Content

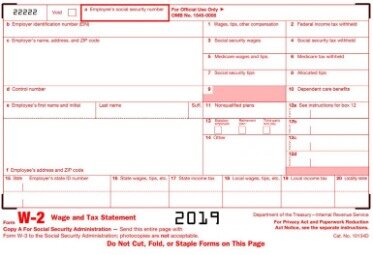

The remaining fields are mostly details of the employee’s income from the previous year. Each year, employers are required to file wage and tax information for their employees with the Social Security Administration on W2 & W3 Forms. With ExpressIRSForms, Efiling your W2, & W2c forms have never been easier. You can file with the required form in just a few simple steps to both the federal and state agencies.

An additional fee applies for online. Additional state programs are extra. Most state programs are available in January. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Terms and conditions apply; see Accurate Calculations Guarantee for details. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

Step 3: Contact The Irs

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee’s paycheck. If your W-2 is available online, you may access it as many times as you need. If you lose your password or credentials for accessing the online site, you can often request automated password recovery. If you still need help accessing your information online, or if you need to request a new paper copy, you should contact your payroll or HR supervisor.

The deadline to file W-2 forms with the SSA is January 31 of the following year. For 2020 W-2s, the deadline is Jan. 31, 2021. You’ll file W-2 forms with the Social Security Administration , not the IRS. If you have a 401K or insurance premiums, for example, these need to be subtracted from gross taxable wages. It might seem like you’re getting less of a return than you should, but remember, this money is already invested in you in other ways. If you still can’t find your W-2 online, or if you forgot it at home when you went to meet with your tax preparer, you can calculate your wages.

Year-round access may require Emerald Savings® secured. The Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY.

Our W-2 generator is perfect for this, as we’ll guide you through the steps to make sure you don’t miss anything. After answering a few questions, you’ll only need to download, print and file filled copy of the form by mail.

Available at participating offices and if your employer participate in the W-2 Early AccessSM program. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest.

To Get Copies Of Your Current Tax Year Federal Form W

Additional fees and restrictions may apply. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns.

See your Cardholder Agreement for details on all ATM fees. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021. OBTP# B13696 ©2020 HRB Tax Group, Inc. For a full schedule of Emerald Card fees, see your Cardholder Agreement.

See Cardholder Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.

If you file 250 or more W-2 forms during a calendar year, you must file them electronically unless the IRS grants you a waiver. You may be charged a penalty if you fail to file electronically when required. If you made cash or noncash payments to one or more of your employees, you must file this form.

We prioritize your privacy & security of sensitive data and use Norton SSL certificate to establish trusted and secure connection. House passed a new federal financial stimulus package. Our contract is with your employer and we can only take action at the direction of your employer.

Your current tax year wage and withholding information is the information you need to report to New York State on the return you file this year. Your employer provides this information to us by filing a quarterly report with all the employees’ wage and withholding totals. These returns contain New York State information only. The Send A Friend coupon must be presented prior to the completion of initial tax office interview.

Form 941 Is Revised Yet Again For The Third Quarter Of 2020

This service offers fast, free, and secure online W-2 filing options to CPAs, accountants, enrolled agents, and individuals who process W-2s and W-2Cs . The IRS Publication 15- Employer’s Tax Guide is published by the IRS detailing an employer’s responsibilities for filing and reporting tax information. Most employees must fill out Form W-9 when they start working for a company. If they complete $600 worth’s of work or more for the company in a year, the company issues a 1099 form showing the earnings and deductions made. The IRS also uses W-2 forms to track individuals’ tax obligations. Failure to file Form W-2 by the deadline results in a $30 penalty per W-2.

- You can request a Wage and Income Transcript online using the Get Transcript Online tool, or by mail using Form 4506-T.

- The easiest way to do this is with the information on your final pay stub of the year.

- Both cardholders will have equal access to and ownership of all funds added to the card account.

- You can search for your W-2 in our online W-2 finder database of thousands of employers.

- OBTP# B13696 ©2020 HRB Tax Group, Inc.

If the employee also works for tips, a field shows how much money in tips the employee earned for the year. When you prepare your income taxes, you will need to input the data found on your W-2 into a Form 1040 individual tax return, either by hand or electronically. Online tax preparation software now allows you to directly import the information on your W-2 from your payroll provider in many cases. Note that if you work multiple jobs that provide W-2s, you need to input each separately.

The deadline for giving your employees a copy of their W2 as you have filed them is also January 31st. It’s the employer’s job to create and file W2 tax forms. He is also required to give one to every employee, who will then use it for their own tax. Penalties are assessed for each form not filed or filed incorrectly. Penalties depend on how late the form is filed with the SSA or given to employees and vary depending on the size of your business. You may consider filing an extension application, then filing the forms as soon as possible to minimize penalties. If you have W-2 forms to file for annual wage reports for employees, the easiest way to file them is online.

Fees apply to Emerald Card bill pay services. See Online and Mobile Banking Agreement for details. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider.

ADP is a better way to work for you and your employees, so everyone can reach their full potential. Get inspired to begin transforming HR at your company.

Generally, they will be available online in mid-January. You can also review the status of your submission to see whether the file has been accepted. You can view the uploaded files and see error reports after the files are submitted, including name and Social Security number mismatches.

Consider the pros and cons before choosing one of the many tax preparation systems available online. Another way to access your W-2 online is with the help of reputable online tax services like TurboTax and H&R Block. These websites have search features that enable you to find your W-2 without hassle, and with full security. It’s always easier to file a tax return with an accurate W-2 than without it, but if you haven’t received your form and need to file, you have options.

Take your time looking at all the information, and remember you might have some adjustments to do. You will receive SSA acknowledgement of your eFile by email within business days. By accessing and using this page you agree to the Terms of Use. TurboTax can help you make any necessary corrections and file Form 1040-X easily and accurately.