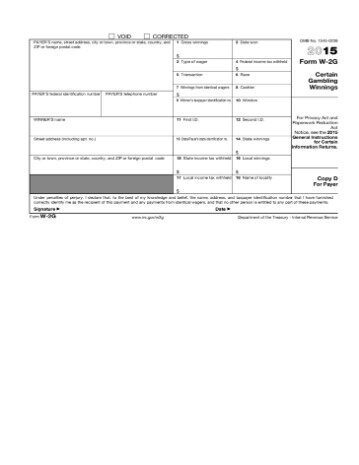

You must provide a statement to the winner (Copies B and C of Form W-2G). See the official IRS instructions. Regular gambling withholding requires payer to withhold 25% of gambling winnings for federal income tax if prize value is greater than $5,000. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify.

for filing of all 1095, 1097, 1098, 1099, 3921, 3922, 5498, 8027, 8955-SSA, 8966 FATCA Report, W-2, W-2G, and 1042-S tax forms. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you.

H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. See Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only.

What Is Form W

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra. Description of benefits and details at hrblock.com/guarantees. If you need more time to respond to an IRS CP2000 notice, ask the IRS to extend the notice deadline.

The type of wager made will vary according to the type of gambling engaged in by the taxpayer or spouse. TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers.

The payer of gambling winnings is required to file Forms W2-G with the IRS by the last day of February of the year following the year of prize award. The winnings are subject to federal income tax withholding . W-2G software to report certain gambling winnings. Print, mail and electronically file IRS Form W-2G.

Who Can File Form W

Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only.

Generally, all gambling winnings must be reported. Gambling losses can be deducted on theSchedule A worksheet as an itemized deduction up to the amount of winnings only.

This reflects the amount of gross winnings required to be reported by the Payer to the IRS. This amount could also reflect the fair market value of property received. This does not reflect the amount of net winnings. See information above for details on deducting gambling losses from Schedule A. Typically, the winnings are calculated by subtracting any wagers or buy-ins from the final payout. Depending on how much you gambled, you may receive W-2G forms from more than one facility.

More Related Products

If you receive a Form W-2G for gambling winnings, you must report the full amount of income shown on the W-2G on your tax return. The W-2G will also show any federal and state income tax withheld from your winnings.

No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file. Form W-2G is a document that a gaming facility may send you in January if you received winnings from gambling in the prior year. When you file with TurboTax, we’ll ask some straightforward questions about your gambling winnings and losses. Then we’ll do all the math and fill in all the appropriate tax forms.

- These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

- In an effort to modernize the department and serve taxpayers better, the Department of Treasury has implemented major changes in requirements for businesses to e-file 1099 & W2 forms.

- File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings.

- This amount reflects the amount of payments made on the taxpayer’s behalf during the tax year to the IRS by the Payer towards payment of the taxpayer’s federal income tax obligations.

- The Send A Friend coupon must be presented prior to the completion of initial tax office interview.

You should enable the security features on your mobile device, because anyone who has access to it will be able to view your account balance. You will still be required to login to further manage your account. Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. See Cardholder Agreement for details. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Minimum monthly payments apply.

If the taxpayer or spouse has not received a Form W-2G, and believes he or she should have, the Payer should be contacted immediately. If the taxpayer requested but did not receive the taxpayer’s Form W-2G by February 28th, contact the IRS at for assistance. The name of other person present with you at the gambling establishment. The name and address or location of the gambling establishment. Gambling income refers to any money that is generated from games of chance or wagers on events with uncertain outcomes.

The taxpayer must keep very accurate records to take these deductions. 525, Taxable and Nontaxable Income and IRS Pub. 529, Miscellaneous Deductions for more information and details on reporting gambling winnings and deducting gambling losses. You must keep an accurate diary or similar record of your losses and winnings.

Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Available only at participating H&R Block offices. CAA service not available at all locations.

If the gaming facility does withhold taxes, it normally does so at the rate of 25 percent. Upgrade to the electronic filing version for just $249.

If you don’t provide your Social Security number, the withholding will be at 28% and start at lower payment amounts. You should receive all of your W-2Gs by January 31st of each year. The form itself will have a number of boxes, but for purposes of preparing your tax return, boxes 1, 2 and 14 are the most important. Box 1 reports your taxable gambling winnings, box 4 reports the federal income taxes withheld and box 14 reports the amount of state income taxes withheld. You must report the amount in box 1, as well as your other gambling winnings not reported on a W-2G, on the “other income” line of your 1040. W-2G form is for reporting gambling earnings and tax withholdings. Please fill this form out to get a copy of your gambling winnings that are subject to federal income tax withholding.

OBTP# B13696 ©2020 HRB Tax Group, Inc. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. The tax identity theft risk assessment will be provided in January 2019.