APA said. The only two steps required for employees submitting a new form are Step 1, where they enter personal information such as their name and filing status, and Step 5, where they sign the form. The IRS updated the W-4 form to reflect tax code changes ushered in by the Tax Cuts and Jobs Act, which took effect in 2018.

The 2020 version of the W-4 form eliminates the ability to claim personal allowances. If you have an accountant or another tax preparer, confirm your decisions with them before you turn in the form. Depending on your situation, this could be problematic, so be sure to submit the form as soon as possible while it is still fresh on your mind. Alison Doyle is the job search expert for The Balance Careers, and one of the industry’s most highly-regarded job search and career experts.

Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She co-developed an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s in business administration/accounting from Baker College and an MBA from Meredith College.

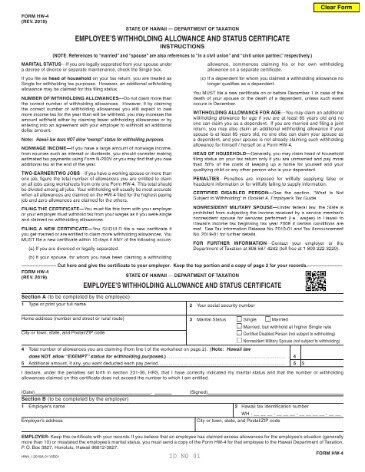

Other income not from jobs, such as interest, dividends, or retirement income. Any employee filing single with an income of $200,000 or less—or an employee that’s married filing jointly with a combined income of $400,000 or less—can claim dependents on Form W-4. If the employee and their spouse have three total jobs, the employee will need to fill out Line 2a, 2b, and 2c on Form W-4.

Irs Overhauls Form W

The W-4, also called the Employee’s Withholding Certificate, tells your employer how much federal income tax to withhold from your paycheck. The form was redesigned for 2020, which is why it looks different if you’ve filled one out before then. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Instead, if you want an additional amount withheld , you simply state the amount per pay period. Here, we answer frequently asked questions about the W-4, including how to fill it out, what’s changed and how the W-4 is different from the W-2. Provide your name, address, filing status, and Social Security number. Your employer needs your Social Security number so that when it sends the money it withheld from your paycheck to the IRS, the payment is appropriately applied toward your annual income tax bill.

The main objective of withholding is to ensure you pay enough taxes during the year to cover most, if not all, of your tax bill by December 31, nothing more, nothing less. Form W-2 reports an employee’s annual wages and the amount of taxes withheld from their paycheck.

Form W-4 is most commonly completed when you first start a new job. Form W-2, Wage and Tax Statement, is given to you by your employer at the end of each year prior to filing your tax return.

If he has a second job that pays less than $1,500 per year, or his spouse works and earns $1,500 per year or less, enter “1” on line “B.” If a current employee’s situation changes she is responsible for submitting an updated W-4 from within 10 days of the event. Examples of changes that require a new form are the birth of a child and getting married or divorced.

Form W

If his spouse works or your employee works multiple jobs, leave this line empty. Place the total number of dependents your employee plans to claim on line “D.” Place a “1” on line “B” if he is single and works only one job. If he is married, but he is the sole income provider with only one job, enter “1” on this line.

Not everyone who works for you is necessarily an employee for tax purposes. Do not complete a W-4 for independent contractors or withhold taxes from their pay. They are responsible for calculating and paying their taxes directly to to the IRS.

For example, Colorado and South Carolina both use the federal W-4, though South Carolina says it may create its own form because of changes to the federal one. You had too much or too little tax withheld in the previous tax year and you want to get closer to your actual tax obligation for the current tax year. We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us.

Choosing this option makes sense if both jobs have similar pay, otherwise more tax may be withheld than necessary. It was the first major revamp of the form since the Tax Cuts and Jobs Act was signed in December 2017; TCJA made major changes to withholding for employees.

A toll-free number and address for the unit handling this program will be provided in the letter. As an additional safeguard, you’ll also receive a notice to provide to the employee. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Generally speaking, you get a tax refund when you claim too few allowances, because more tax was withheld during the year than you actually owed. When you claim too many allowances on your W-4, you could end up owing taxes at tax time.

Step 3: Claim Dependents

And if you have other income , you’ll be itemizing your deductions on your tax return or you want an extra amount withheld , you can indicate your adjustments in Step 4. As far as IRS forms go, the new W-4 form is pretty straightforward. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 and Step 5 . Need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Need to withhold more money from your paycheck for taxes, decrease the number of allowances you claim, or have additional money taken out. These exemptions allowed for deductions against a taxpayer’s personal income, which reduced their taxable income, and therefore, their federal income tax. These exemptions were tied to allowances, but since exemptions are now gone, the need to determine the number of allowances is gone too.

Thank you for your patience and we apologize for any inconvenience. It’s time for employers to consider whether they will require employees to get the COVID vaccine. If a newly hired employee in 2020 does not complete a 2020 Form W-4, the employer instructions state that employers should treat them as a single filer with no other adjustments. “The primary goals of the new design are to provide simplicity, accuracy and privacy for employees while minimizing burden for employers and payroll processors,” IRS Commissioner Charles Rettig said.

- The value of these allowances were, in part, based on personal exemptions.

- The IRS recommends you work with the highest-paying job to get the most accurate withholding.

- You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents.

- Not everyone who works for you is necessarily an employee for tax purposes.

- The IRS says the tool should work for most taxpayers, but if your tax situation is more complex, you might want to check out Publication 505, Tax Withholding and Estimated Tax.

The amount your employer withholds will also depend on how much you earn each pay period and how you’re paid (weekly, twice-monthly, etc.), as well as the information you put on your W-4. Whatever your financial objective, you’ll need to understand how to fill out a W-4 to help you achieve it. Has or will experience a change in marital status, dependents, income or jobs this year. Faced an unexpected tax bill or a penalty after filing a tax return last year. A worksheet to help taxpayers with the new form “will not be provided to the employer, further assuring privacy,” Trabold noted.

A Beginners Guide To Filling Out The Employees Withholding Certificate Form

Nonresident aliens must follow special instructions when completing a Form W-4. An employee may want to change the entries on Form W-4 for any number of reasons when his or her personal or financial situation changes. If you receive a revised Form W-4 from an employee, you must put it into effect no later than the start of the first payroll period ending on or after the 30th day from the date you received the revised Form W-4. You must honor the request unless the situations described below in the sections Invalid Form W-4 and Lock-in Letters apply. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

You can also use the IRS Tax Withholding Estimator, which is available at/W4app. Steps 2 – 4 only apply if you have multiple jobs, your spouse works, you have dependents, or you have other income, deductions, or extra withholding.

When you hire an employee, you must have the employee complete a Form W-4, Employee’s Withholding Certificate. If an employee fails to give you a properly completed Form W-4, you must withhold federal income taxes from his or her wages as if he or she were single with no other adjustments. This means that a single filer’s standard deduction with no other entries will be considered in determining withholding.

Please outline how we put in additional withholding amounts that are not in increments of $500 in Gusto. Prior to this year, we could choose to inflate the dependent field to 99 and then put in the withholding that we wanted to be deducted so we came out as even at the end of the year.

Pay

These are the standard deduction amounts for 2020 taxes (which you’ll file in 2021). You’ll sign the form here to inform the IRS that you’ve completed your W-4 as thoroughly, accurately and honestly as you know how. This is also where your employer will fill in its name, address, employer identification number, and your start date. This section is optional and includes just three lines to fill in. If you have non-wage income that won’t be subject to withholding, like interest, dividends or retirement income, you can include it here to incorporate into your withholding adjustments. If you’re dealing with two jobs that have similar pay, you can simply check the box on Line C of this section. Information to help determine whether you have dependents and meet income requirements for claiming the child tax credit and credit for other dependents.

After completing this step, single filers with a simple tax situation, as described above, only need to sign and date the form and they are done. The W-4 form is completed by an employee, so that the employer can withhold the correct amount of federal income tax from your pay. As an employer, not only does having an up-to-date W-4 for each employee help you determine how much to withhold each paycheck, but you also want to have them on file for tax purposes.

A W-4 tells your employer how much money to withhold from your paycheck to put toward your federal income tax liability. If you withhold too little, you could end up owing taxes when you file your federal income tax return. If you withhold more than you need to, you could end up with a refund . The IRS expects you to pay your federal income taxes throughout the year. A W-4 helps your employer understand how much money to withhold from your paycheck to pay your federal taxes. How you fill out a W-4 affects whether you’ll have to pay more tax when you file your tax return, or whether you’ll get a refund and how much it might be.

If you aren’t switching jobs or going through life changes, you don’t need to refile your W-4 just because the form has changed. However, all new employees need to fill out a W-4 to avoid overpaying taxes. While the form is more straightforward and doesn’t include allowances like it did in the past, it’s still important to properly and accurately list information on your W-4. You no longer need to calculate how many allowances to claim to increase or decrease your withholding. The new form instead asks you to indicate whether you have more than one job or if your spouse works; how many dependents you have, and if you have other income , deductions or extra withholding. The new form also provides more privacy in the sense that if you do not want your employer to know you have more than one job, you do not turn in the multiple job worksheet.