Content

At this point, the user should from the Main Menu of the tax return, Form 1041, select Tax and Payments. In order to properly allocate the charitable gift to the category of income that generated the charitable deduction, from the Deductions Menu, select Charitable Deductions. Any estate or trust that pays or sets aside any part of its income for a charitable purpose must reduce the deduction taken on the Form 1041 by the portion of the gift allocable to tax-exempt income. If the governing instrument specifically provides the source of income from which any charitable deduction is to be made, that specific provision will control. This amount should then be entered on Schedule A as Tax-Exempt Income allocable to Charitable Deductions.

Self-employed people can also upgrade to a special version designed specifically for them. Jumping to TaxSlayer Self-Employed will put you back an additional $30 over the cost of Classic, but it includes professional tax help, tax payment reminders, and other enhanced features. In years past, TaxAct was popular with budget-minded taxpayers who didn’t need a lot of handholding. The program still doesn’t provide much in the way of help, but it’s no longer a bargain. Efile also offers an audit assistance and ID theft restoration service . It will put you back an additional $30 if you select this option.

- Deluxe Online is for maximizing credits and deductions, plus HSA contributions and currently costs $49.99, plus $44.99 per State filed.

- In Step 12, Charitable Deductions were allocated towards tax-exempt income on Schedule A. The user should next allocate any other deductions that were incurred by the entity.

- Here then are the best tax software platforms currently available.

- Julie Ann Garber is an estate planning and taxes expert.

- H&R Block Deluxe has federal tax preparation, and you can choose to download the program directly to your Mac or have a CD sent.

In here you’ll find a further four product options, such as for Sole Proprietor covering Form 1040, Schedule C, or Partnership Form 1065, or C Corporation Form 1120 and finally S Corporation Form 1120 S. TaxAct is another cloud-based online package, which can be accessed using a web browser as well as via a mobile app. A healthy level of support is on offer, but you’ll need to stump up for the better paid for versions to enjoy live assistance. You can import W-2 information from an employer and also upload a picture of it instead, which makes light work of basic filing tasks as does being able to import 1099s. The paid for editions also feature a practical ItsDeductible feature that works in tandem with a dedicated app. Premium Online is aimed at freelancers, contractors and investors and is currently $69.99 plus $44.99 per State filed. Drake Tax has the tools that tax professionals need to do their job quickly and efficiently.

The Best Tax Software Values For 2020

The next section of Form 1041 covers the income of the estate or trust. It’s where you declare income from things like interest, dividends, capital gains and more. For some kinds of income, you’ll have to attach other supporting tax forms as indicated. Add up all forms of income you’ve listed and write the sum on Line 9.

In the year of a person’s death, he or she leaves both personal income and, in some cases, estate income. That’s why the person dealing with the estate of a deceased person will have to file personal income taxesfor the deceased and, potentially, estate income taxes, too. If the estate that a person leaves behind has income sources, that income will be reported on Form 1041.

During tax season – Dec. 3 to April 19 – customer support is available from 8 a.m. ET Monday through Friday, and Saturdays from 8 a.m. During the offseason – April 20 to Dec. 1 – customer support is available from 8 a.m. ET Monday through Friday, and Saturdays from 9 a.m.

The Full List Of Student Loan Forgiveness Programs By State

If you’re the executor of an estate, it may fall on you to fill out – or hire someone else to fill out – Form 1041. Before you get started preparing the form it’s a good idea to gather all the relevant documentation for the estate or trust. That way, you won’t have to keep starting and stopping while you look for more information that will help you give the IRS what it needs. If you’re unsure about the tax liabilities for your trust, ask the lawyer who helped you set up the trust for advice. Step 14– Other Information Menu – Tax Exempt Income Allocation Statement – From the Main Menu of the tax return, Form 1041, select Other Information, then select Tax Exempt Income Allocation Statement. At this allocation menu, each deduction item that is to be allocated between tax-exempt income and taxable income should be entered by selecting NEW.

This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Timing is based on an e-filed return with direct deposit to your Card Account. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

Dependents Credit & Deduction Finder

I use TurboTax Business to prepare the 1041 and K1 for my wife’s testamentary trust. It works much like the personal version and gets the job done. The same concept applies to a decedent’s estate that isn’t immediately distributed to heirs at the time of death. Rest assured, TaxAct guarantees the calculations on your return are 100% correct. Applies to online products only, download products are not available for Mac OS.

For an additional charge (an extra $50 for Deluxe; $70 for Premier), users can have a certified public accountant review their return and point out any deductions they may have missed. But unless you have a complex return or are a really nervous filer, this seems unnecessary, since the program does such a good job of highlighting tax breaks and alerting you to possible errors. TurboTax provides clear and understandable answers to questions, as well as videos and live help from a large community of users.

At that point, it’s the trust that owns the property, not you. But this doesn’t mean that it can earn income tax free. TaxAct Estates & Trusts , The fast, easy and affordable way to prepare and e-file your federal Estates & Trusts tax return.

If this sounds complicated to you , you might want to enlist professional help to process the estate or trust return. This can help make sure that you don’t miss anything or have any glaring errors. People in charge of a large estate will probably want to hire an accountant to help them generate all the necessary tax forms. The accountant can also help you figure out methods of transferring funds in a tax advantaged way. Estates have to file an IRS Form 1041 if they earn more than $600 per year. The estate also has to generate Schedule K-1 forms for any beneficiaries of the estate. This is what you need to know about taxes for estates and trusts.

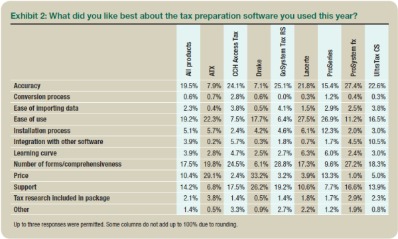

Best Software For Tax Professionals

The trust or estate can take the deduction for the total amount of these K-1s by submitting Schedule B along with Form 1041. Income earned by the estate or trust is reported on lines 1 through 9 of the 1041 tax return, depending on the nature of the income. Lines 23 through 30 of the 1041 tax return totals any income tax due and reports payments made.

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Fees apply if you have us file a corrected or amended return. Each beneficiary who receives a distribution from the estate or trust should be issued a Schedule K-1 at the end of the tax year, detailing the amount and type of any income received from the estate. The beneficiary would then report this income on their own tax return.

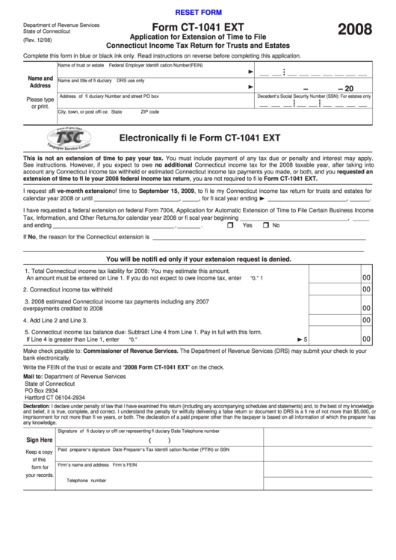

Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. Form U.S Income Tax Return for an Estate or Trust is filed by the fiduciary of an estate or trust and it is due on April 15th for calendar year returns.

Even estates too small to trigger the estate tax can be large enough to create significant paperwork. And if the estate has income, that will need to be reported on Form 1041.

Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. The IRS adjusted your Shared Responsibility Payment and you owe taxes. Learn about notice CP22H and how to address it with help from the experts at H&R Block. Read the IRS definition of a business payment plan and get more insight from the tax experts at H&R Block. Then, follow the steps listed below to fill out a Form 1041 for any additional income received after the date of the death of the individual. Small Business Small business tax prep File yourself or with a small business certified tax professional.

Choose Free Online if you have a W-2, kids and education costs. This tax tool is cloud-based, though there is a desktop edition, while the interface and general workspace is clean and easy to use. It’s possible to import W-2 and 1099 forms and H&R Block also integrates with other packages. Adding on filing options for schedules 1, 2 and 3 means H&R Block lets you cover a host of other tax bases too. Those with more complicated needs, such as landlords or freelancers should head towards the paid versions. Here then are the best tax software platforms currently available.

Additional fees and restrictions may apply. One personal state program and unlimited business state program downloads are included with the purchase of this software. Talk to H&R Block if you need any help filing taxes for deceased members of your family.Make an appointmentwith one of our knowledgeable tax pros at H&R Block. You can count on our tax pros to guide you in making the right decisions for your unique tax situation. Any beneficiary picked by the estate may have to pay tax on the IRD if the estate distributed the right to the income. It seems to be the only program that supports the state forms.

Investment Income

Since most estates and many trusts operate on a calendar year, no entry would be made in this field for any calendar year reporting estate or trust. If a entity has a short year only because it was created earlier in the calendar year, it would still operate as a Calendar Year entity if it’s year ends on December 31. Only fiscal year entities whose year ends on the end of a month other than December 31 would make an entry in this Fiscal Year menu. Improperly entering dates may cause returns to reject because it’s tax reporting period on the return would be different than the IRS’ records.

Tax returns begin to get submitted to the IRS from February 12, although you can use tax software to begin tax filing before then. January 29 is Earned Income Tax Credit Awareness Day, which is being used to raise awareness of valuable tax credits. TurboTax is a staple for preparing taxes, and its programs are so comprehensive and tend to bring the greatest returns. Its Deluxe program works with its online program to provide an e-file for easier submission and a quicker return. You can submit five returns electronically and as many paper returns as you want. And if you live in a state, such as Michigan, Pennsylvania, New York, or Ohio, where city income tax is common, TurboTax will help ensure those are properly declared, too.

There are four versions with a free edition allowing Form 1040 filing but not schedules 1, 2 or 3. So anyone with anything other than super-basic needs should investigate the Deluxe+, Premier + or Self-Employed+ editions.

TaxSlayer’s stated ‘most popular’ package is the next one; Classic which is suited to all tax situations, can be started for free and costs $17. Meanwhile, Premium offers up a swift way to prepare and e-file, with the added bonus of priority support as and when you need it and costs $37.