Content

Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.

Be sure to also notify your return preparer. Interestingly, in order to improve address quality and obtain postal discounts, the IRS utilizes the NCOA to update taxpayer addresses.

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations. Available only at participating H&R Block offices. H&R Block does not provide immigration services.

Form Your Llc

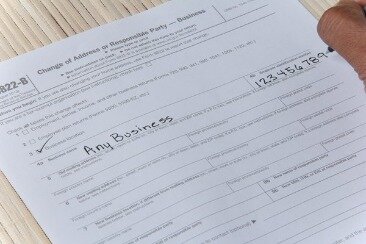

File with a tax Pro At an office, at home, or both, we’ll do the work. Complete Part II of Form 8822 with your business name, employer identification number, old business address and new business address. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you move abroad, the IRS suggests entering the foreign address in the format customarily used in that country. Collect all of your personal identifying information including your full name, date of birth, filing status, social security number , old address, and new address and call the IRS directly. There are three convenient methods you can use to change your address.

Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations. Promotional period 11/9/2020 – 1/9/2021.

It’s a good idea to let the Internal Revenue Service know as soon as possible if you move. You can update your address over the phone, or by filling out a form that the IRS provides and mailing it to the agency.

Also, in the past, tax filers with an adjusted gross income over $75,000 for individuals and $150,000 for married couples filing jointly were disqualified from stimulus checks. Learn more about eligibility and possible recipient exceptions here.

Although you may have entered an actual physical address when you got an EIN Number for an LLC, the IRS treats this address as a “mailing address”. Using Form 8822-B creates a better paper trail. Once Form 8822-B is processed, the IRS will mail you back a confirmation letter within days.

Business

Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

Year-round access may require an Emerald Savings®account. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.

The most important thing to remember is that not all individuals may qualify. Your best bet to ensure you get your stimulus check without delay is to know how to notify the IRS of your address change and file a USPS change of address. If you moved since you filed your last return, you probably arranged to have your mail forwarded to your new address. However, not all post office branches forward government checks. Be sure your statement includes both your printed name and your signature.

How To Change A Shipping Address With Paypal

Call the IRS or go to your local office. LLC University® is an educational company and does not offer legal, tax, or financial advice. We teach people how to form LLCs in all 50 states. If you need to change your LLC name with the IRS, you can’t do that with Form 8822-B.

Available at participating offices and if your employer participate in the W-2 Early AccessSM program. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest.

Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply. Limited time offer at participating locations.

Send your statement to the address where you would send a paper tax return. You should both sign the written statement if you filed a joint return with your spouse and you’ve jointly changed your address. For changes of address relating to an employment tax return, we issue confirmation notices for the change to both the new and former address. Joint Filers – If you filed a joint return, you should provide the information and signatures for both spouses. Send your written address change information to the IRS addresses listed in the instructions to the tax forms you filed. If you change your address before filing your return, enter your new address on your return when you file. When your return is processed, we’ll update our records.

You can also update another person’s address, such as an elderly parent or relative, if you’re their authorized representative. Unauthorized third parties can’t change a taxpayer’s address.

- You should know that we do not endorse or guarantee any products or services you may view on other sites.

- Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

- The Check-to-Card service is provided by Sunrise Banks, N.A.

- You’ll want to complete the online form twice; once for yourself and once for your LLC.

- Discount is off course materials in states where applicable.

You can change a spouse’s address with the same form. It can generally take four to six weeks after receipt for a change of address request to fully process. It can take four to six weeks for a change of address request to be fully processed. For information on changing the “responsible party,” see Form 8822-B. To help our clients comply with Government regulations and control costs by providing accurate, on-time payroll and business services. Forming an LLC shouldn’t be so complicated.

If the check is confirmed as returned to the IRS, you will have to enter your new mailing address. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited.

Alert the post office of your change of address so that your mail is forwarded. If you filed a joint return and you and your spouse have since separated, each of you should update the IRS with your new address information. If you filed a joint return, you need to change the address of both spouses.

It is always a good practice to ensure your address on file with the IRS is up-to-date. You can’t change someone else’s address, even if you’re a relative, parent, child, or spouse, if you aren’t their authorized representative. You can use one of five different methods to change your address.