Content

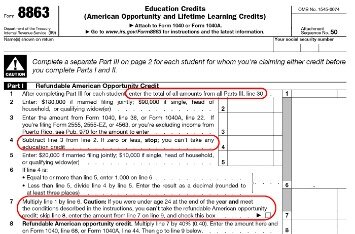

Books and course materials can also count, but only if you are required to purchase them directly from the school. Other expenses, such as optional fees and room and board, do not qualify. You can claim the American Opportunity credit for qualified education expenses you pay for a dependent child as well as for expenses you pay for yourself or your spouse.

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Student fees unless required as a condition of enrollment or attendance. You may not claim the AOTC on a later original return or an amended return if the TIN is issued on or applied for after the due date of the return . Check the Form 1098-T to make sure it is correct. If it isn’t correct or you do not receive the form, contact your school. For 2019, this credit can be worth up to $3,526 for one qualifying child, $5,828 for two kids, and $6,557 for three or more.

Which Expenses Are Covered?

If Dan can’t be claimed as a dependent on anyone else’s tax return, only Dan can claim a tuition and fees deduction for his grandmother’s payment. If someone else can claim Dan, no one will be allowed a deduction for Ms. Baker’s payment. Donna and Charles, both first-year students at College W, are required to have certain books and other reading materials to use in their mandatory first-year classes. The college has no policy about how students should obtain these materials, but any student who purchases them from College W’s bookstore will receive a bill directly from the college.

To pay these expenses, Beatrice withdrew $800 from her Coverdell ESA and $4,200 from her QTP. No one claimed Beatrice as a dependent, nor was she eligible for an education credit.

They must pay tax on the remaining $450 ($3,000 − $2,550) of interest. You may be able to cash in qualified U.S. savings bonds without having to include in your income some or all of the interest earned on the bonds if you meet the following conditions. However, when you cash in certain savings bonds under an education savings bond program, you may be able to exclude the interest from income. A withdrawal from personal savings (including savings from a qualified tuition program ). There are no income tax consequences if the designated beneficiary of an account is changed to a member of the beneficiary’s family. See Members of the beneficiary’s family, earlier. Since the remaining expenses ($5,200) are less than the QTP distribution, part of the earnings will be taxable.

Tuition And Fees Deduction

Tax benefit of, What is the tax benefit of the tuition and fees deduction? But this allows payments made in cash, by check, by credit or debit card, or with borrowed funds such as a student loan to be applied to qualified education expenses. You paid $3,500 of qualified education expenses in December 2020, and your child began college in January 2021.

Tables and figuresAmerican opportunity creditEligible student requirements (Figure 2-2),Overview (Table 2-1),Qualifying to claim (Figure 2-1), Figure 2-1. Can You Claim the American Opportunity Credit for 2020? Overview of the Lifetime Learning Credit for 2020Lifetime learning creditOverview (Table 3-1), Table 3-1. Effect of MAGI on Student Loan Interest DeductionOverview (Table 4-1), Table 4-1.

Q20 What If The Students Return Was Incorrectly Prepared And Filed By A Professional Tax Preparer?

You can’t deduct expenses for personal activities such as sightseeing, visiting, or entertaining. If you are regularly employed and go directly from home to school on a temporary basis, you can deduct the round-trip costs of transportation between your home and school. This is true regardless of the location of the school, the distance traveled, or whether you attend school on nonwork days. Initially, your attendance at school is realistically expected to last 1 year or less, but at a later date your attendance is reasonably expected to last more than 1 year. Your attendance isn’t temporary after the date you determine it will last more than 1 year. Your attendance at school is realistically expected to last more than 1 year.

- For purposes of the qualified tuition reduction, a child is a dependent child if the child is under age 25 and both parents have died.

- The distributed earnings must be included in gross income for the year in which the excess contribution was made.

- You have already met the minimum requirements for teaching.

- If you pay qualified education expenses for a student for whom you don’t claim the American opportunity credit, you can use the adjusted qualified education expenses of that student in figuring your lifetime learning credit.

- Only one tax filing can claim the AOTC, so it’s important to discuss this with your parents to make sure you’re not both claiming the credit.

- Also, the student must not have been convicted of a felony for possessing or distributing a controlled substance.

You can deduct expenses for travel, meals (see 50% limit on meals, later), and lodging if you travel overnight mainly to obtain qualifying work-related education. Assume the same facts as in Example 1, except that on certain nights you go directly from work to school and then home.

They include amounts paid for the following items. To help you figure your lifetime learning credit, the student may receive Form 1098-T. Generally, an eligible educational institution must send Form 1098-T to each enrolled student by February 1, 2021 . An institution will report payments received for qualified education expenses. However, the amount on Form 1098-T might be different from what you paid. When figuring the credit, use only the amounts you paid or are deemed to have paid in 2020 for qualified education expenses. You can claim a lifetime learning credit for qualified education expenses paid with the proceeds of a loan.

Your employer agrees to pay your education expenses if you file a voucher showing your expenses. You don’t file a voucher and you don’t get reimbursed. Because you didn’t file a voucher, you can’t deduct the expenses on your tax return.

If your MAGI is $90,000 or more as an individual or $180,000 or more as a married couple filing jointly, you are not allowed to claim the credit. A tax-free distribution to you of cash or other assets from a tax-favored plan that you contribute to another tax-favored plan. A student who is enrolled for at least half the full time academic workload for the course of study the student is pursuing, as determined under the standards of the school where the student is enrolled. Hadn’t completed the first 4 years of postsecondary education in an earlier tax year. A program of training to prepare students for gainful employment in a recognized occupation. Attends a primary or secondary school or pursues a degree at a college or university.

Jackie doesn’t report any portion of the scholarship as income on her tax return. For a QTP, this applies only to the amount of tax-free earnings that were distributed, not to the recovery of contributions to the program. You can claim a tuition and fees deduction for qualified education expenses not refunded when a student withdraws. For qualified student loans taken out before September 1, 2004, the institution is required to include on Form 1098-E only payments of stated interest. Other interest payments, such as certain loan origination fees and capitalized interest, may not appear on the form you receive. However, if you pay qualifying interest that isn’t included on Form 1098-E, you can also deduct those amounts. See Allocating Payments Between Interest and Principal, earlier.

Unless Todd is claimed as a dependent on someone else’s 2020 tax return, only Todd can use the payment to claim an American opportunity credit. When Kelly enrolled at College X for her freshman year, she had to pay a separate student activity fee in addition to her tuition. Although labeled as a student activity fee, the fee is required for Kelly’s enrollment and attendance at College X and is a qualified expense. Glenda enrolls on a full-time basis in a degree program for the 2021 spring semester, which begins in January 2021. Glenda pays her tuition for the 2021 spring semester in December 2020.

Take Advantage Of Two Education Tax Credits

He can deduct only the meals (subject to the 50% limit) and lodging connected with his educational activities. If you use your car for transportation to school, you can deduct your actual expenses or use the standard mileage rate to figure the amount you can deduct. The standard mileage rate for miles driven from January 1, 2020, through December 31, 2020, is 57.5 cents a mile. Whichever method you use, you can also deduct parking fees and tolls. 463, chapter 4, for information on deducting your actual expenses of using a car. Assume the same facts as in Example 1, except that you attend classes twice a week for 15 months.

H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

Beyond the AOTC and the LLC, deductions and 529 plans can be worthwhile options. Student loan interest is deductible once it begins to be applied. Other educational expense deductions may also be available, including certain itemizations for business deductions and deductions for self-employed workers. The LLC is not limited to students pursuing a degree or studying at least part-time. Instead, it covers a broader group of students—including part-time, full-time, undergraduate, graduate, and courses for skill development. The LLC is non-refundable, meaning once a taxpayer’s bill has been reduced to zero, there will be no refund on any credit balance. A single taxpayer has to have amodified adjusted gross income that is less than $80,000 to qualify for the AOTC.