Content

Using TurboTax Deluxe will help you take advantage of retirement-related income tax deductions. You can make a partial contribution to a Roth IRA if your income is between $124,000 and $139,000.

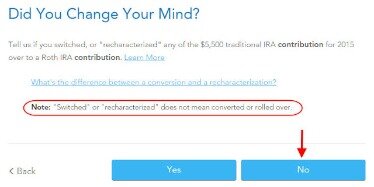

If you are eligible to contribute to Roth for 2013 and you already contributed, you can withdraw 2013 contribution down to $500. Last April I opened a traditional IRA with an after-tax contribution of $5000. Soon after I instructed my broker to convert it to a Roth IRA, attempting a “backdoor” Roth to avoid penalties based on income limitations. Code R is recharacterization for the previous year , not conversion. Either your custodian issued the form wrong, or you filled out a wrong form or used the wrong verb when you made the request, or the person who processed it heard/read it wrong. If you recharacterized before you converted, maybe there’s another 1099-R form for the conversion.

The earnings shouldn’t be too much, although 2013 was a good year in the stock market. While you are at it, contribute for 2014 in 2014 before you finally convert again. Your options are the same as in my reply to @YF. If I were you I would recharacterize the conversion before April 15 . That will put the money back to the traditional IRA.

Can I File Gains And Losses From My Stock On My Tax Returns?

The use of the TaxAct branded tax preparation software and web-based products is governed by TaxAct’s applicable license agreements. TaxAct, the TaxAct logo, among others, are registered trademarks and/or service marks of TaxAct in the United States and other countries and are used with permission. TaxAct is not affiliated with Fidelity Brokerage Services or their affiliates. TaxAct is solely responsible for the information, content and software products provided by TaxAct.

Just spent over an hour stressing because our “Backdoor Roth” was reflecting in Turbo Tax as a taxable event. Thank you for guiding me the rest of the way through.

FWIW, I was having issues with turbo tax incorrectly reporting my backdoor roth contributions as taxable after following this guide to the letter. These directions are not working for me and I am showing that I owe tax in Turbo Tax. It may have something to do when I show I did the conversion. I have no previous IRAs and contributed to the 2013 non-deductable IRA in March 2014, so I checked the box that I made the contribution after Jan 1 and before April15. I did the transfer to the Roth IRA the next day again in March 2014. Does this mean that I need to wait until I do my 2014 taxes to show the conversion?

Your transactions have nothing to do with the topic here. It sounds like you entered IRA contributions with your two 5498 forms. A rollover or a conversion isn’t a contribution. The only difference is box 2a will show 0 for a rollover to traditional. You just enter the two 1099-Rs independently.

Late Contributions To The Backdoor Roth Ira

With a 1040X, you basically recalculate your taxes and put the new calculations on the 1040X and include any relevant schedules. I hope I was able to state year by year contribution and when, whether it was deductible or not, whether I converted it, and my year end balances . I’ll be honest though, I’m having a very hard time following what you’re doing. Perhaps if you list out year by year what you contributed and when, whether it was deductible or not, whether you converted it, and your year end balances someone can assist you. Otherwise, you may want to consider hiring a pro to help you sort through all this. Yes that is exactly what I did for myself for- contributed and rolled over 2015 contribution in February 2016.

There are several different types of IRAs, including traditional IRAs and Roth IRAs. You can set up an IRA with a bank, insurance company, or other financial institution. Next let’s look at Part 2 of Tom’s Form 8606, where the conversion portion is reported. If line 18 is 0, as it is in this example, none of the conversion ends up being taxable. Several years ago when I first met this physician he brought in his tax information with a current year nondeductible traditional IRA contribution, and had prior year nondeductible IRA’s as well.

If you contributed to Traditional and/or Roth IRA on your own, that’s separate. Converting in the following year is fine. After you pay taxes on one year’s worth of earnings, the future earnings will still be tax-free. Yes, if you do both the regular backdoor Roth and the mega backdoor Roth, you will receive two 1099-R’s — one from your IRA custodian, and another from your 401 plan.

Not sure why the 1099-R triggers that screen in a separate area with a pre-filled balance. No notification/problems appeared on the error check. I didn’t import the 1099-R when I initially got the screen. Tried again with just the hand-typed version and checked the total distribution box. Maybe if I try again with a clean return, it won’t appear?

I am trying to report a backdoor Roth In TurboTax. One of the TurboTax screens is “Enter Prior Year Roth IRA Contributions.” This screen asks that I report net regular contributions prior to 2013.

The form can get more complicated if you are doing other Roth conversions at the same time or if you made a contribution for the previous year (i.e. made your 2020 contribution in 2021). Married physicians should be using a personal and spousal Roth IRA, and will usually need to fund both indirectly (i.e. through the back door). That allows you to determine your own tax rate as a retiree by deciding how much to take from tax-deferred accounts and how much from Roth accounts. Remember that IRA stands for INDIVIDUAL Retirement Arrangement. So even if the pro-rata rule keeps you from doing the Backdoor Roth IRA, it doesn’t necessarily keep your spouse from doing so. Each spouse reports their Backdoor Roth IRA on their own separate 8606, so my tax returns always include two form 8606s.

If your 1099-R is correct, the amount of your after-tax non-Roth contributions shows up in box 5 and TurboTax pulls it up here. If your 1099-R isn’t correct, you should work with your 401 administrator to have it corrected. If you import the 1099-R, check the import carefully to make sure it matches your copy exactly. If you type the 1099-R, be sure to type it exactly. The earnings portion should be in box 2a.

Additional Information

My 1099-r with Vanguard is trying to get me to report the entire amount as taxable for 2014. 1) My taxes owed jumps from ~3000 to ~7000 (fed+state). It’s only when I complete the 1099-r that the taxes jump (I didnt go to the very end to see if the # goes down, but I doubt it).

It does lead to the “pennies issue” more frequently though. Come on Vanguard, you can do better than this.

Do I Have To Put My Ira On My Tax Return?

I’ve been doing my backdoor conversion since last 3 years before December 31 each year and have never run into any problems with turbo tax deluxe desktop version yet. Just submitted my federal e-file today and mailed my state returns. Did you enter the Roth as a contribution? It’s a conversion from a traditional IRA to a Roth IRA, not a contribution. Enter the Traditional IRA as a contribution then do a conversion to the Roth. You are moving to a state with higher income taxes. Individual Income Tax Returnor Form 1040-SR, U.S.

It’s really easy, just a few numbers on lines 1-3 and 14. Then just sign and mail in the 2013 Form 8606 by itself. After that, in one of the “Find Your Basis” screens you will enter your contribution for 2013 as your basis. Did you do the contribution part first? Follow the instructions as a complete set from start to finish. Otherwise you scare yourself unnecessarily.

401/403, 457, SEP-IRA, and individual 401 contributions are all “above the line” deductions, so they come out before you get to your adjusted gross income on lines 38/39 of Form 1040. So if your gross income is $210K, and your AGI is $154K, you should be able to do direct Roth IRA contributions.

I have no idea why the number on the 5498 is different. Call the number on the notice and ask them what they need. They will probably want a written explanation. Problem is when you roll your after-tax contributions to a Roth IRA and after-tax gains into a Solo 401k.

In some cases, no tax forms are available to download, but you may still get prompts from TurboTax. If your tax forms don’t import into TurboTax, there are a couple of things you can check. Vanguard has no access to your tax information. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you.

- At the end of the year, account A had zero and account B has a $200K balance.

- They have already been taxed, but still need to be reported.

- Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

- I apologize if this question has been asked before, but I’m in a situation where I want to start following your advice and do both the contribution and the conversions in the same year.

- Last April I opened a traditional IRA with an after-tax contribution of $5000.

Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use. Fidelity disclaims any liability arising out of your use of these TaxAct software products or the information or content furnished by TaxAct. The use of the H&R Block tax preparation software and web-based products is governed by their applicable license agreements. H&R Block tax software and online prices are ultimately determined at the time of print or e-file.

How To Report Backdoor Roth In Turbotax: A Walkthrough

Distributions from a traditional IRA are fully or partially taxable in the year of distribution. To determine if your IRA is taxable, see Is the Distribution from My Traditional, SEP or SIMPLE IRA Taxable? If you made only deductible contributions, distributions are fully taxable. Use Form 8606 to figure the taxable portion of withdrawals when the traditional IRA contains nondeductible contributions.

It has been a great learning experience for me. Unfortunately, I have never contributed to Roth before (never got to know about this website while in training!). I have a question of eligibility for straight Roth contributions. We have a combined dual physician salary of 210k from last year (6 months of training and 3-4 months of attending salaries). We contributed approx 56k to both of our 403b and 457b plans. Would this contribution make our MAGI to be calculated below $183k for us to be able to make direct Roth IRA contributions?

Box 2b says “Taxable amount not determined.” That means the number in box 2 isn’t necessarily accurate. You enter whatever are actually printed on the 1099-R. I of course have not received my 1099 for 2014 yet but wanted to do a practice run for my 2014 taxes so I just used your numbers. Got confused when I looked at line 15b until I realized the problem.