Content

We know your tax refund is important to you, so TurboTax shows you your refund as you go so you know where you stand. We’ll streamline the process so you won’t have to answer any unnecessary questions and file faster. “I’m a single mom with 2 kids and have personal and business income, and TurboTax walked me through both of them. So incredibly helpful and easy.” Get unlimited advice as you do your taxes, or now even have everything done for you from start to finish.

If you qualify, there is another free software program available from TurboTax which will allow you to enter self-employment income. Then you would report one-half of your self-employment tax, $2,473, ($4,945 X .50) on Form 1040 as an adjustment to income, which reduces your Adjusted Gross Income and the amount of income tax you owe. But when figuring your self-employment tax on Schedule SE, Computation of Social Security Self-Employment Tax, the taxable amount is $46,175. Not paying the 15.3 percent tax on $3,825 difference in this example saves you $585. When figuring self-employment tax you owe, you get to reduce self-employment income by half of the self-employment tax before applying the tax rate. Say, for example, that your net self-employment income is $50,000. That’s the amount you report as taxable for income tax purposes on Form 1040.

- That goes for the Form 1040, Form 1040EZ and Form 1040A. For example, all forms are free if you have mortgage interest deductions, children in college or made money in the stock market, among other things.

- TurboTax also does a great job of keeping you engaged in the process and preventing you from mindlessly clicking past important details.

- Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner.

- This is essentially the free version but with on-demand video access to a tax pro for help, advice and a final review.

- Though a tax preparer’s services will likely cost you more than even the most expensive tier of DIY tax software—CPA fees vary depending on where you live and the complexity of your return—you get a lot of value from that higher price tag.

- TurboTax Self-Employed offers seamless integration with QuickBooks Self-Employed, which tracks invoices, helps separate personal expenses from business expenses, tracks mileage automatically, and helps track any quarterly taxes due.

This is a service provided by the charitable organization United Way to anyone and everyone. Most of the software we’ve tested or recommended can handle any tax scenario.

Free Tax Filing For Simple To Complex Tax Situations, If You Qualify

When I was freelancing for multiple clients and ran my own business, preparing my taxes took the better part of a weekend—sometimes two weekends, plus a lot of back-and-forth emails with tax pros to clarify some details. You’ll know, each step of the way, that you won’t have to pay to file your federal or state tax return—unlike in other programs, including the commercial TurboTax Free Edition, where it might be unclear whether you can file for free. TurboTax is the best online tax software because of its thorough and intelligent interview process.

Embedded links throughout the process offer tips, explainers and other resources. And help buttons can connect you to the searchable knowledge base, on-screen help and more. TurboTax’s interface is like a chat with a tax preparer, and you can skip around if you need to.

Turbotax Rated “easiest To Use”

Most of the entry screens offer detailed information that explains exactly what the program is asking for and more importantly, why it’s necessary. An excellent knowledge base is also available to further explain any details that you may not understand.

For more complex tax situations you may need additional documents, like mortgage statements or other detailed financial information. But since we save your return as you go, you can finish anytime. If you’re a returning customer we’ll automatically transfer last year’s information to save you time. She navigated me through the self-employed section and adding it to my existing W2.”

Completing Irs Schedule C

TurboTax Self-Employed is designed for freelancers, independent contractors, consultants, and small business owners who currently operate without corporate status. TurboTax also offers a corporate version designed for C and S corporations. Determined and ranked by our resident expert based on firsthand knowledge and unbiased research. Looking for the best tips, tricks, and guides to help you accelerate your business?

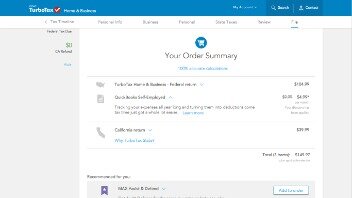

You meet the tax preparer on a video call before they begin working, then you’ll meet again when your return is ready for review and filing. Prices range from $130 to $290 for federal returns, depending on complexity, plus $45 to $55 per state return. For simple tax returns only; it allows you to file a 1040 and a state return for free, but you can’t itemize or file schedules 1-3 of the 1040. Generally, it works only for people who don’t plan to claim any deductions or credits other than the standard deduction, the earned income tax credit or the child tax credit. February marks a high-point in the tax filing season when the IRS experiences many calls to its customer service line from taxpayers with questions. Free File software products can help answer many of your questions by walking you through a step-by-step process to complete your tax return.

If you’ve already received a letter from the IRS for a return you filed with TurboTax, please review our Audit Support Guarantee for instructions on how to receive FREE step–by–step audit guidance and the option to connect with an expert. You can choose to pay for your tax preparation costs right out of your federal tax refund . Have a tax expert guide you to find the right deductions for mortgage interest, property taxes, refinancing fees, and more.

I wish I knew that when filing as an independent contractor that all the information that you keep track of can help you when your trying to receive a refund instead having to owe the government money. Learn how to file like a pro — hear from Lyft drivers and our partners at Everlance. You’ll learn what it means to file as an independent contractor, whether the “standard mileage” or “actual vehicle expenses” deduction is better for you, and which other deductions you may be eligible for. The ‘Tax Information’ tab, in your Driver Dashboard, has all of your tax docs as well as special offers for you.

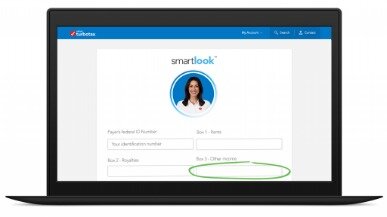

They can handle all kinds of tax situations, from simple to complex. When you connect live with an expert, you’ll see their specific certifications. To connect, just select Live help and set up a call or talk via chat. TurboTax Live is an unlimited service, so you can have as many sessions as you need to get your taxes done right. Not only that—TurboTax always double-checks your return for errors as you go, and before you file your taxes.

Should you have any problems with the IRS, your CPA or EA will be available to help . We contacted support over chat, but as we found in last year’s testing, the automated help was not helpful. It misunderstood our issue and then refused to transfer us to a live agent. The search function should cover most everything else, as TurboTax staff and community members have answered a litany of questions about even the smallest of details. Your adjusted gross income is $39,000 or less (or $72,000 or less if you’re active-duty military).

You may need to upgrade to a more expensive plan to file certain forms through H&R Block. This is especially true if you have any income from freelance work, contract work or any other where payroll taxes weren’t removed. It’s great if you can file your taxes for free, but the average filer will need to upgrade to another option. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat. Most filers can get away with the Deluxe option, which costs $29.99 and includes software for maximizing tax deductions.

If you make $62,000 or less, you qualify for free brand-name software offered through a partnership between the IRS and 13 leading tax software providers. Some of these providers offer free federal and free state return preparation and electronic filing. If you made more than $62,000, you can use Free File Fillable Forms, electronic versions of IRS paper forms best for someone experienced in return preparation. There are a couple of big differences between the options in the forms that they support. TurboTax’s Deluxe option supports Schedule SE, which allows you to fileself-employment taxes. It also allows you to file Schedule C and Schedule C-EZ if you have business income to report but do not have any expenses to report. Developed more than 30 years ago, TurboTax has evolved from personal tax return software to now offer a Self-Employed plan designed for freelancers, sole proprietors, and self-employed.