Content

Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details.

The sooner in the year you submit this change to your employer, the sooner your new withholding will take effect. We can help you understand how to fill out a new Form W-4. Plus, our W-4 calculator page is a great resource.

- Otherwise, you’ll need to fill out Form 9465 and mail it to your local IRS office to see what kind of plan you qualify for.

- Every year, certain taxpayers are surprised that they owe additional income taxes even though their employer withholds taxes from their paycheck each week.

- This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- If you have non-wage income, you may be able to have income tax withheld from it voluntarily.

- By the beginning of April 2019 the IRS had issued about 1.64 million fewer refunds than it had by that same period in 2018.

- This can help you get the outcome you want next year—whether it’s a big tax refund or more money in your paychecks week to week.

E-file fees do not apply to NY state returns. If you use our online tax filing options, you’ll be able to see your refund results in real time.

You Are Leaving H&r Block® And Going To Another Website

The Taxpayer First Act allows the IRS to accept credit or debit card payments beginning in 2020. This penalty applies to all returns due from Jan. 1, 2020 onward.

Withholding is the amount of money taken out of every W-2 worker’s paycheck as an estimated payment for the taxes they will eventually owe. Then, at the end of the year, that worker calculates their taxes and compares the amount withheld to the amount they owe. If the IRS withheld more than that worker’s tax burden, as is the case for more than 70% of all taxpayers in an average year, the Treasury sends a refund check. Most Americans get a refund when they file their taxes. This year, though, tax refunds are down… way down. By the beginning of April 2019 the IRS had issued about 1.64 million fewer refunds than it had by that same period in 2018. Individual refunds have only gone down by an average of $20 per taxpayer, but a lot fewer people are getting them.

Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. File with a tax Pro At an office, at home, or both, we’ll do the work.

News and World Report, CreditCards.com and Investopedia. Rebecca is a graduate of the University of South Carolina and she also attended Charleston Southern University as a graduate student. Originally from central Virginia, she now lives on the North Carolina coast along with her two children. For help with taxes and any other manner of financial questions, consider working with a financial advisor. SmartAsset’s free tool connects you with financial advisors in your area in five minutes. If you’re ready to be matched with local advisors, get started now. Paying taxes is never pleasant, especially when you aren’t expecting to get hit with a bill you can’t afford.

Video: Why Would I Owe Federal Taxes?

OBTP# B13696 ©2020 HRB Tax Group, Inc. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.

For other people, the problem stems from having less federal income tax withheld from their paychecks in 2018. Early last year, the IRS changed its withholding tables in an attempt to more closely match the amount of tax people would owe under the new tax laws. One of the main pitches made by lawmakers in support of the Tax Cuts and Jobs Act of 2017 was that tax reform would provide tax cuts for everyone.

The IRS has announced an effort to help struggling taxpayers get a fresh start with their tax liabilities. The goal of this effort is to help individuals and small business meet their tax obligations, without adding unnecessary burden. Specifically, the IRS has announced new policies and programs to help taxpayers pay back taxes and avoid tax liens. While the majority of Americans get a tax refund from the Internal Revenue Service each year, there are many taxpayers who owe and some who can’t pay the tax all at once. The IRS has a number of ways for people to pay their tax bill. It’s important to pay the taxes you owe to the IRS because non-payment can have a negative impact on your life. An experienced tax attorney can help you work out a plan that fits within your budget and needs, while ensuring proper procedures are followed.

Tax Bracket Calculator

For eligible individuals with lower incomes, the fee can be reduced to $43. We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically when the IRS sends the first notice demanding payment of the tax debt assessed against you and you fail to pay the amount in full. The filing of a Notice of Federal Tax Lien may affect your ability to obtain credit. Once a lien arises, the IRS generally can’t release the lien until the tax, penalty, interest, and recording fees are paid in full or until the IRS may no longer legally collect the tax.

Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only.

Of course, if your income fluctuates unpredictably, this is all a lot harder. But following the steps above should help you get close to a reasonable number. If you adjust your W-4 to make up for any underpayment or overpayment partway through the year, you’ll want to fill out a new W-4 in January or your withholding will be off for the new year. If you don’t have enough tax withheld, you could be subject to underpayment penalties. Note that the IRS requires that you have a reasonable basis for the withholding allowances you claim. You could also decrease the number of withholding allowances you claim, but the results won’t be as accurate. That will tell you how much extra you want to have withheld from each paycheck.

In doing so, the agency reduced the amount it withheld from the average worker’s paycheck. This caused people to keep slightly more of their money on a per-paycheck basis. Media reports have indicated that the IRS was directed to make this adjustment for political reasons during the 2018 election year. Instead of making Tax Day the time when everyone cuts the government an enormous check, Congress made April 15 a day when the government pays them. From a political perspective, it really doesn’t matter that the IRS is paying people with their own money.

Self-employed taxpayers, though not subject to withholding, can face similar issues when they fail to make estimated tax payments. As a self-employed taxpayer, you have an obligation to make up to four of these estimated tax payments to the IRS throughout the year. If you don’t report any income until you file your tax return—you’ll have no choice but to make one larger tax payment. But you should also realize that the IRS may charge you interest and penalties for failing to make sufficient quarterly estimated payments. But one reason you might be looking at a much smaller tax refund — or owe far more money than you’d imagine — is that you’re not earmarking enough cash out of each paycheck toward your taxes. If you need to change your withholding, you need to complete a new W-4 form.

The IRS will sometimes have trouble keeping track of your income and how much you owe. This is especially common if you have been making payments under a payment plan.

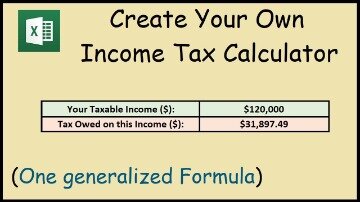

It could eat up most of the refund they might have otherwise expected and, combined with lower withholdings per the new W-4 form, more people may have to send checks to Uncle Sam in April. Markowitz expects to be helping his lower-income clients figure out ways to do that. The new W-4 form was intended to minimize refunds and have withholdings more accurately reflect people’s ultimate tax liabilities. In other words, many taxpayers took home slightly bigger paychecks last year at the expense of refunds this spring. Changes to federal taxes enacted under the Tax Cuts and Jobs Act means many people who didn’t update their W-4 form likely had less tax withheld from each paycheck in 2020. There are a number of free income tax calculators online. If you enter your gross pay, your pay frequency, your federal filing status, and other relevant information, the calculator will tell you your federal tax liability per paycheck.

Here are ten tips for taxpayers who owe money to the IRS. This is the IRS version of “let’s make a deal”. Under certain limited circumstances, the IRS will accept the payment of a smaller sum as payment in full for a larger tax debt. Individual states have similar procedures. If your offer in compromise is accepted, tax liens are removed and you are given a fresh start. Here, the IRS allows you to make monthly installment payments for tax bills of $50,000 or less through a streamlined installment plan. The installments must pay off your entire tax bill within six years.

For more information about payment plans and payment methods, see Additional Information on Payment Plans and Topic No. 202. Advance knowledge is always a good idea when it comes to owing taxes.

If you sell stock, for example, you may have more income than usual – and a bigger tax bill. Even unemployment benefits can increase your tax bill. Overpaying by thousands of dollars “just to be sure” is not the answer. The average tax refund is about $3,000. That’s somewhat curious, considering the average American doesn’t seem that worried about owing money to other creditors.

Tax Services

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. You can even take the IRS to court and they cannot collect from you until the judge issues a decision. Court cases can tie the IRS’s hands for years. If you have been summoned to an IRS interview, you should be represented by a tax attorney. If you are nervous about speaking to a revenue agent, you may have your attorney answer all questions on your behalf.