Content

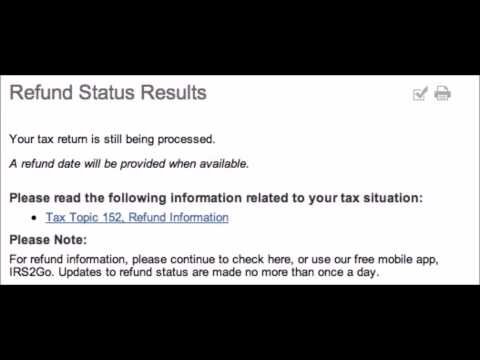

As noted above, you can get a transcript at this IRS webpage Get Transcript. I used an incognito session in my browser and that error message went away, creating a new account worked.

If this is also rejected then you will have to print and mail the tax return. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Have you ever needed a tax return from a prior year, but either forgot where you put your copy or just didn’t have one to begin with? Select the return you want to view and wait for it to open as a PDF file.

Turbotax Editors Picks

Double-click “CovertedTaxFile.pdf” on your desktop to view the file using your PDF reader. Launch TurboTax for the year of the return you want to view. For example, you need TurboTax 2009 to open your 2009 return. If you don’t have the right version, you must convert it to a PDF to view it.

If a copy of their 2017 tax return is not available, taxpayers may be able to obtain a copy from their previous year’s tax preparation software or previous tax preparer. EVERY year before mid-October you should save a copy of your tax return as a pdf and print a copy of it for your records. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers.

Enter the form you used to file your federal income tax return on line 6. If you are requesting a personal income tax return, it’s likely you filed on Form 1040, 1040-SR, 1040A or 1040EZ. You must also enter the tax years you are requesting copies for on line 7.

- Taxpayers can avoid the rush by using online options that are faster and more convenient.

- Of course, you’re also supposed to eat more bran, drink less soda, and drive your car slower.

- Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

- If you don’t see this link, click “Tools” and “View Past Returns.”

- Once the IRS receives your request, it can take up to 60 days for the agency to process it.

- You can also pay the IRS $50 for anexact copy of your return.

for tax year 2017, you want the transcript for the year ending 12/32/2017. Note that transcripts by mail are not available at the moment because of the ongoing situation. But you may be able to get your transcripts online. A “transcript” refers to a specific type of document that contains the numbers from your prior returns, but not the lines and boxes and shading. Yes, you can get a copy of your tax transcript from the IRS website.

Enter your name and Social Security number on line 1. If you filed a joint return for any of the years you are requesting copies, then you must also provide your spouse’s name and Social Security number on line 2.

Before mailing, insure you enclose full payment; otherwise, the IRS will not process your request. You can request copies of your IRS tax returns from the most recent seven tax years. We offer various transcript types free of charge. Citizenship and Immigration Services and lending agencies for student loans and mortgages generally accept a tax return transcript as a substitute for a copy of your return. The electronic signature is the way the taxpayer acknowledges that information on the tax return is true and accurate. Validating the electronic signature by using prior-year adjusted gross income is one way the IRS, state tax agencies and the tax industry work to protect taxpayers from identity thieves.

I need to mail the irs a copy no later than 9/20. i dont wanna do ma taxes al i need if all i need is copy of 2009 for h&r block. There is a charge for copies; however, a transcript of the return is free. Be sure to look at the transcript types to see which one you want and also to indicate the right year.

Latest Tax And Finance News And Tips

Your selected PDF file will load into the DocuClix PDF-Editor. Click My Account on the upper right side of your account screen. Taxpayers who fail Secure Access and need to request a Tax Return Transcript can use the mail option. If so, the files are on your own hard drive or any backup device you used like a flash drive. You can get all forms at the IRS web site () or by calling .

The IP PIN will serve to verify the taxpayer’s identity. If the taxpayer has never filed a tax return before and is age 16, enter zero as the AGI.

Step 4: Enter Form Used

Sign the form and mail to the appropriate IRS address. Page 2 of Form 4506 requires you to mail your request to the address listed for the state you lived in when you filed the original return.

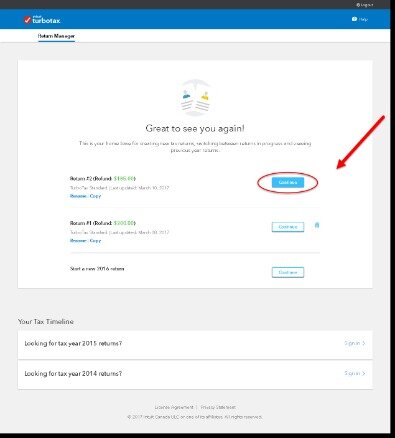

If you filed your taxes with a TurboTax CD/download product, your tax return is stored on your computer, so you can print a copy at any time. If you used TurboTax Online, you can log in and print copies of your tax return for free. TurboTax saves you time by collecting your information and completing the various lengthy forms you need to file for your business. It also enables you to view your prior-year tax returns, though the method of access differs depending on the version of TurboTax you used. For example, if you have the TurboTax software, your prior-year return was saved to your computer. If you used the online version of the software, you can find your return on the TurboTax website. There are different ways to obtain your tax return information.

For additional information about tax relief in disaster situations, refer to Topic No. 107 or call the IRS Disaster Assistance Hotline at . The only way you can obtain copies of your tax returns from the IRS is by filing Form 4506 with the IRS. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. You can go to the Get Transcript page to request your transcript now. Form 4506-T-EZ was created only for Form 1040 series tax return transcripts. Allow at least 10 business days from when the IRS receives your request to receive your transcript.

Watch this video to find how about recovering past years’ tax returns. Click “File” in TurboTax, then click “Open.” Browse to the location of your tax return, then double-click it to view it. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX.

Ready To Try Turbotax?

This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog. Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted.