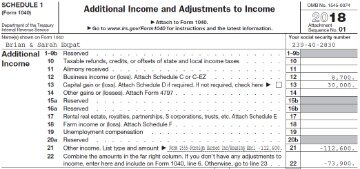

To claim the credit, you need to fill out tax Form 8880, available from the IRS or through online tax prep tools. The form asks you to itemize how much you and your spouse contributed to IRAs and to employer plans like a 401, 403, SEP or SIMPLE plan. It’s a good idea to have your financial records handy when you fill out the form, including statements and tax forms from your employer and retirement plan provider. Form 8880 must accompany Form 1040, Form 1040-SR, or Form 1040-NR in your tax return. To complete the form, taxpayers must declare their AGIs, as well as the total amount of their contributions to a given qualified plan.

There are several types of retirement accounts that could get you a tax deduction for your contributions, such as traditional IRAs and 401s. While this is certainly a nice benefit, there’s another tax benefit for retirement savings that many people aren’t aware of — the Retirement Savings Contributions Credit, or “Saver’s Credit.” DC First-Time Homebuyers Credit You may be able to claim a one-time tax credit of up to $5,000 ($2,500 if married filing separately) if you buy a main home in the District of Columbia. You must reduce the basis of your home by the amount of the credit you claim. Only purchases after August 4, 1997 qualify for this credit. The credit is not allowed if you acquired your home from certain related persons or by gift or inheritance.

signNow makes e-signing easier and more convenient since it provides users with a number of additional features like Add Fields, Merge Documents, Invite to Sign, and many others. And due to its cross-platform nature, signNow can be used on any gadget, PC or smartphone, irrespective of the OS. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Again, when you use TurboTax to complete your tax return, we’ll fill in all the right forms for you. Your Adjusted Gross Income must fall below the income limits for your filing status. For 2020, single filers with an AGI of $32,500 or more, head of household filers with AGI of $48,750 or more and joint filers with an AGI of $65,000 or more are ineligible to claim the credit.

To take advantage of this credit, claimants must satisfy a host of eligibility requirements. First and foremost, they must be at least 18 years old and they cannot be claimed as dependents by other individuals. Eligible participants must also meet adjusted gross income limits. Although full-time students are not eligible for this credit, self-employed individuals may participate in this program.

Refunds

File IRS Form 8880, “Credit for Qualified Retirement Savings Contributions,” to take advantage of the Saver’s Credit. You must use the Form 1040 tax return or Form 1040NR. The 1040 replaces Forms 1040-EZ and 1040-A effective 2018—those tax forms are no longer available.

- An authorized IRS e-file provider, the company has been building tax software since 1989.

- Your Adjusted Gross Income must fall below the income limits for your filing status.

- If you’re eligible for it, the Saver’s Credit is literally free money that the government is willing to give you in exchange for putting money away for retirement.

- Scott is also a published author and an adjunct professor at Maryville University, where he teaches courses on personal finance.

It is important to note that rollover contributions are not eligible. Furthermore, distributions from a qualified plan may reduce the amount claimed for the credit.

Our program will automatically calculate this credit for you based on the dependents and other information you enter into your return. Beginning in tax year 2018, the credit is allowed for dependents listed on your return who are over the age of 17. The credit for those over the age of 17 is $500 per dependent. If you have no tax liability , you will not benefit from the credit. You should still claim the credit so you be able to carryforward the credit to future years in case your tax situation changes.

Reasonable and necessary adoption fees, attorney fees, court costs, traveling expenses, and other expenses directly related to and for the principal purpose of a legal adoption of an eligible child. Beginning in Drake18, the Tax Cuts and Jobs Act has made ABLE account contributions eligible for the 8880 credit. If contributions do qualify, they will need to be manually entered on screen 8880 line 1.

SignNow’s web-based program is specifically created to simplify the organization of workflow and optimize the process of proficient document management. Use this step-by-step instruction to fill out the 8880 form promptly and with ideal precision. Elective deferrals to a 401 or 403 plan , or to a governmental 457, SEP, or SIMPLE plan. A breadwinner is the primary or sole income earner in a household.

The requested file was not found on our document library.

You must be at least 18 years old to qualify for the Saver’s Credit. You can’t be a full-time student, or be claimed as a dependent on another person’s tax return. As a result, you can download the signed service canada retirement application form 2019 printable to your device or share it with other parties involved with a link or by email.

An individual retirement account is a tax-advantaged account that individuals use to save and invest for retirement. As of 2021, the credit is available to single taxpayers with a maximum income of $33,000. It is filed on the one-page IRS Form 8880, which is used to calculate saver’s credits by individuals, heads of household, or married couples. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

Taxslayer Support

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). You may be able to enter information on forms before saving or printing. The Saver’s Credit is designed to give low- to moderate-income taxpayers an incentive to save for retirement, and it could be worth up to $1,000 per year if you qualify. If you qualify, this tax credit could be worth up to $1,000 in 2018.

The credit is subtracted from your tax liability, if you qualify. If you have any expense reimbursed, such as by an employer, those expenses are not eligible for the credit.

Are You Eligible For The Saver’s Credit?

You can carryforward the credit for five years from the first year you were able to claim the credit. For more information, please see the instructions for Form 8839 on the IRS websiteclick here. You must also list the total amount of distributions from such plans that you and your spouse received over the course of the tax year. You’ll subtract this number from the amount of contributions you made. If the difference is $2,000 or more, simply write $2,000 since that’s the maximum amount you’re allowed to use to figure out your credit. The credit is based on the amount you contributed to your qualified retirement plan during the year.

Scott is also a published author and an adjunct professor at Maryville University, where he teaches courses on personal finance. If you’re eligible for it, the Saver’s Credit is literally free money that the government is willing to give you in exchange for putting money away for retirement. Or put another way, the Saver’s Credit allows you to make an investment in your future that will produce an instant 10%, 20%, or even 50% return. Because the maximum credit percentage is 50%, the credit can be worth as much as $1,000 per person. Those in the 20% and 10% income ranges can claim a credit of up to $400 and $200, respectively. Taxes which are refunded to you, or taxes which are paid to a country whose government is not recognized by the US, are not considered qualified foreign taxes.

Furthermore, as of 2018, a taxpayer who is the beneficiary may also be entitled to receive this credit for contributions to Achieving a Better Life Experience savings accounts. Under the tax laws in effect for 2017, married couples making up to $62,000 can claim the credit, as can a head of household making up to $46,500 and other taxpayers making up to $31,000. Adjusted gross income levels determine the percentage of your contributions that you’re allowed to claim as a credit. Use the 2017 rules for 2017 returns, even if you’re filing them or amending them in later years. The Saver’s Credit is a dollar-for-dollar reduction in income tax. The amount of the saver’s credit you can qualify for is based on the retirement plan contributions you make and your credit rate. The credit rate ranges from 10% to 50%, depending on adjusted gross income and filing status.

Fillable Form 8880 (

Additionally, the income limits for different levels of the credit are slightly higher in 2018 than in previous years. For 2018, if you make more than $63,000 as a married couple filing jointly, more than $47,250 if filing as head of household or more than $31,500 otherwise, you’re not eligible because of your income.

Credits range between 10% and 50%, depending on the AGI. For IRA contributions, the maximum allowable credit is $2,000 for individuals and $4,000 for spouses filing jointly. The qualified retirement accounts eligible for saver’s credit include traditional IRAs, Roth IRAs, 401 plans, 403 plans, and 457 plans. Taxpayers may take advantage of this credit even when claiming separate deductions for their IRA contributions.

A tax credit is a dollar-for-dollar reduction of your gross tax liability—the total amount of taxes you’re responsible for paying as you finish your tax return. You might owe the IRS $3,000, then you go back and claim a $1,000 credit. It’s also worth mentioning that the Saver’s Credit is in addition to any other tax benefits you get for your retirement contributions.

She would like to save money for retirement and decides to contribute $2,000 to a Roth IRA to take advantage of the potential tax-free growth of earnings. Susan can claim a 50% credit, or $1,000, for her $2,000 contribution. The first column defines how much of your contribution you can claim, followed by the income parameters for each percentage for the different filing statuses. The single status includes those who are married and filing separately, as well as qualifying widows. You must be at least 18 years old to qualify for the Saver’s Credit. You can’t be a full-time student, or be claimed as a dependent on another person’s tax return. Child Tax CreditIn many cases, you can receive a credit of up to $2,000 per dependent listed on your return who is under the age of 17.

Due to its multi-platform nature, signNow is compatible with any gadget and any operating system. Choose our e-signature solution and forget about the old times with affordability, efficiency and security. The sigNow extension was developed to help busy people like you to reduce the burden of signing documents. Start e-signing service canada retirement application form 2019 printable by means of tool and join the millions of happy clients who’ve previously experienced the key benefits of in-mail signing. Once you’ve finished signing your service canada retirement application form 2019 printable, decide what you want to do next – save it or share the document with other parties involved. The signNow extension provides you with a range of features to guarantee a much better signing experience. After that, your service canada retirement application form 2019 printable is ready.

Dependents Credit & Deduction Finder

The question arises ‘How can I e-sign the I received right from my Gmail without any third-party platforms? ’ The answer is simple – use the signNow Chrome extension. Speed up your business’s document workflow by creating the professional online forms and legally-binding electronic signatures.