Content

The maximum deduction allowed is based on up to 300 square feet. Be sure to use only expenses for the period of time when the space was used as a home office when you’re calculating your deduction, such as if the space was used for only part of the year. Daycare service providers calculate their business use percentage for the home office deduction in a dedicated section of Form 8829, Lines 4 through 7. You might turn an extra, unused bedroom into your office, and that’s fine. You can claim a deduction for that entire room if you don’t do anything other than work there. Or you could place a desk, computer equipment, and filing cabinets in the corner of your own bedroom, and that’s fine, too, but you can only deduct the square footage of the space where you work.

- The key thing to remember, though, is that tax reform didn’t take away home office expense deductions for everyone.

- If you are a self employed individual or work in the gig-economy, eFile.com is a great platform for you to prepare and eFile your 2020 Taxes at a much lower price – dare to compare – than other platforms.

- Find out if you could be eligible to take the home office deduction on your federal taxes and how you can maximize it.

- The space you want to deduct expenses for can’t be used for personal purposes.

- You can also qualify if you meet clients in your home or the office is a separate structure on your property, like a studio or workshop.

- The space is used in connection with your trade or business if you’re claiming the deduction for a separate structure that’s not attached to the residence.

You should also consider the time it will take you to gather receipts and records. The regular, more difficult method values your home office by measuring actual expenditures against your overall residence expenses. You can deduct mortgage interest, taxes, maintenance and repairs, insurance, utilities and other expenses. The home office deduction rules also apply to freestanding structures. You can use a studio, garage or barn space as your home office as long as the structure meets the “exclusive and regular use” requirements. Your home office business deductions are based on either the percentage of your home used for the business or a simplified square footage calculation.

Looking For More Information?

The rate is $5 per square foot for up to 300 square feet of space. The other exception is if you use the office for storage of inventory or product samples you sell in your business. Here’s what small businesses should know about the home office deduction. If you use part of your home for business, you may be able to score the home office deduction.

Store product samples or inventory you sell in your business. Assume your home-based business is the retail sale of home-cleaning products and that you regularly use half of your basement to store inventory. Occasionally using that part of the basement to store personal items wouldn’t cancel your home office deduction.

Which Method Should I Use To Calculate My Home Office Deduction?

This test is applied to the facts and circumstances of each case the IRS challenges. This place must be the sole, fixed location of their business. Don’t be surprised by an unexpected tax bill on your unemployment benefits.

Know where unemployment compensation is taxable and where it isn’t. The answer to this question comes down to whether your stimulus check increases your “provisional income.” Divide the number of rooms you’ve dedicated to business by the total number of rooms in your home. This might be suitable if all your rooms are much the same size. You won’t meet this requirement if your application for licensure was rejected for some reason or it your license was revoked. You use a specific area of your home for business on a regular basis.

But the Tax Cuts and Jobs Act affected who’s eligible to deduct those costs. Find out if you could be eligible to take the home office deduction on your federal taxes and how you can maximize it. If you qualify, then you’re allowed to take a deduction for the expenses associated with the use of that portion of your home. That typically allows you to deduct a proportional fraction of expenses incurred throughout the home, such as rent and utilities.

Eligibility For The Home Office Deduction

The home office deduction is available for homeowners and renters, and applies to all types of homes. Farmers claim the home office deduction on Schedule F, Line 32. There are two options for figuring and claiming the home office deduction. If your home isn’t your principal place of business, you may still be able to deduct home office expenses if you physically meet with patients, clients or customers on the premises.

1) The simplified method says you can deduct $5 per square foot. The maximum square footage you can take the deduction for is 300 square feet. There are additional rules regarding depreciation and carryover losses. Special rules apply if you qualify for home office deductions under the day care exception to the exclusive-use test. The biggest roadblock to qualifying for these deductions is that you must use a portion of your home exclusively and regularly for your business.

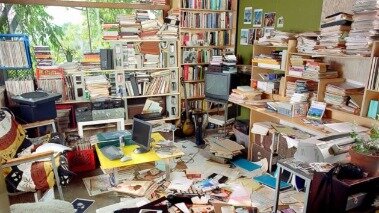

A desk in a corner of a room could qualify if it is used exclusively for work. However, the IRS is strict in its interpretation of “exclusive use” of the space. Even children’s toys or a television in the “exclusive use” zone is enough to disqualify the space (but for special rules pertaining to day care services, see Prop. Regs. Sec. 1. If you plan on deducting actual expenses, keep detailed records of all the business expenses you think you’ll deduct, such as receipts for equipment purchases, electric bills, utility bills and repairs.

Your business use percentage would therefore be 150 divided by 1,250, or 12%. Multiply the length of the area by the width to ascertain your business area, then divide this square footage by the total square footage of your home. Indirect expenses are those that apply to your whole property. They benefit both the business-use area as well as personal-use areas.

Instantly compare loans from online lenders to find the right one for your business. Compare online loan options for funding and eventually growing your small business. Complete the form below and NerdWallet will share your information with Facet Wealth so they can contact you. Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed. For 2020, the prescribed rate is $5 per square foot with a maximum of 300 square feet.

If you’re self-employed and work from home, you may be able to claim the home office deduction to help lower your federal income tax bill. But if you’re an employee who works at home, tax reform may have put a wrinkle in your dreams of a home office tax deduction. If you’re self-employed and work from home, the home office deduction may get you a tax break for expenses related to your home office.

The loss of the home office deduction has some employees wondering if it’s time to make a switch and become self-employed. That’s an individual decision, but if you’re focusing simply on the home office piece, the numbers probably don’t support that kind of shift. For more to consider when it comes to business-related decisions in light of tax reform, check outthis article. The simplified method can make it easier for you to claim the deduction but might not provide you with the biggest deduction. TurboTax makes it easy to determine if you qualify and how much you can write off by asking you simple questions about your unique tax situation. TurboTax has you covered whether your tax situation is simple or complex.

Property For Business Use

A few examples include mortgage, property taxes, utilities, repairs and insurance, as well as depreciation. Or you might be able to claim the simplified home office tax deduction of $5 per square foot, up to 300 square feet ($1,500). If you’re self-employed and have a home office, look into the home office deduction to see whether you can deduct some of the costs of maintaining your home and save money on your federal taxes. Just make sure your home office meets IRS requirements and keep careful records to substantiate your deduction. The Tax Cuts and Jobs Act of 2017 eliminated the miscellaneous deduction for home office expenses for tax years . However, if you’re self-employed, you can still claim the home office deduction on Schedule C if your home office meets certain requirements.

Incidental or occasional business use does not count as regular use. Here’s how to minimize and delay the chunk that Uncle Sam claims.

Being an employee doesn’t mean you can’t also claim the deductions you’re entitled to as a self-employed person. If you’re a homeowner and use part of your home for business purposes, you may qualify to deduct a portion of actual expenses.