Content

You set up automatic deductions from your paychecks that are contributed to this account and are eligible to use those funds for qualifying child care expenses. The current maximum contribution is $5,000 per year for each household. So, even if both you and your spouse have a Dependent Care FSA available through your individual employers, you can only contribute $5,000 total to one or across both accounts. You may qualify for a child and dependent care credit for someone other than your child. You might be able to get back some of the money you spent on childcare expenses by claiming this nonrefundable credit.

Families each plan for the financial stress of child care in their own way. Some parents choose to have one of them stay home full time with kids who aren’t in school yet because it actually costs less than having a dual income household that pays for full-time child care. If your spouse or another person lived with you for more than half the year and was unable to care for himself or herself, you may be entitled to the credit. In order to claim the credit, you or your spouse must have earned income—that is, money earned through employment—and you must have paid for the care so that you can work or search for work.

Fantastic Option For Life Insurance

This decreases your taxable income and could potentially drop you into a lower tax bracket. Even if your contributions didn’t change your bracket in the past, make sure to check thecurrent tax brackets.

You can’t claim this credit if you file married-filing-separately except under certain rare circumstances. Paying for child care or adult dependent care is one of the steepest monthly expenses many families face. But without care, parents may not be able to leave home to earn a living or go to school. To qualify for the CDCTC, a single parent must be working or in school. For married couples, both adults must be working or attending school. In general, allowable expenses are capped at the earnings of the lower-earning spouse. Special rules allow individuals who were students or disabled to have their earned income assumed to be $250 per month ($500 if there is more than one qualifying child).

Can You Claim The Child And Dependent Care Tax Credit?

You must identify all persons or organizations that provide care for your child or dependent. You must report the name, address, and TIN of the care provider on your return. If the care provider is a tax-exempt organization, you need only report the name and address of the organization on your return. You can use Form W-10, Dependent Care Provider’s Identification and Certification to request this information from the care provider. If you can’t provide information regarding the care provider, you may still be eligible for the credit if you can show that you exercised due diligence in attempting to provide the required information. If you pay a provider to care for your dependent or spouse in your home, you may be a household employer. If you’re a household employer, you may have to withhold and pay social security and Medicare taxes and pay federal unemployment tax.

However, because the child and dependent care credit is a non-refundable credit, it has no value if you do not owe any income tax for the year. It also has a reduced value if your total tax liability is less than the full value of the credit, as it can only reduce your tax liability to zero. The Child and Dependent Care Credit is a non-refundable tax credit offered to taxpayers who pay out-of-pocket expenses for childcare. The credit offers relief to individuals and spouses who pay for the care of a qualifying child or a disabled dependent while they work or look for work.

Is Preschool Expense Deductible From Gross Income On 1040?

The American Family Act also provides the benefit for higher-income earners. Individuals who earn up to $150,000 and married couples filing jointly who earn up to $200,000 can qualify. Additionally, the bill proposes indexing the credit to inflation so that it will not be diminished over time. A financial advisor can help you optimize your tax strategy for your family’s needs. SmartAsset’s free tool connects you with financial advisors in your area in five minutes.

If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Senator Mitt Romney proposed a similar increase to the child tax credit last week, but created a permanent increase of $3,000 a year per child for school-aged children and $4,200 per child under 6. “The inclusion of an expansion and improvement of the child tax credit in coronavirus rescue legislation moving in the House this week is groundbreaking, but we cannot stop there,” DeLauro says. DeLauro’s office projects that the increase to the child tax credit, if implemented on a permanent basis and with a higher income cap as she has proposed, would cut overall childhood poverty by 45% in the U.S.

Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

- The Send A Friend coupon must be presented prior to the completion of initial tax office interview.

- If your income is below $15,000, you will qualify for the full 35%.

- Fees apply for approved Money in Minutes transactions funded to your card or account.

- Personal state programs are $39.95 each (state e-file available for $19.95).

- Families can claim up to $3,000 in dependent care expenses for one child/dependent and $6,000 for two children/dependents per year.

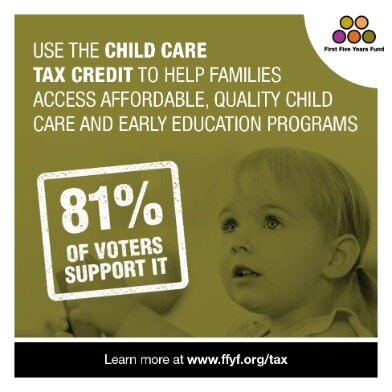

- Two of the strategies that many families might consider to help augment the cost of child care are the Dependent Care Flexible Spending Accounts and the Child Care or Dependent Care Tax Credit.

Although saving money on your taxes may feel like it’s always a good idea, there are a few drawbacks to the Child Care Tax Credit to keep in mind. The Child Care Tax Credit is an excellent way for individuals without a Dependent Care FSA option to offset some of the cost of child care for their family. You, and your spouse if you are married, generally must work or be looking for work to take this credit.

See your Cardholder Agreement for details on all ATM fees. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit.

If your employer gives you money to pay child care expenses, or if you have money withheld from your pay on a pre-tax basis, you must subtract this money received from your allowable expenses. The care has to be for qualifying kids, 13 years old or under. A spouse or dependent who lives with the taxpayer for more than half the year and is either physically or mentally incapable of caring for themselves also qualifies. Have work-related expenses for child care. Basically, child care has to be necessary so that you can work. To prove this, the government requires that both parents provide proof of income. The exception to this rule is if a spouse is disabled or a full-time student.

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

A permanent $3,000 child tax credit would lift an additional 4.1 million children above the poverty line, he estimates. “It’s not quite doubling, but it’s really a similar order of magnitude,” Marr says. According to the IRS, expenses that qualify for the CDCTC include money that you paid “for household services and care of the qualifying person while you worked or looked for work.” Child support payments do not qualify. In addition to the six tests mentioned above, your income determines whether or not you can claim the CTC. First, you need to have earned income of at least $2,500 to qualify for the credit. Then, as your adjusted gross income increases, the child tax credit begins to phase out. Your child must have been younger than age 13 when the care was provided, or, if they were older than 13, they must have been physically or mentally incapable of self-care.

The cost of before- or after-school programs might qualify if the program is for the care of the child. Education costs below kindergarten qualify if you can’t separate those costs from the cost of care. Expenses for care provided outside the home.

No matter your spouse’s age, the IRS won’t allow you to claim a tax credit for money you pay to them to take care of a qualifying child. Also, you can’t claim payments you make if the person providing care is a relative or dependent and the child they’re taking care of is yours and under the age of 13. The Internal Revenue Service’s child and dependent care tax credit provides a tax credit of up to 35% of the expenses you pay someone to take care of your children or adult dependents, making it somewhat easier to afford. Because a portion of the child tax credit is refundable, it could potentially offset any taxes you owe.

If your income is below $15,000, you will qualify for the full 35%. The percentage falls by 1% for every additional $2,000 of income until it reaches 20% (for an income of $43,000 or more). The care may be provided in the household or outside the household; however, don’t include any amounts that aren’t primarily for the well-being of the individual. You should divide the expenses between amounts that are primarily for the care of the individual and amounts that aren’t primarily for the care of the individual.

Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. There, you can add Text and/or Sign the PDF. In addition, the Qualifying Person must have lived with you for more than half of the year.

Compare your claimed expenses with your earned income and, if you’re married, your spouse’s earned income. Take the smallest of all these amounts. A number of states offer some version of an earned income tax credit for working families, so you might be able to get that credit, too. You have to file a tax return to get this credit, even if you don’t owe tax and are not legally obligated to file a return. This is a tax credit, which means it reduces your tax bill on a dollar-for-dollar basis. Up to $1,400 of the Child Tax Credit is refundable; that is, it can reduce your tax bill to zero and you might be able to get a refund on anything left over. The Child Tax Credit is one of three kid-focused federal tax credits that are among the most effective ways to reduce your tax bill.