Content

“Victims of Texas winter storms get deadline extensions and other tax relief.” Accessed Feb. 24, 2021. File your quarterly payments and, if anything, overpay a little. Self-employed persons who are not farmers or fishermen are limited to using the optional method only five times during their lifetimes. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund.

Meals with clients and business travel are deductible, but meals that are included with entertainment may not be, according to the TCJA. Adjusted gross income equals your gross income minus certain adjustments. A tax refund is a state or federal reimbursement to a taxpayer who overpaid taxes. “When are quarterly estimated tax payments due?” Accessed Oct. 22, 2020.

The Social Security Administration uses the information from Schedule SE to compute your benefits under the Social Security program. Refer to Deferral of employment tax deposits and payments through December 31, 2020for information about deferring payment of certain self-employment taxes. Employees typically have social security taxes and Medicare taxes taken out of their paycheck.

One of the most popular ways to avoid or limit SE tax is to change the business structure. All the income from a sole proprietorship is likely to be subject to the SE tax because the owner and business are essentially the same entity.

Latest Tax And Finance News And Tips

If you own your business, you have access to tax breaks and write-offs. When leveraged correctly, those additional tax benefits can make up for the higher self-employment tax and lead to a lower total effective tax rate. A major exception applies to clergy who are employed by a congregation. If a clergy member is paid by a church organization and not directly by the congregation, that exemption might not apply. If your passive income is defined as such by the IRS, then it isn’t subject to the self-employment tax . The first is a trade or business you do not actively participate in during the year.

If you’re using a part of your home for your office, you’ll be able to deduct a portion of the costs to maintain your home. Beware there are some specific requirements for claiming this home office deduction. For tax purposes, the easier method is using the standard mileage rate. Each year, the Internal Revenue Service publishes a mileage rate for business use of a personal vehicle. We’ve highlighted the additional top four hidden tax breaks you’ll need to maximize your tax savings and lower your self-employment income.

How To Pay Yourself In An Llc

For example, if you operate your business as a sole proprietorship and you earn $100,000 for the year, self-employment tax is due on the entire amount. However, under the appropriate circumstances with an S Corp, the amount that exceeds the reasonable salary you make is not subject to self-employment taxes. However, when you are filling out your 1040, the IRS allows you to deduct a portion of the self-employment tax payments you make as an adjustment to income. You can deduct between 50 and approximately 57% of your self-employment tax payments. The precise amount depends on how much self-employment income you earn.

- The total maximum contributions cannot exceed $57,000 for 2020 and $58,000 for 2021 (not counting catch-up contributions of $6,500, if eligible) for both contribution categories, with a self-employed 401.

- If you’re self-employed, consider talking this over with an experienced financial advisor.

- Third-party blogger may have received compensation for their time and services.

- The first $5,950 the child earns is sheltered by the standard deduction, and any amount above that is taxed at the child’s rate, which is generally much lower than yours.

- Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice.

As with the home office deduction, it may be worth calculating your deduction both ways so you can claim the larger amount. If you want to use the standard mileage rate on a car you own, you need to use that method in the first year the car is available for use in your business. In later years, you can choose to use either the standard mileage rate or switch to actual expenses. If you are leasing a vehicle and wish to use the standard mileage rate, you must use the standard mileage rate in each year of the lease period. Using the standard mileage rate is easiest because it requires minimal record-keeping and calculation. Just write down the business miles you drive and the dates you drive them. Then, multiply your total annual business miles by the standard mileage rate.

The IRS will issue you an ITIN if you are a nonresident or resident alien and you do not have and are not eligible to get an SSN. To apply for an ITIN, file Form W-7, Application for IRS Individual Taxpayer Identification NumberPDF. Special rules apply to workers who perform in-home services for elderly or disabled individuals . See theFamily Caregivers and Self-Employment Tax pageand Publication 926 for more details. As an S-Corp, you’ll be required to pay yourself “reasonable compensation”. Once you have your corporate entity you can choose to be taxed as an S-Corp by filing Form 8832 and Form 2553. However, if you don’t want to keep track of your home expenses, the IRS allows you to use the simplified method.

Defer Income To Avoid Higher Tax Brackets

Any education expenses you want to deduct must be related to maintaining or improving your skills for your existing business. The cost of classes to prepare for a new line of work isn’t deductible. A daily newspaper, for example, would not be specific enough to be considered a business expense.

If you structure your business as an S Corp, you would pay yourself a salary from that $75,000—let’s say $50,000. As an S Corp, you would only have to pay self-employment taxes on your salary of $50,000—not on the additional $25,000 in earnings. The way you structure your business can impact how much you have to pay in self-employment taxes.

How To Avoid Paying Taxes On 1099

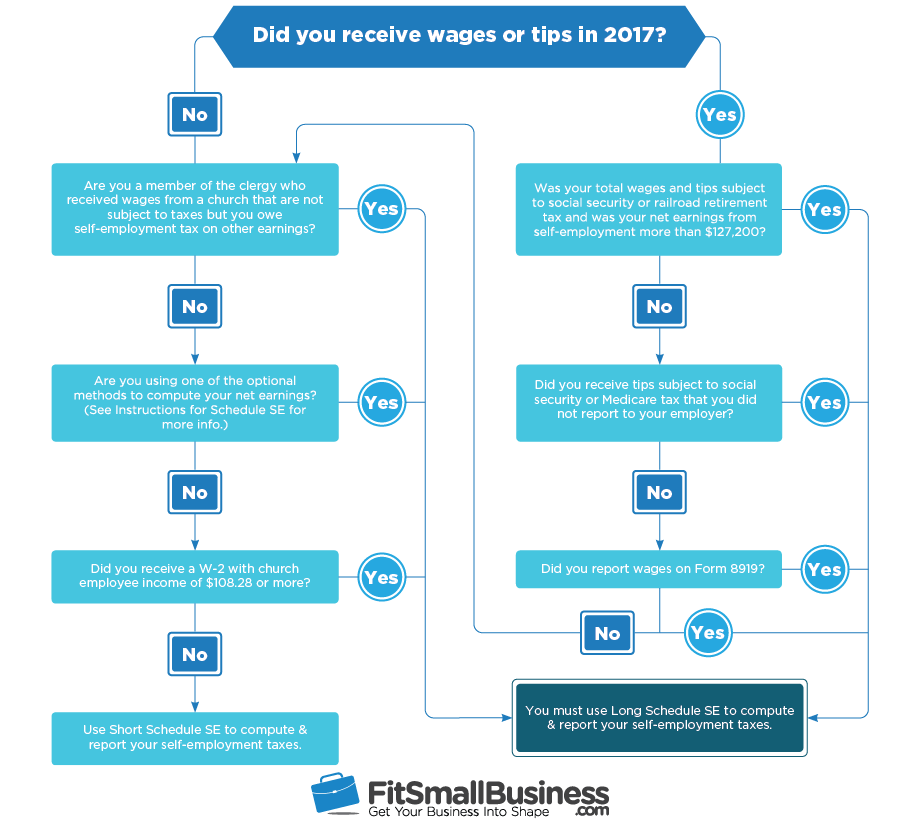

If your clients or customers pay your S-corp, rather than paying you directly, that’s not yet considered income you have earned. It is difficult to avoid paying the self-employment tax entirely. However, there are three good ways that you can reduce the amount of self-employment tax that you owe. Self-employment tax is calculated using Schedule SE form 1040 or 1040-SR. You must pay the self-employment tax even if you are already receiving Medicare or Social Security.

Whether you choose to form an S-corp or use another strategy, effectively lowering your self-employment tax can be tricky. The best way to do it may change from year to year, especially as self-employment tax rates and income subject to these rates can change annually.

How An Independent Contractor Can Avoid Paying Taxes

The disabled access credit provides up to $5,000 in tax credits to business owners who spend money to make their businesses more accessible for people with disabilities . Tax credits, on the other hand, lower your actual tax dollar for dollar. So, if you have a tax credit of $500, that credit will actually lower your taxes by $500. There are many advantages to self-employment in comparison to being employed by someone else, like being able to set your own hours and not having to punch in every morning. But, at the end of the day, your tax obligations are similar to those of employees.

Third-party blogger may have received compensation for their time and services. This blog does not provide legal, financial, accounting or tax advice. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Comments that include profanity or abusive language will not be posted. No, the Healthcare expenses from the W-2 would be deducted as an Itemized deduction on schedule A.

A review of the most common self-employed taxes and deductions is necessary to keep you up to date on any necessary changes to your quarterly estimated tax payments. But if your income varies from month to month or year to year, it’s tough to determine the amount of taxes to pay.