Content

My issue with your view is the same as with Intuit’s. Millions of people have S corporations, yet no one ever addresses which person tax software they should use. The personal one for S corporation owners remains a mystery every year.

This Turbotax software can be downloaded or installed via CD and also includes live support available 24/7. TurboTax Home & Business is the company’s most advanced tax-preparation program. It has all the features the less expensive versions have and gives you additional tools to help you report business income. Intuit recommends choosing TurboTax Home & Business if you are a single-member LCC, a sole proprietor or a 1099 contractor. Intuit also suggests using this version if you file personal and business taxes together, prepare W-2s and 1099-MISC forms, or receive income from self-employment or a side job. The dark side, if there is one, of these multiple offerings from TurboTax is that you never know if you are paying more than you need to for these helpful services.

Intuit TurboTax Home and Business 2019 Free Download new and updated version for Windows. It is full offline installer standalone setup of Intuit TurboTax Home and Business 2019 Free Download for compatible version of Windows. Program was checked and installed manually before uploading by our staff, it is fully working version without any problem. After majoring in physics, Kevin Lee began writing professionally in 1989 when, as a software developer, he also created technical articles for the Johnson Space Center. Today this urban Texas cowboy continues to crank out high-quality software as well as non-technical articles covering a multitude of diverse topics ranging from gaming to current affairs.

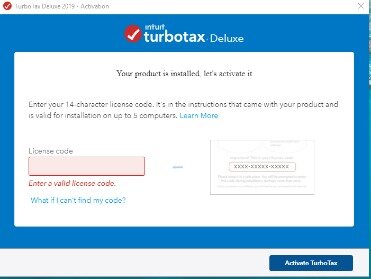

No automatic access to past filing info unless you pay extra for the PLUS package. As with the CD, Deluxe includes added features relating to deductions. If you want easy, effortless filing and don’t mind paying for it, follow Intuit’s advice about which version to choose. See the chart below for the way TurboTax adds features to increasingly expensive versions. Turbotax recommends the Premier Edition, which has all the features of Deluxe plus more tools to deal with investments and rental property, to people who have stocks and bonds or rental income. It calculates losses and gains on stocks, bonds, mutual funds and employee stock plans, and calculates rental property income, expenses, and refinancing issues.

But you can’t be sure you need the extra features you pay for in the higher-level versions. Even self-employed people, and others with more than basic tax needs, may be able to get away with a cheaper version than what Intuit recommends. In fact, all versions but Freedom Edition charge you for e-filing state returns. Make filing taxes easier and maximizing deductions with the help of Intuit Turbotax Home & Bus 2019. It’s suitable for use by numerous industries, including self-employed freelancers, small business owners and landlords collecting income from rental properties. Calculate expenses based on industry to find write-offs, reducing the amount owed. Fill out forms such as the 1099-MISC quickly and easily.

Popular Products

It guides users through completion of Schedule C and maximizes deductions for your home office, vehicle, and other business costs. It includes a simple way to enter income and expenses. It creates W-2 and 1099 forms for your employees and contractors. And it walks you through start-up costs new businesses can deduct. The Basic Edition fit my needs when my income was from W-2s and interest on savings and my deductions were few and straightforward.

We know your industry, Don’t miss any tax write-offs—we’ll help you spot overlooked tax deductions for your industry. Intuit’s product additionally gives its clients genuine feelings of serenity by keeping up a database of in excess of 350 derivations and credits. The program searches out any applicable reasonings and credits to assist you with getting the biggest assessment form conceivable. When the structures are finished, TurboTax runs a precision check before sending them off to the IRS. A blunder or oversight can make things particularly hard for organizations, so the capacity to twofold check your recording is a significant component you need from your product. , Over the years, TurboTax has stayed a top name in the duty programming division for a few reasons. Intuit’s contribution flaunts vigorous highlights for independent companies and vows to help clients precisely document with the IRS every year.

Self-employed deductions, We’ll tell you which expenses you can deduct such as phone, supplies, utilities, home office, and more. Get exclusive email-only offers and advance notice about sales & events. If you would like to share feedback with us about pricing, delivery or other customer service issues, please contact customer service directly. Get specific details about this product from customers who own it.

- Intuit also suggests using this version if you file personal and business taxes together, prepare W-2s and 1099-MISC forms, or receive income from self-employment or a side job.

- Even self-employed people, and others with more than basic tax needs, may be able to get away with a cheaper version than what Intuit recommends.

- Most items come with a limited manufacturer’s warranty.

- It’s very hard to tell beforehand exactly what the package you are buying allows you to do, even if you read through Intuit’s FAQS and its responses to customer critiques on product pages on Amazon.

- The program searches out any applicable reasonings and credits to assist you with getting the biggest assessment form conceivable.

- Self-employed deductions, We’ll tell you which expenses you can deduct such as phone, supplies, utilities, home office, and more.

Importing this data saves you having to input it and avoids errors. But TurboTax Free Version will NOT import this data unless you pay an additional $30 for the PLUS package. Intuit recommends TurboTax Home & Business for the self-employed.

The product’s online interface is easy to utilize, so you can undoubtedly record your charges without having a degree in account or perusing the government charge code’s a huge number of pages. With the correct business charge programming close by, you can rapidly and accurately record your yearly duties absent a lot of issue. Subsequent to inspecting numerous answers for do only that, we suggest Intuit TurboTax as the best online assessment recording choice accessible. Estimate the monthly payment amount of a purchase using our easy Payment Calculator. Simply enter the purchase amount, select the desired period, then calculate. A Walmart Protection Plan can be added within 30 days of purchase. I’ve used turbo tax deluxe and premium for several years and I was really satisfied.

Tips For Choosing A Version Of Turbotax

Using Home & Business is a “recommendation” of Intuit’s, not a “requirement.” Here’s a summary of my advice, based on information in TurboTax’s forums and FAQs and Amazon product forums. So let’s talk figure out which version of TurboTax best fits your needs. I have used the Basic, Deluxe, Premier, and Home & Business versions over the years, based on what was going on in my life, and have been equally satisfied with each version. Tall Clovers is a former legal and finance professional and small business owner. A vehicle tax deduction, let us determine if actual expenses or the standard mileage rate will get you the biggest tax deduction.

You can view your Walmart Protection Plan after your purchase in the Walmart Protection Plan Hub. Most items come with a limited manufacturer’s warranty. The addition of a Walmart Protection Plan adds extra protection from the date of purchase. Walmart Protection Plans cover the total cost of repair, or replacement, for products, as well as covering delivery charges for the exchange.

Some, perhaps all, versions of TurboTax also allow you to import your W-2 and 1099 data from over 100,000 companies. As with the CD, Premier includes features in Deluxe plus features relating to investments. Basic on CD is replaced online by the Freedom Edition and the Free Edition, both free, although they have some differences.

The method developed behind it is it calculates based on provided input values and runs the values with different methods designed. Users can customize the methods according to their business type or running.

How To Efile Your Income Tax Return And Wealth Statement Online With Fbr

This is the cheapest version of TurboTax that you can get on a CD, but TurboTax also has two free online versions . Each version of TurboTax adds a tier of features to the next cheapest version, based on your tax preparation needs.

Select all that apply to find reviewers similar to you. Perfect for entering multiple sources of income reported on the NEW 1099-NEC, and sales from goods and services on 1099-MISC. We’ll walk you through expense categories and offer additional tax-deduction suggestions.

I am speaking here of the four CD/Download versions that both TurboTax and Amazon sell, which let you install Turbotax on your computer using a CD or download. Either version will update itself online after installing. This difficulty, some say, benefits Intuit but makes your decision more difficult. Consider your lifestyle when deciding which version of TurboTax software suits your needs best; also consider how much you want to pay for convenience.

You will get product key and an email download link immediately after make payment. Answers as you go, Free U.S.-based product support and easy-to-understand answers online 24/7. Toward the finish of the expense recording process, TurboTax lets you survey both your state and government returns before e-documenting them with their separate assessment organizations. The product creates the two profits based for the data you gave.

Users can add some automatic rules such as deduct instalment amount from the register or account and many other rules users can set and ease their workflow. Having expressed my general dissatisfaction with the merely adequate nature of their products ; unfortunately, there are no other reasonable alternatives despite what BlockHead might opine.

Your information is secure when using any TurboTax version because you create a secure password and user ID when you sign up. You don’t have to finish your return in one sitting because the site remembers everything you’ve done. With all TurboTax versions, if the IRS notifies you of an audit, TurboTax then lets you talk to a tax professional of some kind for free; this is the Audit Support Guarantee. Also—though you can only get this protection by paying extra at the time that you file—you can purchase Audit Defense, where a tax professional will represent you if you are audited. The CD/Download versions allow you to fill out five returns as long as the software stays on the same computer, so you could do your childrens’ or relatives’ returns as part of your purchase.

This button opens a dialog that displays additional images for this product with the option to zoom in or out.

Generally a nice review, but not anymore in depth than Intuit’s inadequate description of its products. It’s very hard to tell beforehand exactly what the package you are buying allows you to do, even if you read through Intuit’s FAQS and its responses to customer critiques on product pages on Amazon. Although the software is super-simple to use, if you need to speak with a tax professional, each version of TurboTax allows you to call one, in some cases for a fee. As with the CD, Self-Employed includes features in Deluxe plus support for self-employment income . Free download of one state return , but e-filing state returns is an extra fee. If you are self-employed, do not use any online version of TurboTax cheaper than Home & Business. We used the Deluxe Edition later when our kids were older and we had more different kinds of deductions.

we sure will let you know every time we post something new here. enter your email for notifications and join thousands other subscribers. Click on below button to start Intuit TurboTax Home and Business 2019 Free Download.

Last year I had a problem with an item on Schedule C not calculating correctly. A support guy spent over an hour on the phone with me to work around it. It beats paying the fees to an accountant for an S-Corp return! Intuit assures taxpayers that its results are accurate. It also notes that the company will pay any penalty and interest you incur if the IRS discovers a mistake due to a TurboTax calculation error. When you’re ready to submit your return, you have multiple options.