Content

Offers additional support-TurboTax Tax Preparation software offers the feature of Audit Defense from Tax Resources, Inc. This service can prove to be extremely useful during an income tax audit. Filing your taxes can be a hassle, depending on your situation. If you’re just an individual filling out a W-2, you can likely handle that yourself. But when your return is more complex, you might find it’s worth hiring a professional — someone who can save you not only time and stress but also money. Tax CPAs also often provide expert advice regarding rental property, investment income, business expenses, and industry-specific deductions that people might miss. CPAs are authorized to represent clients before the IRS to help deal with all matters including tax return audit and collections.

I felt that TurboTax made it pretty simple and optimized my return quite well given the number of possible deduction options it provided. However, I have no basis of comparison with anything else. I’m always a little skeptical when it comes time to take some of the more obscure deductions. I’m also wary that the software may have bugs from time to time. The good thing though is that the IRS and Intuit seem to work together.

I do a better job than Turbo Tax without all of the annoying questions. My personal experience is that we save some first time clients money when we prepare their taxes, some break even, and some even pay more in the short run. Yes, they find out that they were doing it wrong or just plain not doing it and come to us to get on track. Often this happens after an IRS agent gently lets them know that they are over their heads. Steve, the advantage of an accountant probably won’t show on this year’s taxes. The advantage of an accountant is that he / she can tell you where to make changes that will save you taxes and other headaches next year.

Because we emailed him an archive of about a dozen password protected pdf’s, his assistant got fed up because she didn’t feel like opening each pdf up and printing them out. So she called and asked us to mail a physical copy of our tax forms to their office instead. In any case, since we didn’t want to make the drive up to his office, we decided to scan all of our 1099’s and other tax forms into pdf format and emailed encrypted versions to him for review.

If my situation was complicated, I am certain a tax accountant would be able to find those hidden deductions but its not. A serious accountant tax preparer deals with tax authorities on a regular basis and therefore adds a layer of real world knowledge and interpretation based on practice.

I was worried I was doing something wrong, so I decided to go to a CPA to do our taxes and see what he came up with. Well, long story short, he is getting us back 150$ less and charging us 240$. Steve, personally I’m really hoping that your accountant pulls it off and saves you some money! Don’t forget that your time spent preparing your taxes is time that you are not making income on other projects.

If you do have the time, the TurboTax will help you create a high-quality return for a budget-friendly price. If you place your income into the wrong section, such as self-employment income instead of W-2 income, then TurboTax is going to place your numbers into the boxes you’ve designated. Although the software asks plenty of questions to prevent mistakes from happening, it doesn’t always catch a mistake that occurs.

Another problem is you really don’t have any idea if your doing it correctly. If you have an LLC, a Corp, an S-Corp and your doing your own accounting and taxes and not paying a CPA to do them you are flat out crazy! Turbotax is great for the 80% of tax situations out there.

Cost effective- In comparison to hiring the services of a CPA, the cost of using Turbo Tax is quite less. Though obviously, you will have to invest in the software, but over a period of time, you will get value for your money. Moreover, you have also got the option of using outsourced Turbo Tax preparation services. In such a case, you will not have to invest in the software and will have to pay only for a number of hours; the outsourcing firm has worked for.

Who Should Hire An Accountant?

With my own copy of my data, I could have typed the number in myself and would have immediately known the answer to my question. Over the year, in my own planning, when I filed my own taxes, I routinely would open my computer software mid-year and play the “what if” game.

Working with a Certified Public Accountant means you’ve got someone who is taking a comprehensive and personalized look at your financial information. As a trusted professional, a good accountant will be able to answer important questions that arise not just during your annual consultation, but at other times during the year. Amazing article And you defined very clearly about taxes and need of an accountant to handle tax transactions. I have learned a lot of useful information through your blog. Worst case, next year you’d rather do your own again, you can always itemize the $500 you paid and get back some of that. Hope you’ve been doing that with the $75 you paid toward turbo tax.

Under their current structure, you can file taxes from for a cost that is comparable to what the current year filing costs happen to be. You can purchase the Deluxe return for 2016 at $69.99, the Premier for $99.99, or the home and business package for $109.99. At the time of writing, the 2014 tax returns were actually $10 cheaper. You can use it to fill out your state and federal income tax returns. The software allows you to electronically file your tax returns once you’ve completed them.

Here’s How To Choose Diy Tax Software According To Tax Expert Kathleen Delaney Thomas

With TurboTax, you are able to complete the return on your own and verify that the information is complete. Starting in 2017, you could even pay to ask CPAs a question about your return if you were uncertain about something. You’ll still pay more by using TurboTax than you would if you completed all the tax forms on your own. Thanks to the IRS website, you can fill out, then submit your forms electronically, without a fee. If you must file a state return and a federal return, you’ll pay $37 for the state, and a range of prices for the federal, which can be more than $90. Taxpayers who find themselves at the center of complicated business and investment matters may even have the skill to sort through their taxes on their own, but is it worth their time? A professional tax preparer is so familiar with the system, they can quickly and easily accomplish tasks that might take even skilled taxpayers hours of research.

In the end, they discovered that he made a typo on his filing that was easily correctable and he didn’t have to pay anything extra. That being said, one of the things that I like about Turbo Tax is that they offer this program called Audit Defense. For an extra $40, an accountant or an account representative will take care of dealing with the IRS for you in the event of an audit.

If you’d like to hire an experienced CPA to help you with your tax preparation and tax planning, we can help. We work with clients in and around the Triangle including Raleigh, Durham, Wake Forest, Wilson, Apex, and Cary and offer telephone and video conferencing, as well as in-person meetings. Weighing the pros and cons and answering your questions will help you choose the best option for how you choose to complete your tax return.

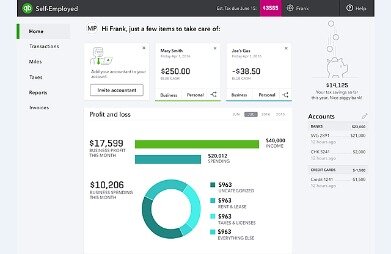

TurboTax Live experts are highly knowledgeable, with an average 12 years experience in professional tax preparation. Their tax advice, final reviews, and filed returns are guaranteed 100% accurate. It’s interesting that you mention that hiring a professional accountant to help you with your taxes can help you save money. I want to make sure that I’m not paying more to the government than I need to, so I’m considering hiring an accountant to help me with my tax return. I’m going to look for a reputable accountant in my area that offers tax planning services. Using an accountant can help you to file your taxes correctly and prevent you from making any costly mistakes if you’re self-employed or own your own business. Your accountant can also help determine how much you should pay in quarterly estimated tax payments going forward so you’re not faced with a big tax bill at filing time.

Reliable Home Care Service Llc

Before I continue, I just want to emphasize that the conclusions I’m making in this article should be taken with a grain of salt and are not indicative of accountants in general. There are thousands of CPAs out there and our experiences represent just a single data point. If the accountant saved me more than $425, then it’d be a no brainer to use him again.

To verify that a CPA is registered with a PTIN, simply search the IRS Return Preparer Office Directory. It is our goal to be our client’s most trusted financial advisor and to serve with the highest professional standards in a warm and friendly atmosphere.

- Later on when we confronted the accountant, he explained that he could not have possibly known about the work done on our house.

- Easy to use- While preparing your tax return using Turbo Tax software, you don’t require having in-depth knowledge about tax preparation.

- When you file your own taxes, even with the help of TurboTax, then you are taking responsibility for the accuracy of the information.

- Management accounting, analyzing the financial information of the organizations for which they work.

- Picnic’s goal is to make tax filing simpler and painless for everyday Americans.

- If you used an accountant in the past, try TurboTax; if you used a tax preparation software, give human a chance.

It sounds like your tax situation is more complicated than mine. I just have a W2, a bunch of 1099’s and the Schedule C to worry about.

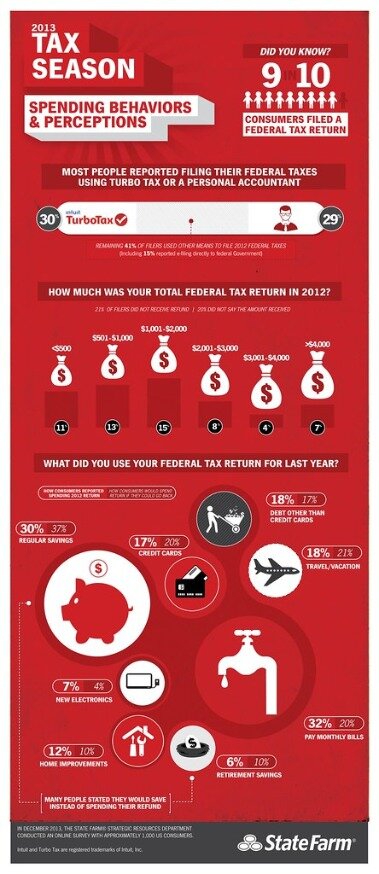

For example, let’s say you just converted your business to an LLC. An experienced accountant will be able to sit down with you and explain step by step how to file for taxes and how this year differs from last. You can set up a meeting with a CPA and engage in a face to face conversation about your tax and financial situation. Many people really value that conversation and want to have that one on one time to understand the tax return process and help uncover all possible credit and deductions. To begin, I never want to hear that individuals are not filing their taxes, but I am not naïve to think the percentage would ever be 0. But the data that really breaks my heart is that the percentage of people using a tax prep software is higher than that of the population using an accountant.

Cheap Ways To Get A Tax Refund Faster

After all, the tax implications of funds you bring in through your business can be more complex than income taxes when you only have income from an employer. Ryan McInnis founded Picnic Tax after working for more than a decade at some of the financial services industry’s leading firms. Picnic’s goal is to make tax filing simpler and painless for everyday Americans. For example, the IRS might be willing to set up a payment plan with you if you meet the qualifying criteria. It helps to have an accountant work on your behalf to make sure everything is filed correctly as you attempt to rectify the issue. Your tax picture will change significantly if you buy your first home.

You can easily access the information, whenever necessary. A CPA can provide a variety of services depending on whether they are in a public practice or work for a corporation as an accounting professional. The services an accountant can provide includes analyzing financial data, maintaining accounting records, providing financial projections, and preparing taxes. With TurboTax, the bottom line is that you need to have a desktop, laptop, or compatible mobile device to use the software or online services for your taxes. To use the online version of TurboTax, you must have a reliable connection to the Internet. If you do not have any of these things, then a CPA is going to be your better option.

Users receive targeted questions that you must acknowledge before you can file your taxes. A CPA may offer a similar guarantee, to provide similar results, but again – at a cost that may be much higher. Although this option may go away in 2018 with the removal of the 1040EZ form, there are still circumstances where you can qualify for free tax preparation with TurboTax. That includes completing and filing your returns for free. In theory, a CPA could offer this service as well, but you would need to search for one willing to work with you. Ultimately, there is no universally correct answer to the question of hiring a tax professional or doing your taxes yourself with software. Your comfort and familiarity with IRS rules will be part of your decision, but the complexity of your finances should be the key deciding factor.

The software is highly intelligent, but I would not go as far to say it is artificially intelligent. And when you finally find one you want to work with, their office is far away. If you are employed, you may have questions relating to the tax implications of changing jobs or a life event. A completely FREE mini course on how to develop a niche ecommerce website in 5 easy steps! Learn how to find products to sell and setup your online store. No one is perfect and people make mistakes which is why TurboTax found some things that first accountant did not.

Although there will still be quite a little work to do, it can save you some time next time around. TurboTax is tax preparation software created by Chipsoft in the 1980s in San Diego, USA. Since its inception, this software has become extremely popular. It has various versions like TurboTax Deluxe and TurboTax Premier.