Content

SeeEmployees of Interstate Motor and Rail Carriersfor more information. If there is no requirement to withhold federal income tax because of the type of income, then you don’t have to withhold Massachusetts income tax. If you’re a Massachusetts employer with a nonresident employee, you still need to withhold wages paid to the nonresident for services performed in Massachusetts. However, if a nonresident employee doesn’t work in Massachusetts, even if they’re paid from a Massachusetts office, you don’t have to withhold.

If her hourly rate is $12, she receives overtime at the rate of $18 for 3 hours, totaling $54 of overtime. This overtime of $54 is added to her regular hourly pay of $480 (40 hours x $12), for a total of $534. You can pay more than the required overtime rate, but here we’ll use the required amount.

Check your employment agreement and determine whether you were told you were a salaried employee or an independent contractor. If you’re working on a freelance basis, your employer isn’t required to withhold taxes on you. Even if you’re going into an office every day, you can be classified as an independent contractor.

It may help to refer to your tax return from the prior year to get some of this information. You can use the blank vouchers that are included with Form 1040-ES to mail your estimated tax payments, or you can pay online using the Electronic Federal Tax Payment System . If this is the first year you’re self-employed, you will need to estimate the amount of income you expect to earn for the year. There’s no avoiding giving Uncle Sam his due, and if you want to avoid an audit, it’s important to do it right the first time. Unlike W-2 employees, self-employed individuals do not have taxes automatically deducted from their paychecks. It’s up to them to keep track of what they owe and pay it on time.

Always save the receipts for any business expenses that you deduct. If this is your first year freelancing, you can estimate how much you should deduct. It’s typically safer to estimate low rather than high in order to avoid owing significant additional tax in April. Depending on the size of your payroll, you must make deposits monthly or semi-weekly. Be sure you are using the correct amount of gross pay for this calculation.

Whether you work for an employer or are self-employed, you must make estimated tax payments during the year when your income exceeds certain levels. As an employee, you pay these estimated payments by having your employer withhold amounts from your paycheck. However, if you have no employer to withhold federal taxes, then you will need to do this by making estimated tax payments. Household/domestic employers have the option to withhold federal and state income taxes from wages, which can relieve employees of the responsibility to pay estimated taxes. TheHousehold Employment Tax Guideprovides household/domestic employers with the information they need to fully understand their obligations when hiring household help.

Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Each week, Zack’s e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). A senior product specialist with Credit Karma Tax®, Janet Murphy is a CPA with more than a decade in the tax industry. She’s worked as a tax analyst, tax product development manager and tax accountant.

This tactic works well if you’ve been freelancing for a few years. You can look at the 1099-MISC forms you received last year, then use these to estimate what you’ll earn in the upcoming year. You can also estimate how much you think you’ll earn for the entire year at the beginning of the year, then calculate 25-30% of that and divide by four going forward. This is essentially a save-as-you-go plan, which works well for an inconsistent income and the realities of your day-to-day budget.

How To Withhold Your Own Taxes

She has written content for online publication since 2007, with earlier works focusing more in education, craft/hobby, parenting, pets, and cooking. Now she focuses on careers, personal financial matters, small business concerns, accounting and taxation.

Remember, federal taxes aren’t automatically deducted from self-employment income. If you have a side business or do freelance work, it’s especially important to factor that income into your tax equation. Tax withholding is simply the chunk of money your employer sets aside from each paycheck to cover your taxes.

- Casino winnings are subject to withholding if it is required under IRS guidelines.

- Some taxpayers have to file amended returns and applications for abatement electronically.See if electronic filing and payment requirements apply to you.

- The eFile.com tax app will guide you through this when you prepare and eFile your Taxes.

- If the due date falls on a Saturday, Sunday, or legal holiday, you will be on time if your payment is made on the next business day.

When you do not have an employer withholding your taxes from your paycheck, you must be responsible for calculating your tax burden throughout the year and setting aside enough money to cover your payments. If the due date falls on a Saturday, Sunday, or legal holiday, you will be on time if your payment is made on the next business day. If you want or need to make additional payments than just the quarterly ones, make a copy of a payment voucher and mail it in with your additional payment or pay online. However, make sure that you pay enough by each due date to cover the preceding payment period. The penalty for underpayment of estimated tax is approximately 2.6 percent of the amount underpaid. IRS Publication 505 has worksheets to help you figure out the amount of tax to pay, and you can find the worksheet on the IRS website. You will need to know your expected adjusted gross income, taxable income, taxes, deductions and credits for the year.

Get More With These Free Tax Calculators And Money

For example, due to the coronavirus pandemic in 2020, estimated tax payments for the first two quarters of the year were both due on July 15, 2020. If you have many employees or don’t have the staff to handle payroll processing, you might want to consider a payroll processing serviceto handle paychecks, payments to the IRS, and year-end reports on Form W-2. You will have to do some research to determine the amounts of these deductions and how to send them to the appropriate state/local taxing authority. The Qualified Business Income deduction was created as a result of tax reform and begins with 2018 tax returns, and will last through 2025. The QBI deduction allows you to deduct up to 20% of qualified business income if you are self-employed or are a small business owner. The deductible amount depends on your total taxable income including wages, interest, and capital gains in addition to income generated by your business.

Read this publication on retirement Plans for small business or independent contractors. Keep in mind, you can’t take the premium deduction if you were eligible for group insurance from your or your spouse’s employer. Included are reimbursements via a Qualified Small Employer Health Reimbursement Arrangement . A trade or business, in general terms, is an activity carried out to make a profit. A trade or business may be full-time or part-time, and it may be carried out in addition to regular employment.

Unemployment & Employee Withholding In Washington State

The Social Security tax rate for employees and employers, as of 2018, is 6.2 percent each, so you will owe a total of 12.4 percent of your profits. The Medicare tax rate for employees and employers is 1.45 percent, making your self-employed rate 2.9 percent.

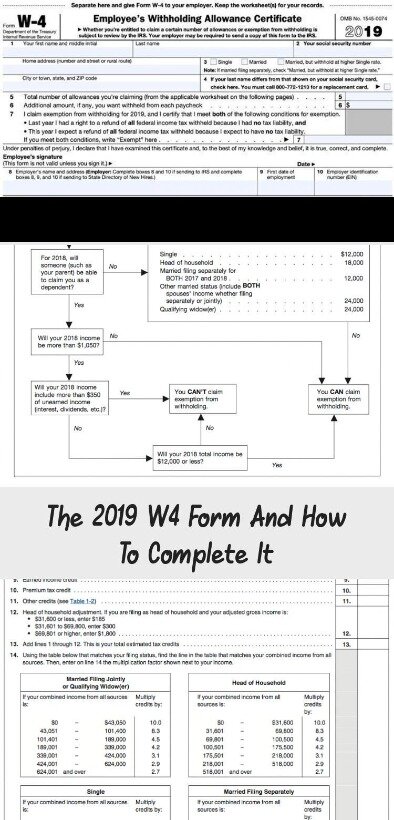

“Financial literacy is a critical skill, that literacy includes an understanding of taxation.” Thenadd the two togetherto get your total household tax withholding. A tax refund is a state or federal reimbursement to a taxpayer who overpaid taxes. Thepenalty for failing to file a return by the due dateis 1% of the balance due per month , up to a maximum of 25%. Any additional withholding amounts requested on the Massachusetts Employee’s Withholding Exemption Certificate (Form M-4). Employees must report the above-listed information on aForm M-4 – Employee’s Withholding Exemption Certificate and claim the proper number of exemptions. Employees can change the number of their exemptions on Form M-4 by filing a new certificate at any time if the number of exemptions increases.

That annual salary is divided by the number of pay periodsin the year to get the gross pay for one pay period. If you pay salaried employees twice a month, there are 24 pay periods in the year, and the gross pay for one pay period is $1,250 ($30,000 divided by 24).

It also saves your returns, and, if nothing major changes, you can transfer last year’s tax info to the new tax year. Take back your hard-earned cash and pay the IRS only what you have to.

Learn about the Pandemic Unemployment Assistance program and unemployment benefits for self employed as a result of the second stimulus payment package. You expect your withholding and refundable credits will be less than 100 percent of the tax owed for the prior year. If you own your business, you have access to tax breaks and write-offs. When leveraged correctly, those additional tax benefits can make up for the higher self-employment tax and lead to a lower total effective tax rate. The self-employment tax rate for 2019 is 15.3%, which encompasses the 12.4% Social Security tax and the 2.9% Medicare tax. “You need to hold on to some of your money,” added Lise Greene-Lewis, CPA and tax expert for TurboTax. “You should pretend you don’t have that much money because your income varies so often. You have to think about paying your taxes.”

They can make sense of your personal tax situation and guide you toward a reasonable target. With a few minor adjustments, you can strike a better balance and look toward next year’s tax season with a lot less stress. Maybe you’re getting hit with massive tax bills and you’re sick and tired of sending the IRS a big check every April. Independent contractors are considered to be self-employed, even if they only work for a single client. If you use part of your home for business, you may be able to deduct expenses for the business use of your home.

Returns are due annually, and payments follow the same schedule as wage withholding. Anyone who is registered to withhold must file an annual report, whether they withheld Massachusetts taxes during the calendar year or not.

Estimated taxes are due four times during the year – April 15, June 15, September 15, and January 15. If you pay late, pay too little, or don’t pay at all, you face a penalty from the IRS. This tactic assumes that you’re already saving some of your income and your account isn’t empty, or won’t become emptied when you transfer the tax money. If you spend everything that comes into your account, set aside money for taxes before you begin paying your bills. Depending on the frequency with which payments come in, it can be a headache to remember to transfer some of every single payment you receive. An alternate method could be to calculate how much money you earned last month, then set aside 25-30% of it before you begin paying the next month’s bills.

If you are self-employed, and you expect to owe $1,000 or more in taxes when you file your return, then the IRS requires you to make quarterly estimated tax payments. Estimated tax payments are used to pay income tax and self-employment tax. If you do not pay enough tax throughout the year via estimated tax payments to cover your tax liability, then you will be charged a penalty by the IRS. The tax penalty is calculated on your tax return, and added to the amount you owe . If you work on your own and you are not an employee, you will pay taxes a little differently than employees do. As a self employed individual, you are required to pay federal incomes taxes, Social Security, and Medicare taxes on your own, either through quarterly estimated tax payments or when you file your tax return. If you do not pay enough tax throughout the year, you could be assessed penalties.

However, such employers still need to withhold Social Security tax from their employees. For more information about these requirements, contact the IRS at . Household/domestic employers also should contact the Department of Unemployment Assistance at for information regarding their obligations for state unemployment taxes. You don’t have to withhold if your only connection to Massachusetts is the employment of a Massachusetts resident outside of Massachusetts. However, you may withhold for the employee’s convenience if both you and the employee agree.

If you don’t, you could find yourself hit with costly penalties in April. The IRS recommends paying estimated payments during the year if you expect to owe $1,000 or more once all of your deductions and credits are taken. The IRS provides a work sheet as part of Publication 505 to help you determine whether you should pay quarterly and, if so, how much. You’ll calculate how much you’ll pay in taxes for the entire tax year and divide it by four, remitting payments in mid-April, mid-June, mid-September and mid-January. Unfortunately, you may not realize your employer isn’t withholding taxes until too late.