Content

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated.

Pay your property taxes only when they’re due. Don’t prepay your next installment by the end of the year. Make sure your state tax withholding isn’t higher than your expected payment. State tax payments aren’t deductible under the AMT. The AMT exemption is much larger than the standard exemption. But it starts to disappear after you reach a certain income level, called the phaseout.

Amt

The AMT is now most likely to hit those at the top of the income scale who are engaged in certain tax sheltering activities. It added the personal exemption, state and local taxes, and the standard deduction. It even targeted deductions like union dues and some medical costs. On the flip side, Reagan’s AMT tax reform eliminated the more exotic investment deductions that were used only by the very wealthy. Congress created a simplified version of theAlternative Minimum Taxin 1969 which was originally known as the millionaires’ tax. It was designed to make sure the wealthy didn’t get away tax-free. In 1969, theInternal Revenue Service discoveredthat 155 millionaires paid no taxes because they used deductions not available to the average worker.

Students will need to contact SNHU to request matriculation of credit. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit.

In contrast, under the regular tax rules capital gains taxes are not paid until the actual shares of stock are sold. For example, if someone exercised a 10,000 share Nortel stock option at $7 when the stock price was at $87, the bargain element was $80 per share or $800,000. Without selling the stock, the stock price dropped to $7.

What Triggers The Alternative Minimum Tax?

The bargain element of an incentive stock option when exercised and the stock is not sold in the same tax year, regardless of whether the stock can immediately be sold. The AMT exemption for 2020 is $113,400 for married couples filing jointly, up from $84,500 in 2017 . For singles and heads of household, the exemption rises from $54,300 in 2017 to $72,900 in 2020. In 2013, Congress passed the American Taxpayer Relief Act. It automatically adjusted the income thresholds to inflation. Congress added the AMT fix to a law that prevented thefiscal cliff in 2013. The downside is that when your income hovers just below the threshold, a pay increase greater than inflation might be enough to push you over the AMT limit.

Intuit, the Intuit logo, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries and are used with permission. Intuit is not affiliated with Fidelity Brokerage Services or their affiliates. Intuit is solely responsible for the information, content and software products provided by Intuit. Fidelity disclaims any liability arising out of your use of these Intuit software products or the information or content furnished by Intuit. Fees apply to Emerald Card bill pay service. See Online and Mobile Banking Agreement for details. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

The use of the H&R Block tax preparation software and web-based products is governed by their applicable license agreements. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. H&R Block is a registered trademark of HRB Innovations, Inc. H&R Block is not affiliated with Fidelity Brokerage Services or their affiliates. H&R Block is solely responsible for the information, content and software products provided by it.

- If that person earned more than $197,900, the AMT tax rate goes up to 28 percent.

- The individual alternative minimum tax operates alongside the regular income tax.

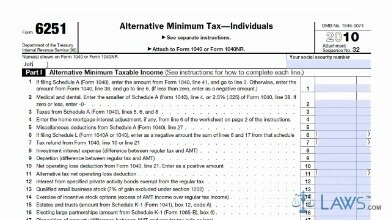

- Line 15 on your Form 6251 is $3000 (100 shares x ($33-$3 per share).

- Offer valid for returns filed 5/1/ /31/2020.

- State e-file available within the program.

Starting price for state returns will vary by state filed and complexity. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns.

Changes To The Tax Base Matter When Evaluating The Impact Of Tax Reforms

The simplest way to see why you are paying the AMT, or how close you came to paying it, is to look at your Form 6251 from last year. To figure out whether you owe any additional tax under the Alternative Minimum Tax system, you need to fill out Form 6251. The AMT exemption amounts are now indexed to rise with inflation. We want to hear from you and encourage a lively discussion among our users.

In January 1969, Treasury Secretary Joseph W. Barr informed Congress that 155 taxpayers with incomes exceeding $200,000 had paid no federal income tax in 1966. That year, members of Congress received more constituent letters about the 155 taxpayers than about the Vietnam War. Congress subsequently enacted an “add-on” minimum tax that households paid in addition to regular income tax. It applied to certain income items (“preferences”) taxed lightly or not at all under the regular income tax. The largest preference item was the portion of capital gains excluded from the regular income tax.

Discount is off course materials in states where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you.

If your income tax under the AMT rules is higher than your income tax under the regular rules, you pay the higher amount. This basically determines who has to pay alternative minimum tax. The difference between a taxpayer’s AMTI and his AMT exemption is taxed using the relevant rate schedule. If the TMT is higher than the taxpayer’s regulartax liabilityfor the year, they pay the regular tax and the amount by which the TMT exceeds the regular tax.

The alternative minimum tax is a tax imposed by the United States federal government in addition to the regular income tax for certain individuals, estates, and trusts. As of tax year 2018, the AMT raises about $5.2 billion, or 0.4% of all federal income tax revenue, affecting 0.1% of taxpayers, mostly in the upper income ranges. The TCJA enacted a higher AMT exemption and a large increase in the income at which the exemption begins to phase out. As a result, the TCJA shielded almost all upper-middle and high-income taxpayers from the AMT. The tax is now most likely to affect those at the top of the income scale who take advantage of certain tax shelters allowed under the regular tax but not the AMT. The original minimum tax and the AMT affected fewer than 1 million taxpayers annually through the late 1990s. In 2001, Congress passed the Economic Growth and Tax Relief Reconciliation Act, which substantially reduced regular income taxes but provided only temporary relief from the AMT.

For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU.

Depending on your income and deductions, you may find yourself affected by the AMT in one tax year but not the next. If you’re close to the AMT threshold, it’s good practice to do a multiyear projection to see which tax years pose the most risk for you and how you might mitigate that risk. For example, you could accelerate or delay certain transactions to minimize the risk of triggering the AMT, such as determining the best tax year to sell an asset with a large gain. Real estate property taxes also are disallowed as deductions under the AMT. If that person earned more than $197,900, the AMT tax rate goes up to 28 percent. The AMT is prescribed in 26 USC 55 through 59 and 26 CFR 1.55-1 through 1.59-1. The IRS has not issued a publication on alternative minimum tax, but provides details in instructions to individual Form 6251 and corporate Form 4626.

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. The Check-to-Card service is provided by Sunrise Banks, N.A. and Ingo Money, Inc., subject to the Sunrise Banks and Ingo Money ServiceTerms and Conditions, the Ingo MoneyPrivacy Policy, and the Sunrise Banks, N.A.Privacy Policy.

Thus, barring legislation from Congress, the AMT will return in force in 2026, affecting 6.7 million taxpayers. That number will rise to 7.6 million by 2030.

Standard Deduction And Personal Exemption

Partnerships and S corporations are generally not subject to income or AMT taxes, but, instead, pass-through the income and items related to computing AMT to their partners and shareholders. Foreign persons are subject to AMT only on their income effectively connected with a U.S. trade or business. In 2018, the corporate AMT was permanently repealed. Before tax year 2018, corporations with average annual gross receipts of $7,500,000 or less for the prior three years are exempt from AMT, but only so long as they continue to meet this test. Further, a corporations were exempt from AMT during its first year as a corporation. Affiliated corporations were treated as if they were a single corporation for all three exemptions ($40,000, $7.5 million, and first year). Previously, corporations filed Form 4626 for AMT.

There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. Additional training or testing may be required in CA, MD, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

A new client is an individual who did not use H&R Block office services to prepare his or her 2016 tax return. Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment.