Then, the company establishes the allowance by crediting an allowance account often called ‘Allowance for Doubtful Accounts’. Though this allowance for doubtful accounts is presented on the balance sheet with other assets, it is a contra asset that reduces the balance of total assets. The aggregate balance in the allowance for doubtful accounts after these two periods is $5,400. To establish an adequate allowance for doubtful accounts, a company must calculate its bad debt percentage. To make that calculation, divide the amount of bad debt by the company’s total accounts receivable for a period of time and then multiply that number by 100. Review the largest accounts receivable that make up 80% of the total receivable balance, and estimate which specific customers are most likely to default.

Regardless of company policies and procedures for credit collections, the risk of the failure to receive payment is always present in a transaction utilizing credit. Thus, a company is required to realize this risk through the establishment of the allowance for doubtful accounts and offsetting bad debt expense. In accordance with the matching principle of accounting, this ensures that expenses related to the sale are recorded in the same accounting period as the revenue is earned.

What is bad debt expense?

Instead of applying percentages or weights, it may simply aggregate the account balance for all 11 customers and use that figure as the allowance amount. Companies often have a specific method of identifying the companies that it wants to include and the companies it wants to exclude. The allowance can accumulate across accounting periods and may be adjusted based on the balance in the account. In addition, the company should re-examine how it manages credit extended to customers.

Let’s say you review historical collection data from the last year and discover that you write off 5% of your invoices on average. You can use three methods to calculate an appropriate allowance for doubtful accounts. Each of these methods suits different businesses and one is not necessarily better than the other. However, Days Sales Outstanding (DSO) benchmarks offer insight into AFDA standards. As a rule of thumb, the longer your collection cycle is, the greater your allowance for doubtful accounts must be to account for increased risks.

Allowance for Doubtful Accounts and Bad Debt Expenses

This amount is referred to as the net realizable value of the accounts receivable – the amount that is likely to be turned into cash. The debit to bad debts expense would report credit losses of $50,000 on the company’s June income statement. An allowance for doubtful accounts is considered a “contra asset,” because it reduces the amount of an asset, in this case the accounts receivable. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be paid by customers. While both bad debt expense accounting and allowance for doubtful accounts signify the same thing from a business perspective, the accounting world treats them very differently. Allowance for doubtful accounts is a balance sheet account and is listed as a contra asset.

Basically, your bad debt is the money you thought you would receive but didn’t. Whereas AFDA is an estimate of accounts receivable that will likely go uncollected, BDE is a record of receivables that went unpaid during a financial reporting period. In other words, AFDA is an estimate while BDE records the actual impact of uncollectibles. If your company relies primarily on credit sales, either number makes sense.

How to calculate allowance for doubtful accounts

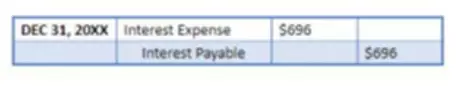

Doubtful debt is money you predict will turn into bad debt, but there’s still a chance you will receive the money. To reverse the account, debit your Accounts Receivable account and credit your Allowance for Doubtful Accounts for the amount paid. When it comes to bad debt and ADA, there are a few scenarios you may need to record in your books. Your allowance for doubtful accounts estimation for the two aging periods would be $550 ($300 + $250).

- In addition, this accounting process prevents the large swings in operating results when uncollectible accounts are written off directly as bad debt expenses.

- Debit your Bad Debts Expense account $1,200 and credit your Allowance for Doubtful Accounts $1,200 for the estimated default payments.

- Now that you have got a grasp of what an allowance for doubtful accounts is and why it’s vital for your financial strategy, let’s understand how to calculate it.

- In this article, we’ll explain what allowance for doubtful accounts is, why it matters, how to calculate it and record the journal entries.

- For companies having minimal bad debt activity, a quarterly update may be sufficient.

Then use the preceding historical percentage method for the remaining smaller accounts. This method works best if there are a small number of large account balances. In simpler terms, it’s the money they think they won’t be able to collect from some customers. The sales method estimates the bad debt allowance as a percentage of credit sales as they occur. Suppose that a firm makes $1,000,000 in credit sales but knows from experience that 1.5% never pay.

FAQs on Allowance for Doubtful Accounts

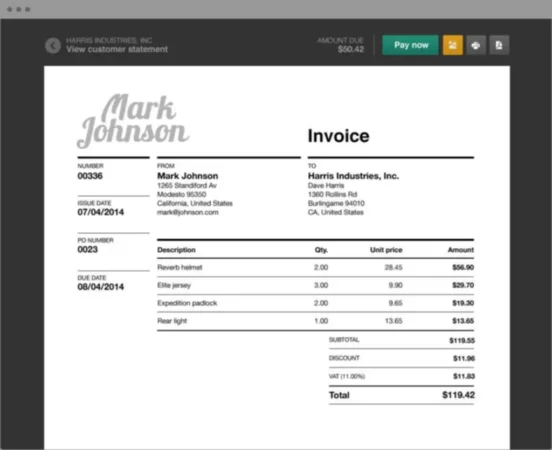

Lenders use an allowance for bad debt because the face value of a firm’s total accounts receivable is not the actual balance that is ultimately collected. When a customer never pays the principal or interest amount due on a receivable, the business must eventually write it off entirely. They are the accounts receivable aging method and percentage of sales methods. A bad debt expense occurs when a customer does not pay their invoice for any of the reasons we mentioned earlier. This figure also helps investors estimate the efficiency of a company’s accounts receivable processes.

The sales method applies a flat percentage to the total dollar amount of sales for the period. For example, based on previous experience, a company may expect that 3% of net sales are not collectible. If the total net sales for the period is $100,000, the company establishes an allowance for doubtful accounts for $3,000 while simultaneously reporting $3,000 in bad debt expense. An allowance for doubtful accounts is a contra account that nets against the total receivables presented on the balance sheet to reflect only the amounts expected to be paid.