Content

Your child may be subject to AMT if he or she has certain items given preferential treatment under the tax law. The AMT may also apply if your child has passive activity losses or certain distributions from estates or trusts. If line 4 doesn’t include any net capital gain or qualified dividends, use the Line 7 Tax Computation Worksheet to figure this tax. The Line 7 Tax Computation Worksheet in the Form 8615 instructions will calculate tax using the trust and estates rate bracket.

- For the 2018 tax year, $3,461 is the cap if you have one child, $5,716 is the most you can claim if you have two children and $6,431 is the maximum credit you can receive if you have three or more children.

- Although this credit is nonrefundable, if your adoption expenses exceed $13,810, which is the maximum credit allowed, the IRS allows you to carry the overage for the next five years.

- If your child received qualified dividends, the amount of these dividends that is added to your income must be reported on Form 1040 or 1040-SR, lines 3a and 3b; or Form 1040-NR, lines 10a and 10b.

- earned and unearned income together total more than the larger of $1,100, or total earned income (up to $11,850) plus $350.

- Itemized deductions can’t be claimed if the standard deduction is chosen.

Emerald Cash RewardsTMare credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Learn about gift tax exclusion rules with help from the tax pros at H&R Block. Use the FILEucator tool to quickly find out if you have to file a return.

Easily Overlooked Ways To Increase Tax Refunds

Or they may want to file their own return in order to get a refund of any tax they overpaid or claim a credit they’re eligible for. A parent can elect to claim the child’s unearned income on the parent’s return if certain criteria are met. Generally, the unearned income over the annual threshold ($2,200 in 2020) is taxed at the parent tax rate. For 2020, dependents who are not 65 or older or blind, who have earned income more than $12,400, must file their own return. Income levels required to file a return for those 65 and over or blind are higher. You do not include their earned income on your taxes.

By making the Form 8814 election, you can’t take any of the following deductions that the child would be entitled to on his or her return. Make the election by attaching Form 8814 to your Form 1040, 1040-SR, or 1040-NR. Attach a separate Form 8814 for each child for whom you make the election. You can make the election for one or more children and not for others. An employee who is a dependent ordinarily can’t claim exemption from withholding if both of the following are true. Certain dependents can’t claim any standard deduction. To find out whether a dependent must file, read the section that applies, or use Table 1.

Tax Filing Requirement (for Dependents)

If you use Form 8814, your child’s unearned income is considered your unearned income. To figure the limit on your deductible investment interest, add the child’s unearned income to yours. However, if your child received qualified dividends, capital gain distributions, or Alaska Permanent Fund dividends, see chapter 3 of Pub. 550 for information about how to figure the limit. If a child’s parents have never been married to each other, but lived together all year, use the return of the parent with the greater taxable income. If the parents didn’t live together all year, the rules explained earlier under Parents are divorced apply.

They must be under age 19 (24 if a full-time student) at the end of the tax year, or be permanently disabled. They must have lived in your residence with you for at least half of the tax year.

You don’t include these dividends on Form 8814, line 12; Schedule 1 (Form 1040 or 1040-SR), line 8; or Form 1040-NR, line 21. If it is, you must include it with your own tax preference items when figuring your AMT. See Form 6251, Alternative Minimum Tax—Individuals, and its instructions for details.

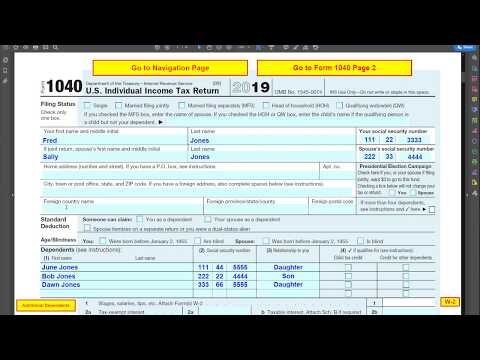

Fred’s parents elect to include Fred’s income on their tax return instead of filing a return for him. In 2019, he received dividend income of $2,300, which included $1,725 of ordinary dividends and a $575 capital gain distribution from a mutual fund. (None of the distributions were reported on Form 1099-DIV as unrecaptured section 1250 gain, section 1202 gain, or collectibles (28% rate) gain.) All of the ordinary dividends are qualified dividends. He has no other income and isn’t subject to backup withholding. No estimated tax payments were made under his name and SSN. Enter on Form 8814, line 3, any capital gain distributions your child received. You don’t include it on Form 8814, line 12; Schedule 1 (Form 1040 or 1040-SR), line 8; or Form 1040-NR, line 21.

Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns. Enrolled Agents do not provide legal representation; signed Power of Attorney required.

Do I Have To File A Tax Return For My Dependent?

from self-employment, any net operating loss deduction, any foreign earned income exclusion, and any foreign housing exclusion from your child’s Form 1040 or Form 1040-NR. Enter this total as a positive number _____C. Your child meets condition 3 only if your child didn’t have earned income that was more than half of his or her support. If any of the child’s capital gain distributions are reported as section 1202 gain on Form 1099-DIV, part or all of that gain may be eligible for the section 1202 exclusion. (For information about the exclusion, see chapter 4 of Pub. 550.) To figure that part, multiply the child’s capital gain distribution included on Schedule D, line 13, by a fraction. The numerator is the part of the child’s total capital gain distribution that is section 1202 gain.

The child generally must live with you over half of the year, but this rule is easier to meet than you think. This mistake can cause them to miss out on thousands of dollars per year of potential EIC, even in excess of tax they paid or had withheld from their paychecks. Credit Karma is committed to ensuring digital accessibility for people with disabilities. We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. Kim Porter is a writer and editor who has written for AARP the Magazine, Credit Karma, Reviewed.com, U.S. News & World Report, and more. Her favorite topics include maximizing credit… Read more. Jennifer Samuel, senior tax product specialist for Credit Karma Tax®, has more than a decade of experience in the tax preparation industry, including work as a tax analyst and tax preparation professional.

She has dividend income of $275 and wages of $2,500. She enters $2,850 (her earned income plus $350) on line 1 of Worksheet 1. On line 3, she enters $2,850, the larger of $2,850 or $1,100. On line 5a, she enters $2,850 (the smaller of $2,850 or $12,200) as her standard deduction. His parents can claim him as a dependent on their tax return. He has taxable interest income of $800 and wages of $150. He enters $500 (his earned income plus $350) on line 1 of Worksheet 1.

Dependents Credit & Deduction Finder

H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. No estimated tax payments were submitted for the current Tax Year and no overpayment for the previous Tax Year were applied for the current Tax Year under your child’s name and Social Security number. Go to IRS.gov/TCE, download the free IRS2Go app, or call to find the nearest TCE location for free tax return preparation. Go to IRS.gov/VITA, download the free IRS2Go app, or call to find the nearest VITA location for free tax return preparation.

Figure the tax on your child’s taxable income in the normal manner. If your child is the beneficiary of a trust, distributions of taxable interest, dividends, capital gains, and other unearned income from the trust are unearned income to your child.

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two.

The decimal on line 7b is 0.333, figured as follows and rounded to three places. If line 2 is blank, skip lines 7a and 7b and enter the amount from 6 on line 8 of the 2019 Tentative Tax Based on the Tax Rate of Your Parent Tax Worksheet.

Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Check cashing not available in NJ, NY, RI, VT and WY. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour.

Regardless of your filing status, the IRS places maximum limits on the credits taxpayers can claim. For the 2018 tax year, $3,461 is the cap if you have one child, $5,716 is the most you can claim if you have two children and $6,431 is the maximum credit you can receive if you have three or more children. If your earned income tax credit is more than the tax you owe, the IRS will refund you the difference. But as eager as you may be to receive this tax refund, even if you file your tax return in early January, you’ll have to wait until mid-February, which is the earliest that the IRS can release this refundable credit.

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Note that the above is a synopsis of the IRS rules that apply. There are numerous exceptions to these rules. So, while the above is a reliable summary of the rules that apply, your child’s requirements may differ and you should confer with an accountant familiar with your family. IRS Publication 929,”Tax Rules for Children and Dependents,” goes into these somewhat complex rules in detail. Therefore, either a thorough reading of this document or consultation with your tax adviser is highly recommended.