Content

Report the amount of payments and reimbursements the employee is entitled to receive under the QSEHRA for the calendar year, not the amount the employee actually receives. For example, a QSEHRA provides a permitted benefit of $3,000.

Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018.

How Are Bonuses Taxed?

For example, you may need to report more than four coded items in box 12 or you may want to report other compensation on a second form. If you issue a second Form W-2, complete boxes a, b, c, d, e, and f with the same information as on the first Form W-2. Show any items that were not included on the first Form W-2 in the appropriate boxes.

File a Form W-3c along with one Form W-2c, entering $30,000 in box 3 under “Previously reported” and $25,000 in box 3 under “Correct information.” File a Form W-3c along with one Form W-2c, entering $30,000 in box 3 under “Previously reported” and $0.00 in box 3 under “Correct information.”

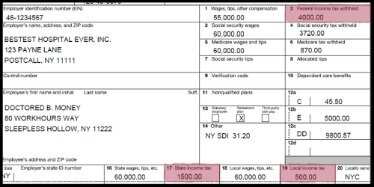

Whether you receive a bonus or not, there are many ways you can reduce the amount of federal income tax you owe. Assuming everything else is equal about these three people’s tax situations, they’d all pay the same amount of federal income tax. The IRS just uses a different methodology to withhold taxes from paychecks where you only receive bonus income. Learn how your bonuses are taxed by the IRS, including tax withholdings based on the amount of your bonus income. By checking the “Retirement plan” block, an employer notifies the IRS that an employee’s eligibility for a deductible Individual Retirement Arrangement is limited. describe how wage and tip income is reported to employees. Enter the total of amounts reported in boxes 1 through 8, 10, and 11 as “Previously reported” and “Correct information” from Forms W-2c.

Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. This should be the same as shown on your Forms 941, 941-SS, 943, 944, CT-1, or Schedule H (for 2019, Schedule H (Form 1040 or 1040-SR)).

Get More With These Free Tax Calculators And Money

Differential wage payments made to an individual while on active duty for periods scheduled to exceed 30 days are subject to income tax withholding, but are not subject to social security, Medicare, and unemployment taxes. Report differential wage payments in box 1 and any federal income tax withholding in box 2. Differential wage payments made to an individual while on active duty for 30 days or less are subject to income tax withholding, social security, Medicare, and unemployment taxes and are reported in boxes 1, 3, and 5. , I.R.B. 896, available at IRS.gov/irb/ _IRB#RR . Some small businesses give personal gifts of food or gift cards, while others mimic larger businesses who customarily give the equivalent of one or two weeks salary to their employees at this time of year. According to the IRS, bonuses of money and of gift cards are considered taxable income and must be reported. If your employer has neglected to account for them – you can ask for a corrected W-2 before you file your taxes.

If you included 100% of a vehicle’s annual lease value in the employee’s income, it must also be reported here or on a separate statement to your employee. Check this box only if you are a third-party sick pay payer filing a Form W-2 for an insured’s employee or are an employer reporting sick pay payments made by a third party. For additional information on employees who are eligible to participate in a plan, contact your plan administrator. For details on the active participant rules, see Notice 87-16, C.B. 590-A, Contributions to Individual Retirement Arrangements . You can find Notice on page 5 of Internal Revenue Bulletin at IRS.gov/pub/irs-irbs/irb98-38.pdf.

Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

Unless otherwise noted, references to Medicare tax include Additional Medicare Tax. An employer’s EIN may not be truncated on any form. Additionally, Forms W-2 and W-2c electronic and paper wage reports for household employers will be rejected under the following conditions. Two Forms W-2 were filed under the same EIN, but wages on one were incorrect.

- Check this box if you file Form 941 or Form 941-SS. If you are a railroad employer sending Forms W-2c for employees covered under the RRTA, check the “CT-1” checkbox.

- You may use an acceptable substitute form instead of an official IRS form.

- The amount reported as elective deferrals and designated Roth contributions is only the part of the employee’s salary that he or she did not receive because of the deferrals or designated Roth contributions.

- Emerald Cash RewardsTMare credited on a monthly basis.

- You will meet the “furnish” requirement if the form is properly addressed and mailed on or before the due date.

- Report differential wage payments in box 1 and any federal income tax withholding in box 2.

On the Form W-3c, enter the correct tax year in box a and/or the correct EIN in box e. Enter zeros in the “Previously reported” boxes, and enter the correct money amounts in the “Correct information” boxes. Under nonqualified plans or nongovernmental 457 plans, deferred amounts that are no longer subject to a substantial risk of forfeiture are taxable even if not distributed.

Pushing You Into A Higher Tax Bracket

Employees use Form W-2 to complete their individual income tax returns. When students are comfortable with the material, have them complete Assessment-Wage and Tip Income. Check this box if you are a railroad employer correcting Forms W-2 for employees covered under the RRTA.

If you are a military employer, report any nontaxable combat pay in box 12. Report in box 12 only the amount treated as substantiated . Include in boxes 1, 3 , and 5 the part of the reimbursement that is more than the amount treated as substantiated. Report the unsubstantiated amounts in box 14 if you are a railroad employer.

For example, if a civilian spouse is working in Guam but properly claims tax residence in one of the 50 states under MSRRA, his or her income from services would not be taxable income for Guam tax purposes. Federal income taxes should be withheld and remitted to the IRS. State and local income taxes may need to be withheld and remitted to state and local tax authorities.

If you aren’t withholding taxes from the employee’s paycheck , you must add the bonus amount to the employee’s current paycheck and figure the withholding as if the regular paycheck and the bonus amount are one amount. Year-end bonuses carry a slightly different message to employees. But they can be different in that some are tied into individual performance and others tied into the annual profitability of a company. Therefore they are variable in size and subjectively awarded.

Are Bonuses Included In Gross Income For Taxes?

The safe harbor generally applies if no single amount in error differs from the correct amount by more than $100 and no single amount reported for tax withheld differs from the correct amount by more than $25. Generally, section 409A is effective with respect to amounts deferred in tax years beginning after December 31, 2004, but deferrals made before that year may be subject to section 409A under some circumstances. If Employer X made the payment after the year of death, the $3,000 would not be subject to social security and Medicare taxes and would not be shown on Form W-2.

However, the employer would still file Form 1099-MISC. If an employee dies during the year, you must report the accrued wages, vacation pay, and other compensation paid after the date of death. Each Form W-2 should reflect the EIN of the agent in box b.

Who Doesnt Love A Bonus From Their Employer?

A bonus is discretionary if it’s not expected. If you give an employee a performance bonus at the end end of a year one time, that’s not discretionary. Holiday bonuses are considered discretionary. You may not use discretionary bonuses to satisfy any portion of the standard salary level. These bonuses are ones in which you as the employer retain the discretion of the fact of the payment and the amount. For amounts over $1 million, tax is withheld at the highest tax bracket level. In 2017, that was 39.6 percent and starting in 2018, that’s 37 percent.