Content

The most common asset this procedure applies to in the world of real estate investing is rental property, yet it can also apply to other assets, like furniture and equipment. If a taxpayer is selling an investment property, a capital gains tax applies to depreciation recapture. However, in some other cases when a taxpayer financially gains from the sale of an asset, like equipment, a capital gains tax does not apply. Keep in mind that if you sell your home for a loss, whether it’s currently a rental or is now your primary residence, you aren’t subject to depreciation recapture or other gains taxes. However, due to depreciation decreasing your cost basis in the property each year until it reaches zero, it’s more common that sales of former rental homes result in gains. This current bubble created the biggest loss of equity in homes nationwide and California is the worse compared to other states.

Or you can carry it forward to offset future income for up to 20 years. While this looks like a big loss, remember that you’ve already benefited from $74,130 in depreciation deductions over the previous 10 years.

To figure out the value of the land based on the amount you paid, multiply the purchase price by 25%. You can also deduct the cost of buying and improving your rental property, but it works differently. Instead of claiming one huge deduction when you buy the property, you depreciate the costs across the useful life of the property. If you’re a savvy rental property owner who took advantage of depreciation, be aware that the IRS might want some of that money back. In the event that you have sold investment property at a loss, you will likely be able to deduct that specific loss from your annual tax obligations.

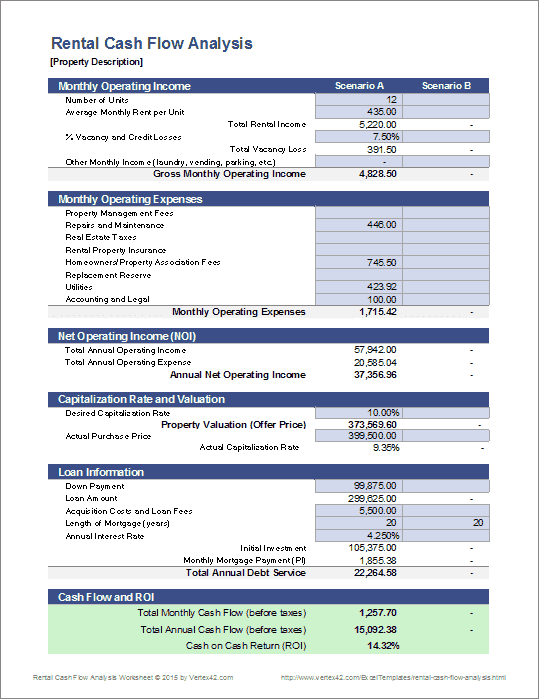

Their adjusted basis prior to converting the home into a rental is $375,000. It depends on whether you report your property as a rental before or after a decline in value. If your property declines in value after you’ve reported it as a rental, congratulations! This allows you to redeem some of the taxes that you paid in the previous years, which in turn means you can even take forward the loss you’re currently facing to recover in the future years. Use my free rental property Excel spreadsheet to calculate this upfront. Once you’ve calculated your tax basis, you’ll know the status of the loss you’re going to face. And if it does, there are always ways you can minimize or capitalize on the unavoidable losses.

The IRS doesn’t want people abusing the five-year rule with rentals that they move back into just before the sale. You may have to prorate your capital gains exclusion based on your number of years of qualifying use of the property. That means if you move back in for two years after renting for seven years, your prorated exclusion limit will equal 2/9 of the gains. If 2/9 is less than the full $500k exemption ($250k for single filers), then you are limited to excluding the lower amount. It isn’t very easy to realize that your rental property business is not doing well.

Many home owners try to sell their principal residences for a long time, and then finally give up selling it. Instead, they decide to rent it and wonder if they could deduct the loss if they finally sold their rental properties below the purchase price of their principal homes. For example, if you purchased your principal residence at $600,000 in 2005, but you decided to convert it to a rental property in 2009 after several failed attempts to sell it. The basis for your rental property is the lower of the costs or the fair market value at the time of conversion, so, if the market value has declined to $250,000, then your basis is $250,000 (not $600,000). Assume you have taken out $20,000 of depreciation expenses from 2009 ~2011 and sold your home for $200,000, then your loss is $30,000 ($250,000 – $200,000 – $20,000). If you’re looking to sell your current property and invest in another, a 1031 exchange will be the most straightforward way to go and will keep you from having to pay taxes. If you need the capital right away, you are likely going to have to pay some taxes.

How To Report Your 2020 Rmd Rollover On Your Tax Return

The IRS defines a short-term gain as a gain on a property that was held for a year or less and is taxed at the same percentage as your regular income tax. If you’re facing a large tax bill because of the non-qualifying use portion of your property, you can defer paying taxes by completing a 1031 exchange into another investment property. This permits you to defer recognition of any taxable gain that would trigger depreciation recapture and capital gains taxes. More importantly, it allows you to separate out tax-free and taxable portions of the property sale.

The IRS allows a property seller to take the total amount of the property sale and reinvest it in another property while deferring any tax payments. To be considered a valid 1031 exchange, your property must meet certain requirements outlined by the IRS.

If you sold this property for $250,000, then your total gain would be $100,000 ($250,000 – $150,000). Out of the $100,000 gain, the first $50,000 would be taxed at an ordinary tax rate up to 25% and the other $50,000 would be taxed at 15% long term capital gains rate. If you converted a personal residence into a rental property and then sold the property at a loss, you might still have a deductible loss. The cost basis for a converted property is the lesser of the purchase price or the market value when it was converted to a rental. You can add in any improvements to the rental and subtract depreciation you took while you owned it. If the property was worth less than you paid for it before you converted it to a rental, you might not have a deductible loss.

- Subtract out depreciation claimed in prior years for the property and improvements.

- For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

- Also, four years of the 10-year rental period are considered qualifying use because they occurred prior to 2009 where all ownership is considered qualifying use for the purpose of this test.

- That amount of time would result in a total depreciation expense of $36,360 ($7,272 x 5), which will be collected and taxed at 25% as a way of actively “recapturing” any previous depreciation the property has incurred.

- Many home owners try to sell their principal residences for a long time, and then finally give up selling it.

Those who miss the deadline must pay full capital gains taxes on the sale of the original rental property. If you have a large appreciation in your rental home, then there is a great tax advantage for converting it to your principal residence and then sell it because of $500,000 exclusion explained above. But, there are conditions and limitations that must be carefully considered. As I explained above, the depreciation expenses that you have taken out throughout previous years must be recaptured as an ordinary income which would be taxed at a maximum 25%. The nonqualified use portion of the gain would be not excluded under Section 121. Don’t feel too badly if you sold your rental property at a loss, which is not so uncommon now days.

Turn Your Rental Property Into Your Primary Residence

You use the property in your business or income-producing activity (i.e., this is a business or rental property). Let’s say we purchased an investment property for $100,000, with $5,000 in closing costs, plus $15,000 in upgrades. The first step in calculating your loss is figuring out your property’s “tax basis,” which you will later compare to your property’s sale price. TurboTax calculates depreciation and helps keep track of your property’s tax basis so that you will know exactly where you stand when you sell your property. Add in any closing costs and legal fees you paid, including title transfer, documentation, and any property tax the original seller did not cover.

But you’re in a rough real estate market, and need to sell for $100,000 – a huge loss. In fact, when you subtract your tax basis from your sales price, you find that your loss totals $110,000, for tax purposes. Let’s assume you do expect a tax loss from selling a rental property you’ve owned for more than a year. That loss will be a Section 1231 loss—which can be a good kind of loss to have. You may be required to pay a higher capital gains rate on depreciation that must be reported as ordinary income when the property is sold. It limits the amount of the write-off, however, and there’s no deduction for any drop in value before you begin to rent.

Qualifying use– The home was their primary residence for four years out of the 14-year holding period. Also, four years of the 10-year rental period are considered qualifying use because they occurred prior to 2009 where all ownership is considered qualifying use for the purpose of this test.

Capital gains are taxed at lower rates than ordinary income, and are reported on Schedule D of the 1040. Fortunately, you can also deduct suspended PALs when you sell the property that generated them. If you sell a rental property with suspended PALs, you may be able to deduct them on top of deducting any Section 1231 loss from the sale.

Tax Bracket Calculator

That way you’ll receive the most favorable tax treatment possible and avoid any surprises at tax time. While it would be nice to pay taxes at the lower capital gains rate on the entire gain, you’ll pay up to 25% on the part that’s tied to depreciation deductions. In this example, your adjusted cost basis in the property after 10 years is $135,870 (the original cost basis of $210,000 less the $74,130 depreciation). If you sell for, say, $300,000, you’ll recognize a gain of $164,130 ($300,000 minus $135,870). You can’t depreciate a rental property that you put in service and sell within the same year.

The IRS code, Section 121 provides the exclusion amount of up to $500,000 of gain from the sale of a residential property if the property was used as a principal residence for at least 2 out of 5 years. However in this column, the focus will be on the sale of rental properties, which is more complicated and unfamiliar then the sale of a principal residence. Rental property is income-producing property and, if you’re in the trade or business of renting real property, report the loss on the sale of rental property on Form 4797, Sales of Business Property. Normally, you transfer the loss as an ordinary loss to line 4 of Schedule 1 and attach it to Form 1040, U.S. If your rental activity doesn’t rise to the level of a trade or business, but instead is held for investment or for use in a not-for-profit activity, the loss is a capital loss.

If your rental property has generated losses in past years, you might have suspended passive activity losses . You can generally deduct these passive losses only against passive income, which can be from other activities such as rentals or other passive business activities. First, Section 1231 losses can be used to reduce any type of income you may have—salary, bonus, self-employment income, capital gains, you name it. To help ease the pain, losses from selling rental properties generally receive favorable tax treatment. Property held for less than one year is taxed at a higher rate, equal to the rate on income. Property held over one year generates long-term capital gains, which are taxed at a lower rate. Expenses for utilities, repairs, maintenance, or other upkeep on the property do not affect the adjusted basis or the calculation of capital gains.

Additionally, a taxpayer may not exclude the portion of the gain that was previously attributable to a depreciation deduction. This is known as depreciation recapture, specific to rental properties, and the amount previously taken as a depreciation deduction is taxed at a recapture rate of 25%. Also, rental property tax laws are complicated and change periodically. Unless you’re a real estate tax law rock star, you should work with someone who is. Find a qualified tax accountant when you establish, operate, and sell a rental property.

If you know you’ll be entering in a 1031 exchange, it’s a good idea to start looking for your new place before you sell your current one. If you’re looking to invest in a new property without acquiring immediate capital, a 1031 exchange is a great option. Of the $190,000 gain, the first $40,000 is subject to depreciation recapture up to 25%. Since the gain is greater than the depreciation recapture amount, the remaining $150,000 ($190,000 – $40,000) must be allocated between qualifying and non-qualifying use. The $75,000 ($150,000 × 50%) related to the qualifying use part of the gain is tax-free as part of the Section 121 gain exclusion. While the remaining $75,000 related to non-qualifying use is subject to capital gains taxes.

The good news is that you might be able to turn lemons into lemonade in the form of tax benefits. Second, you may have a net operating loss if the Section 1231 loss is large enough to reduce your other income below zero. If so, you can carry back the NOL for at least two years and use it to offset taxable income in those years. In doing so, you can recover some or all of the taxes you paid in those previous years by amending those returns. Subtract any tax credits, energy conservation subsidies or exclusions received for the property.

Turbotax Cd

To add “real” value, the improvement must give an appraiser good reason to bump up the value of the property. the costs of getting or refinancing a loan, including appraisal fees, credit reports, mortgage insurance premiums , and points. Access to timely real estate stock ideas and Top Ten recommendations. Join our blog newsletter to stay up to date on property management industry insights. You will discover creative ways to identify and eliminate routines that are no longer benefiting your business. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system.

When they sell the property on January 1, 2019, its adjusted basis is $335,000 ($375,000 – $40,000 depreciation taken). Don’t listen to the people who advise you that selling a rental property will result in nothing but losses. Selling a home you live in is more tax beneficial than unloading a rental property for a profit.

Factors like depreciation recapture, qualified vs. non-qualified use and adjusted cost basis could make you think twice before moving back into your rental to avoid taxes. So, if you’re selling a rental property at a loss, you must look through the cost-benefit analysis from all angles. It may seem like your ship is sinking, but that doesn’t mean you can’t minimize your losses. For example, assume an investor made $50,000 from the sale of a rental apartment in the current year. She can choose to sell off a portion of her stocks to realize a $50,000 loss in order to fully offset the $50,000 in capital gains.

Therefore, eight years, or 57% of the gain is attributable to qualifying use and is eligible for the tax-free gain exclusion. This is similar to Scenarios 1 and 2, except the couple buys the home on January 1, 2003 and then rents out the home for 10 years starting on January 1, 2005. They sell the property two years later on January 1, 2017, with depreciation of $70,000 over the rental period. It isn’t uncommon to face losses in the real estate business, so don’t feel too bad. Be sure to consult a tax attorney or accountant to look at your taxes and finances well before you sell it at a loss. There are quite a few ways you can lose money in the rental property business, and it doesn’t always mean you’ve done something wrong.

You might not be allowed to claim all your primary residence capital gains exemption, even after accounting for depreciation recapture. This gets tricky since we have to dig into recent changes with the tax code. Since 2009, the IRS has required your ownership period to be categorized between qualifying and non-qualifying use. Qualifying use is when the home serves as your primary residence and is eligible for the IRC Section 121 gain exclusion for the sale of principal residence. Non-qualifying use is the period where the property is rented out or serves as a secondary home to you, such as a vacation property. But timing is key with this method, as investors have just 45 days from the date of a property sale to identify potential replacement properties, which they must formally close on within 180 days. And if a tax return is due before that 180-day period, investors must close even sooner.