Content

No matter your size, where you operate, or what kinds of customers you serve, we’re here to help you create more meaningful interactions between you and your customers. Your savings is federally insured to at least $250,000 and backed by the full faith and credit of the United States Government. This Credit Union is federally-insured by the National Credit Union Administration. TurboTax now has a section on its website for customers who have not gotten their money. “Receiving the stimulus would have given me some breathing room. It would have given me an opportunity to say, ‘okay, I can pay off last month’s rent and not be struggling and not be anxious,” Davis, a Pewaukee resident and single mother of two, said.

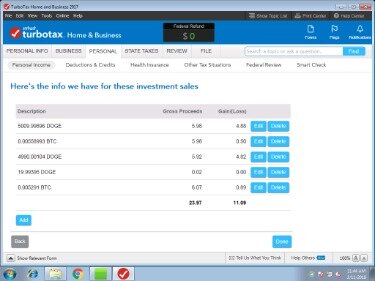

During peak tax season the application has to support over 250,000 users at once with an average session time of 35 minutes. When TurboTax’s monolithic architecture couldn’t keep up with increasingly complex requirements, Intuit partnered with Couchbase to move it to a microservices architecture on AWS. Couchbase provides the built-in high availability and data replication TurboTax needs for dependable performance and 24/7 uptime – plus the unmatched flexibility developers need for testing and deploying updates on the fly.

To claim your deductions, you must demonstrate to the IRS that you are running a bona fide business. If you have a profit in at least three of the most recent five tax years, you can usually qualify your business as legitimate. Be aware that as a blogger, you’re likely to face estimated taxes, something most traditional employees don’t have to worry about. What’s even better, CSE Federal Credit Union members can save up to $15. NCR suppliers can access and update information regarding invoices, orders, billing inquiry and performance evaluations.

Members Save On Turbotax, The Tax Software That Has You Covered

TaxAudit may, but has no obligation to monitor or respond to comments. It is not uncommon for state wages to be higher than their federal wages. This alone generally should not trigger a return to be rejected for e-filing.

If your office is in your home, you may be able to deduct some of your household expenses as well, including rent and utilities. When saving for your estimated income taxes, don’t forget to set aside additional money for self-employment tax.

During times like this, that is much needed money for many households. The IRS typically issues nine out of 10 tax refunds within 21 days or less from acceptance with e-file and direct deposit – the fastest way to get your refund. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Intuit’s TurboTax is the best-selling online tax preparation software, serving millions of customers annually.

Recent Tax Tips

By accessing and using this page you agree to the Terms of Use. From tips on tax deductions to our latest commercials, we’ve got you covered.

Under the coronavirus relief law, the IRS has to issue payments by Jan. 15. People who are eligible for stimulus payments but do not receive them, or who received amounts that are smaller than what they are entitled to, can claim them as a credit when they file their 2020 tax returns this year. The Treasury recently announced the federal tax filing deadline will be extended to July 15, 2020. Taxpayers getting a refund are encouraged to file their taxes now. Last tax season close to 72% of taxpayers received a tax refund close to $3,000, which for many taxpayers is their largest paycheck of the year.

TaxAudit deals with the IRS and state taxing authorities, so taxpaying individuals and small businesses don’t have to. As the largest tax representation provider in the country, TaxAudit handles more audits than any other firm and also offers Tax Debt Relief Assistance to taxpayers who owe back taxes to the IRS or state government.

- “2020 has proved that things wont go smoothly for really anyone in America right now, and so telling us we can get the money faster by filing taxes seems irrelevant,” Davis said.

- Still, millions of Americans have yet to receive their payments, and some of them have taken to Twitter to criticize the IRS and tax-prep services such as TurboTax and H&R Block.

- The links provided on our website are provided solely for your convenience and may assist you in locating other useful information on the Internet.

- Your savings is federally insured to at least $250,000 and backed by the full faith and credit of the United States Government.

- The main danger from a tax perspective is that, as a self-employed blogger, your taxes won’t be automatically withheld from your earnings, as is typical with traditional employees.

The main danger from a tax perspective is that, as a self-employed blogger, your taxes won’t be automatically withheld from your earnings, as is typical with traditional employees. Additionally, you’ll owe self-employment taxes that most employees don’t pay. However, you may be able to take advantage of certain deductions to reduce your tax bill. We sell more payment, assisted and self-service technologies than almost any other vendor in the world. And our experience can help you focus your efforts on the most promising market opportunities. To help prepare, Travis Credit Union members can get up to $15 off TurboTax® federal products. With TurboTax Live, you can have a live CPA or EA by your side to answer questions and review your tax return.

Be The Boss Of Your Money! Tax Refund Quick Tips

Melissa Davis said she used TurboTax and was expecting a stimulus payment in her bank account. Screen sharing capability allows the TurboTax tax expert to visually guide you and answer your questions by circling information and highlighting next steps right on your screen. With the combination of document upload capability and accurate data transfer, TurboTax autofill eliminates the need for manual data entry for millions of tax filers, increasing the ease and accuracy of tax preparation. Whether you start on your Windows 10 tablet or computer, TurboTax securely imports your tax information – W-2s and 1099s – directly. This credit union is federally insured by the National Credit Union Administration. The IRS will disallow your tax deductions if your blogging business is categorized as a hobby.

Our customers receive expert tax representation and relief from the nightmare of facing the IRS alone. Travis Credit Union offers links to other third-party websites that may be of interest to our website visitors. The links provided on our website are provided solely for your convenience and may assist you in locating other useful information on the Internet. When you click on these links, you will leave our website and be redirected to another site. Please be advised that the third-party website is not operated by Travis Credit Union. Travis Credit Union does not guarantee the products or services advertised on them.

Terms, conditions, features, availability, pricing, fees, service and support options subject to change without notice. Intuit, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries. Other parties’ trademarks or service marks are the property of their respective owners. Visit turbotax.intuit.com/lp/yoy/guarantees.jsp for TurboTax product guarantees and other important information.

The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Other things the IRS may consider are the time and activity you put into the business, whether or not you depend on income from it and if you can reasonably expect to make a profit in future years. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). This blog does not provide legal, financial, accounting, or tax advice. TaxAudit does not warrant or guarantee the accuracy, reliability, and completeness of the content of this blog.

Jessica Brown is the Graphic and Communications Analyst for TaxAudit. Since she began working for the company in 2008, she has found herself surrounded by people whose passion for taxes is contagious. She writes blogs to share her unique perspective as a non-tax professional with a fondness for tax-related issues. has teamed up with TurboTax to help keep you up-to-date on the latest tax filing info – visit the TurboTax coronavirus tax center to learn more. Taxpayers can be confident that TurboTax is ready to help them file now up until the extended July 15 deadline. And if you have any questions along the way, TurboTax has a team of credentialed TurboTax Live CPAs and EAs available on demand to help you out.

Taxpayers getting a refund are encouraged to file now and get their money. NCR is the world’s leading enterprise technology provider of software, hardware and services for banks, retailers, restaurants, small business and telecom & technology. We enable digital transformation that connects our clients’ operations from the back office to the front end and everything in between so they can delight customers anytime, anywhere and compete. H&R Block said earlier this week that the IRS determines where payments are sent and that it some cases, the $600 payments were sent to different accounts than the earlier round of stimulus payments were sent to in the spring. The IRS said in a question and answer document earlier this week that because of the speed with which it is required to issue the payments, some payments may have been sent to inactive or unfamiliar bank accounts. In cases where payments were sent to inactive accounts, the banks cannot keep the payments and have to return them to the IRS. A coronavirus relief package enacted in late December provides for payments for most Americans of up to $600 per adult and per child.

Even if you only work part-time as a blogger and full-time as a salaried employee somewhere else, the blogging part of your income qualifies as self-employment income. As a result, you must pay self-employment tax on that income, which is the combined Social Security and Medicare taxes paid by an employee and an employer. Since you run your own business, you must pay both the employee and the employer portions. Self-employment tax must be paid whether or not you owe any federal income tax. If the income items on the Schedule K-1 are sufficiently large, they will generate additional taxes due on your return.