Content

It was checked for updates 2,953 times by the users of our client application UpdateStar during the last month. TurboTax is a Shareware software in the category Business developed by TurboTax. There are some serious glitches in this year’s program and I honestly wouldn’t recommend downloading it.

H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

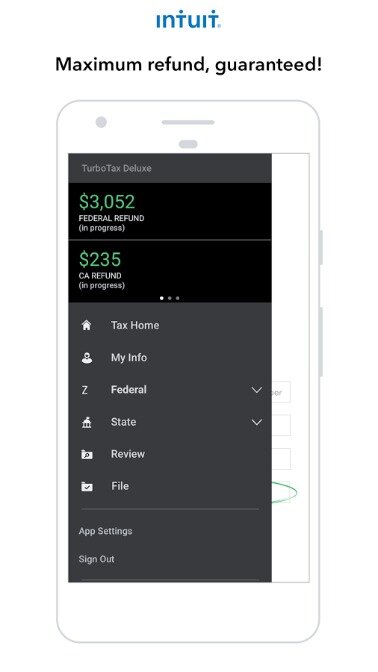

Automatically import thousands of transactions from hundreds of participating financial institutions, for seamless investment income reporting. All to make sure you get your maximum refund, guaranteed. To file 2019 taxes, please select a TurboTax product. You can file taxes for a different year by selecting the year above.

Well Help Get Your Taxes Done Right, However You Choose

Click here to learn how to notify TaxSlayer if you believe you are entitled to a refund. For those who do not qualify the price to file a federal tax return is $17 and the state is $32. Please read the Terms of Service below. They cover the terms and conditions that apply to your use of this website (the “Website,” or “Site”). (“TaxSlayer”) may change the Terms of Service from time to time. By continuing to use the Site following such modifications, you agree to be bound by such modifications to the Terms of Service. If not 100% satisfied, return within 60 days to Intuit Canada with a dated receipt for a full refund of purchase price.

TaxSlayer makes it easy to prepare and e-file your state return. TaxSlayer guarantees 100% accurate calculations or we will reimburse you any federal and/or state penalties and interest charges. We guarantee you will receive the maximum refund you are entitled or we will refund you the applicable TaxSlayer purchase price paid. TaxSlayer Premium is the perfect solution for taxpayers who are self-employed or do freelance work. TaxSlayer Self-Employed is the perfect solution for taxpayers who are self-employed or do freelance work.

Our Simply Free Edition is excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.

In addition, you can contact TaxSlayer Support specialists by email about any questions you may have. TaxSlayer.com’s Knowledge Center also provides you with valuable tax knowledge and troubleshooting tips. Select the Learn More links or the Helpful Page topics for on screen assistance. You can also enter key words to search additional articles. Please check the contact us link in your my account for the support center hours of operation. Usually, email responses can be expected within 24 to 48 hours.

Instantly Completed Tax Returns

Applicants must be 18 years of age in the state in which they reside (19 in Nebraska and Alabama, 21 in Puerto Rico.) Identity verification is required. Both cardholders will have equal access to and ownership of all funds added to the card account. See Cardholder Agreement for details. Fees apply to Emerald Card bill pay service.

The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred. You also will be responsible for paying any applicable taxes relating to purchases through the Site. If you’re looking for a cost-friendly online tax filing software, TaxSlayer doesn’t disappoint.

Not Sure Where To Start? We’ll Find The Tax Prep Option For You

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

H&R Block tax software and online prices are ultimately determined at the time of print or e-file. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply.

Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

Discount must be used on initial purchase only. Not valid on subsequent payments. Expires January 31, 2021. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify.

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra. Description of benefits and details at hrblock.com/guarantees.

- Vanilla Reload is provided by ITC Financial Licenses, Inc.

- Skip the trip to your wallet.

- Available only at participating H&R Block offices.

- Plus, you can deduct the cost of your TaxSlayer products and services from your federal tax refund and pay nothing out of pocket.

- We guarantee you will receive the maximum refund you are entitled or we will refund you the applicable TaxSlayer purchase price paid.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify.

Weve Been Helping People Slay Taxes For Over 50 Years

TaxSlayer is taking reasonable and appropriate measures, including encryption, to ensure that your personal information is disclosed only to those specified by you. However, the Internet is an open system and we cannot and do not guarantee that the personal information you have entered will not be intercepted by others and decrypted.