Content

This amount is then subtracted from your income to arrive at the final taxable income number. There are, however, two employment related expenses you can deduct that aren’t subject to this adjusted gross income limitation and don’t require that you itemize. If you ever move to a new area to work at a new job or because your employer transfers you to a different office, some of your moving expenses may be deductible. There are a few other things you should know about your employment related expense deductions. But sometimes—you just can’t avoid having to pay for some work-related expenses yourself. As the 1040 indicates, itemizing deductions requires preparation of the Schedule A—and this form, as well as the instructions to it, will list every possible expense you can include.

- Similarly, the qualified self-employed health insurance payment are fully deductible irrespective of your AGI.

- But it’s easy to overlook the child and dependent care credit if you pay your child care bills through a reimbursement account at work.

- You have the option of deducting sales taxes or state income taxes off your federal income tax.

- Self-employed professionals required to have liability insurance should consider setting up their own insurance company.

- Small businesses may be able to deduct the entire cost of a depreciable asset in the year it is placed in service instead of spreading the cost out over the life of the asset.

- While most self-employed people celebrate the first two, they cringe at the latter, especially at tax time.

Beginning in 2018, these expenses are no longer deductible for federal tax but some states, such as California, still allow this deduction after 2018. Few realizations are more painful than realizing that you forgot to include a tax deduction that would have lowered your tax bill or increased your tax refund on your tax return. For years prior to 2018, itemized deductions also include miscellaneous deductions such as work-related travel and union dues. Beginning in 2018, these types of expenses are no longer deductible for federal tax, however some states still allow these deductions. When you buy a home, have a child, or go through any other big change in your life, it might affect your taxes.

Simply start your TurboTax Online return and use your military W-2 to verify rank, and your savings will be applied when you file. There’s one main group of people who can still claim their moving expenses to the IRS. If you’re an active duty military member who is relocating, you can still deduct these expenses —if you don’t receive reimbursement from the government for the move. It’s hard to overlook the big charitable gifts you made during the year by check or payroll deduction. But the little things add up, too, and you can write off out-of-pocket costs you incur while doing good deeds.

Schedule C: Consider Income, Expenses And Vehicle Information

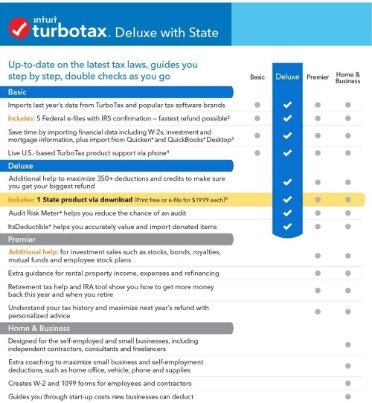

When you use TurboTax to prepare your taxes, we’ll do the math and recommend the better choice. Ultimately, the more deductions you can report on your tax return, the lower your taxable income will be. And the lower your taxable income is, the less income tax you will owe or bigger refund you will receive.

The deductions you may take to arrive at AGI tend to be less restrictive than below-the-line deductions since their limitations have no relation to your AGI. Then remember to include that amount with your state tax itemized deduction on your 2020 return, along with state income taxes withheld from your paychecks or paid via quarterly estimated payments. Beginning in 2018, the deduction for state and local taxes is limited to $10,000 per year. See the 10 most common deductions taxpayers miss on their tax returns so you can keep more money in your pocket. If you operate a small business as a sole proprietor, you must incorporate business earnings into your personal tax return by preparing a Schedule C attachment. The Schedule C is a separate calculation of your net profit or loss that requires you to report all business income and deductions. Regardless of which expenses you discover that you may write off, the most important thing is to keep accurate records throughout the year.

Medical expenses can blow any budget, and the IRS is sympathetic to the cost of insurance premiums—at least in some cases. Deductible medical expenses have to exceed 7.5% of your adjusted gross income to be claimed as an itemized deduction for 2020. However, if you’re self-employed and responsible for your own health insurance coverage, you might be able to deduct 100% of your premium cost. That gets taken off your adjusted gross income rather than as an itemized deduction. The best way to see what you can deduct is to use the IRS’s Sales Tax Calculator for this.

Regular use means that you use the space as an office on an ongoing basis. Occasional or incidental use does not qualify for business use, even if the office is used exclusively for business purposes. The 100% expensing is also available for certain productions and certain fruit or nuts planted or grafted after September 27, 2017. If the IRS ever audits you, you will need to provide written documentation to substantiate your deduction. Keep a record of your gas purchases, insurance and registration payments, and repairs and maintenance costs. If you decide to deduct your actual expenses, you must keep a log of your trips noting the date, the miles driven, and the purpose of each trip.

But if the tax is on a depreciable asset, add the tax to the basis of the asset. Real estate taxes, which are deductible to the extent that you use the land for your business. If you qualify for the home office deduction, you can deduct a portion of your real estate tax against your gross revenue. Fees that you pay to professionals, such as attorneys and accountants, are deductible when they relate to your ongoing business. If you purchase business assets, the fees paid for professional services are not deducted, but are added to the tax basis of your business. The size of your deduction depends on the percentage of your home that is used for business. If your total business expenses exceed gross income from business use of your home, your deduction will be limited.

With self-employment comes freedom, responsibility, and a lot of expense. While most self-employed people celebrate the first two, they cringe at the latter, especially at tax time. They might not be aware of some of the tax write-offs to which they are entitled. TurboTax Self-Employed, TurboTax Home & Business, and TurboTax Business can help you to uncover the money-saving tax deductions available to small-business owners.

You can only take the deduction if you elect to itemize instead of claiming the standard deduction. And even when you do itemize, you can’t take a deduction for the full amount of your expenses. This is because you report your employment related expenses as miscellaneous deductions that must be reduced by 2 percent of your adjusted gross income. Unfortunately, there is no secret formula for taking all possible tax deductions on your return. If there is anything consistent about the tax law, it’s that you must generally incur an actual expense and satisfy a number of requirements before you can report a deduction on your return. You can choose to pay for your tax preparation costs right out of your federal tax refund . If you can be claimed as a dependent on your parents’ or someone else’s tax return, you cannot claim the higher education deduction.

Video: Tax Deductions For Employment Related Expenses

If you drove your car for charity in 2020, remember to deduct 14 cents per mile. Forgetting to include the reinvested dividends in your cost basis—which you subtract from the proceeds of sale to determine your gain—means overpaying your taxes. TurboTax Premier and Home & Business tax preparation solutions include a very cool tool—Cost Basis Lookup—that will figure your basis for you and make sure you get credit for every dime of reinvested dividends. This isn’t really a tax deduction, but it is a subtraction that can save you a lot of money.

Without written documentation of the loan, the IRS may treat the advance as a contribution of capital to the business and it will not be deductible. If you choose to deduct your actual expenses in the year you start using your car for business, you can’t switch to the standard mileage rate later. As a small business owner, you can deduct automobile expenses for visits to clients, customers or travel to business meetings away from your regular workplace. If you have a home office, a drive from your home to a supplier and back home again is a 100% deductible business expense. Most taxpayers know they can deduct money or goods given to charitable organizations—but are you making the most of this benefit? For example, if you make cupcakes for a charity fundraiser, you can deduct the cost of the ingredients you used to bake them.

State Tax You Paid Last Spring

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. When searching for ways to reduce your taxable income, itemizing your deductions can really maximize your tax savings. The benefit of itemizing is that it allows you to claim a larger deduction that the standard deduction. However, it requires you to complete and file a Schedule A with your tax return and to maintain records of all your expenses.

John L. Hillis, president of Hillis Financial Services in San Jose, California, said the best tax write-off for the self-employed is a retirement plan. While the cost of entertainment at social, athletic, luncheon, sporting, airline and hotel clubs is deductible, the dues you pay to be a member are not, even if your membership is for business.

We’ll tell you how and make sure you get any new deductions you qualify for. There’s a fine line between looking to save money on your taxes and taking deductions that will raise eyebrows at the IRS. Some taxpayers are tripped up by expenses that they assume are tax deductions, but don’t qualify under IRS guidelines. Here are eight items that can lead to unpleasant surprises in case of an audit. The federal tax law allows you to deduct several different personal expenses from your taxable income each year. This can really pay off during tax season because the reduction to taxable income reduces the amount of income that is subject to federal income tax. However, not all expenses you incur will provide tax savings; the Internal Revenue Code is very specific about the types of expenses you can deduct and the taxpayers who may claim them.

But, Davis warned, if money accumulates and claims are minimal, the money taken out is taxable under capital gains. Davis emphasized that this is not a retirement strategy, but that it can save you money by allowing you to “pay yourself” instead of an insurance company and still deduct the premiums. Perkins also mentioned subscriptions to trade or professional publications and donations to business organizations, both of which are frequently necessary for the continuation and growth of your business. “The individual can contribute $19,500 in 2020 as a 401 deferral, plus 25 percent of net income,” Hillis said. For example, on January 1, 2020 Jim signed a three-year lease for office space, agreeing to pay a total of $30,000 in rent. Jim can deduct $10,000 in 2020 and another $10,000 in each of the next two years.

Entertainment expenses fall into a broad category and include any activity generally considered to provide amusement or recreation. Some examples include hosting clients at social, athletic or sporting clubs, theaters, yacht trips, hunting or fishing, vacations and the like. Beginning with tax years after 2017, generally no entertainment expenses are any longer deductible. For rent paid in advance, you can only take a deduction for the portion that applies to your use of the property during the tax year. In 2020, you can deduct up to $5,000 in business start-up expenses and another $5,000 in organizational expenses in the year you begin business.

For most citizens of income-taxing-states, the state and local income tax deduction is usually the better deal. Basically, the higher your adjusted gross income is, the lower your deduction for employment related expenses will be.

First, it helps to familiarize yourself with each deduction the tax law allows for. This will help ensure that you track the right expenses and keep the right receipts. Get unlimited access to the helpful TurboTax community if you have questions about doing your taxes. We’ll help you determine who qualifies as your dependent, and then we’ll get you tax-saving deductions and credits like the Child & Dependent Care Credit, Earned Income Credit , and child tax credit.

Many of these deductions have varying limitations that directly relate to the amount of AGI you report. Most below-the-line deductions relate to the expenses you itemize on the Schedule A attachment to your personal income tax return. Some common itemized deductions include medical and dental expenses and charitable contributions. Personal income tax returns require the calculation of Adjusted Gross Income before arriving at the final taxable income amount.

Keep in mind, the total of your itemized deductions for all of your state and local taxes is limited to $10,000 per year. This write-off makes sense primarily for those who live in states that do not impose an income tax. We’re lookin’ at you, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming. You must choose between deducting state and local income taxes or state and local sales taxes.

For those of you in an income-tax free state, there are two ways to claim the sales tax deduction on your tax return. One, you can use the IRS tables provided for your state to determine what you can deduct. Or two, you can you can keep track of all of the sales tax you paid throughout the year and use that. When you use TurboTax to prepare your taxes, we’ll ask simple questions about your tax situation and we’ll recommend whether itemizing or claiming the standard deduction will get you a bigger tax refund . When deciding whether to itemize, keep in mind that you will be giving up the standard deduction amount. So, after adding up your itemized deductions, make sure your itemized deductions total is greater than the standard deduction amount for your filing status. When it comes to reducing your taxable income, itemizing your deductions can really maximize your tax savings.

Paying The Babysitter

Some self-employed people may purchase property and equipment for a business. If they expect that property to last longer than one year, it should be depreciated on the tax return, Perkins advised.

Essentially, the IRS lets you deduct expenses that are ordinary and necessary for your line of work and that help you do your job. But if your employer reimburses you and doesn’t include the payment on your W-2 form, you won’t be able to take a deduction for those expenses. Hello, I’m Jill from TurboTax with some important information about deductions you can take for the expenses you incur at work.