Content

A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Referred client must have taxes prepared by 4/10/2018.

This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

Assist with tax compliance in foreign jurisdictions, assist with transfer pricing policies and related contemporaneous documentation. , we deliver a package of must read news and information to build your business.

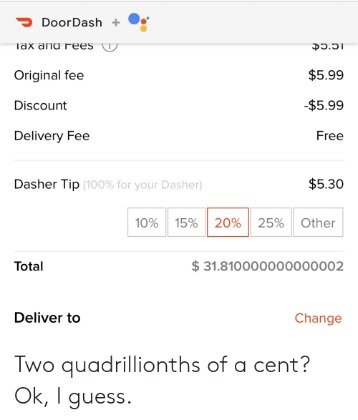

I’m in California, single no children, currently living in my car . Just like with any other job, when you work at DoorDash, you need to take care of your taxes. When you’re a Dasher, you’re employed as an independent contractor, so you’re responsible for keeping track of what you earn. Your employer can’t give you any professional tax advice, so if you need help, you’ll need to talk to an expert. You should be receiving your 1099-MISC from DoorDashby or before January 31st.

Tap on Tax Form Delivery to choose the desired form of the 1099 form delivery. To access your 1099-MISC form, you need to accept an invite DoorDash sends you. When you do, you automatically get a Payable account, so you don’t have to create one on your own. If you have an account from before, you can see the 1099 form for the current year under DoorDash name. Minimum of 10 years’ experience, in a corporate tax department, public accounting or technology consulting firm or other related experience. Experience with Indirect Taxes in the US and familiarity with other Countries Indirect Tax regimes. Lead the design and implementation of tax systems, ensuring projects are delivered on time and on budget.

H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice.

H&R Block prices are ultimately determined at the time of print or e-file. Get started with H&R Block Deluxe Online. If this all sounds intimidating, take heart. H&R Block is here to make filing for Dashers easier, so you can file confidently. Our mileage deduction rules article outlines considerations for both methods mentioned above. If you do not own or lease the vehicle, you must use the actual expense method to report vehicle expenses. File with a tax Pro At an office, at home, or both, we’ll do the work.

Do You Have To Keep Paper Receipts For Taxes? The Great Tax Myth

How do you fill out the Schedule C when you contract with gig companies like Uber Eats, Postmates, Grubhub, Doordash etc.? We talk about different parts of this form. What do I do if I didn’t track my miles as a gig economy driver? We look at different places you can find evidence to use in building a mileage log. What miles can I claim when delivering for Grubhub, Doordash, Postmates, Uber Eats and other delivery gigs?

This is where a tax pro could help a lot. Use a third party app like Hurdlr or Quickbooks Self Employed to calculate your taxes for you. You’ll pay 15.3% self employment tax on Every. You don’t have to be a tax expert. But it helps to have a basic idea of how taxes work. You don’t need to be a tax expert but it helps to have a basic understanding of how taxes work. Now that you have everything you need to know about your 1099 tax deductions, you may be wondering when your taxes are due.

How Do I Know If Doordash Has Filed The 1099?

As well as my fund for any emergencies, funds to party for the weekend or splurge that money on purchasing stuff I don’t need since I don’t live the frugal life. Hooray for multiple financial goals. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you didn’t use the mileage method the first year, then you will only be allowed to use the actual expenses method going forward. You can get a deduction for the number of business miles multiplied by the IRS mileage rate—57.5 cents per mile in 2020. For example, suppose you use your phone 30% for delivery food and 70% for personal use.

Check with your local government’s website to determine if you are in an area that imposes such a tax. If you use your car for both work and personal purposes, you’ll need to distinguish mileage driven for each purpose.

We’ll walk you through the process for filing your Form 1040 and your Schedule C with the IRS. One of the most common questions Dashers have is, “Does DoorDash take taxes out of my paycheck? As an independent contractor, the responsibility to pay your taxes falls on your shoulders. Don’t let that stress you out— over the years H&R Block has helped hundreds of thousands of gig workers like you. Careful–you can’t deduct both mileage and gas at the same time! The standard mileage deduction is calculated by the IRS to include the average costs of gas, car payments, maintenance, car insurance, and depreciation.

On $8,000 of net profit you would owe $1,130 . Make sure you deduct all expenses to reduce the tax you owe.

This Isn’t The Only Way To Figure Your Tax Savings

State e-file available within the program. An additional fee applies for online. Additional state programs are extra. Most state programs are available in January. Release dates vary by state. Online AL, DC and TN do not support nonresident forms for state e-file. Software DE, HI, LA, ND and VT do not support part-year or nonresident forms.

The gov already knows how much we make and how much we make. Stop with the BS of having to file taxes every farkin year. It’s BS and the stress + is uncool. I file every year and if I screw up, by not including an extra payment I received or similar, the IRS sends me a nice fat envelope telling me to pay now. Just deduct the fargin money and stop with tax paperwork BS. Doordash are for the folks who can self-motivate themselves and can get up to get their job done and get it done correctly.

- I imagine that the businesses in question have found other ways of underpaying their staff and not paying company taxes.

- Fees for other optional products or product features may apply.

- Students will need to contact WGU to request matriculation of credit.

- One of the most common questions Dashers have is, “Does DoorDash take taxes out of my paycheck?

- May not be combined with other offers.

- Our mileage deduction rules article outlines considerations for both methods mentioned above.

You pay that on every dollar of profit. That’s what your self employment tax is. It’s your version of Social Security and Medicare. We just never think about that because employees never have to file those taxes. Think about Social Security and Medicare – the FICA taxes on a paystub. Ever notice those are taken out of even the smallest paychecks?

Itemized deductions are reported on Schedule A. How much should I save for taxes when delivering for gigs like Grubhub, Doordash, Postmates, Uber Eats and others? These ideas help you prepare for taxes.

Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. How long do you keep my filed tax information on file? For many third-party ordering apps make sense. They act as the middle man who gets you in front of your next customers at precisely the right time.

But you can claim mileage and expenses. But if you have children and normally get a large refund it likely won’t hurt you nearly as much. It really depends on your situation but many people are unaware about this. When all my payments come in from Doordash, Uber Eats, Grubhub etc., I have those sent to my business bank account. I don’t touch a penny until I’ve taken out tax money, car expense money, and some paid time off money. However, you don’t always have to open up a separate bank account.

Gas, but like… it’s dirt cheap, like $2.50 a gallon. If you are using your vehicle for delivering items, you might be able to deduct the costs of its use.

Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

We will make this process as easy to understand as possible. You will become excellent at reporting your taxable income in no time. Without further ado, let’s dive into the first step of your journey, discovering which taxes you have to file as a self employed individual. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting.

We know it can be tough to estimate how much of your phone usage is due to work.