Content

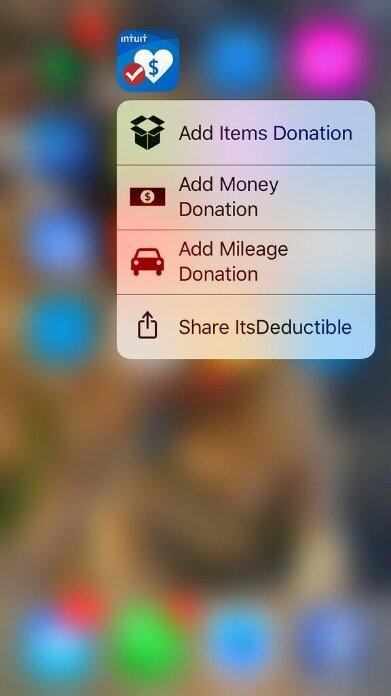

This also comes up when someone buys a “toy” just because they can claim it as a business expense. Used it for years, great way to org those sheets of 3 shirts, 2 shorts…until this year. Try to create an account, fill in all of it, hit enter, gray screen and lock, 2 hours of aggravation and nada. I don’t know what they did this past year, but they ruined It’s Deductible. If you’re going to use a fire hose, make sure it works when there’s a fire. It you can’t logon to It’s Deductible at tax time, it’s broken. Another great feature is that ItsDeductible reminds you to take a mileage write-off for all the traveling you did to help your charities.

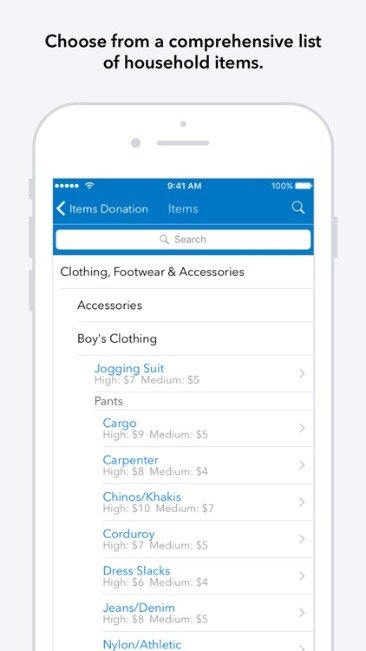

If you’re not sure whether the organization you donated to is a qualified one, you can ask, or you can look it up using the Tax Exempt Organization Search tool on the IRS website. Your contributions generally can’t be more than 60% of your adjusted gross income , although exceptions may apply. ItsDeductible uses market data from online auction sites, including eBay, as well as thrift stores and resale shops to help estimate a dollar value for your donated item. ItsDeductible is an easy way to keep track of your donations and get back the maximum deductions you deserve for your charitable acts. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Get expert advice and a final review—Connect live on your screen with real tax experts or CPAs for on-demand tax advice and even a final review of your return to guarantee it’s done right.

When I got to the Other category and had entered about half of the items a pop-up appeared and said I could not enter more than 50 items. I was going to delete a couple of the items in the OTHER category and enter them as Miscellaneous so it would be one item and it would not let me back into the category or any other category. It only poped up the notation that I could not enter more than 50 items. Now I am getting really frustrated and called H&R Block locally to find out who to call for help with this program. I was given a number for Deduction Pro Customer Service and called finding that it was H&R Block Bank. I had just spent 4 hours entering the information as my hand written sheets are by box the items were in when picked up, and I had to reorganize the information to Deduction Pro’s organization.

Using itsdeductible To Figure The Value Of Donations

The IRS places the responsibility for coming up with a fair market value on you, the taxpayer. The places that accept your non-cash donations only give you a receipt for what you donated. They don’t tell you how much the items are worth. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

So if Tom is in the 25% federal bracket (over $68k taxable income if MFJ), business deductions effectively save 40%, not including state tax savings. I have used Tax Cut and Deduction Pro for over 10 years. I have always bought the software from Office Depot or Office Max. I tried to find Deduction Pro and had a hard time finding it. After reading all the mess you guys had, I am thinking maybe I will change my tax software to Turbo Tax. I haven’t used Turbo Tax for years and wonder if they are a mess also. It’s bad enough that we have to do taxes anyway, but when the tools we use are a wreck, and we have to do our own spread sheets, I’d rather just do it by hand.

In the case of an audit, you’ll wind up getting paid some of your tax money back since the IRS will actually owe you money. The lower deduction would make it less likely you have to deal with the pain and hassle of an audit while still getting some sort of compensation for your charitable giving. Of course it’s important for the user to be honest about the quality and quantity of the donated goods.

Who Should Not Use itsdeductible

As long as everything else is on the up and up (meaning both trying to cheat the IRS which I doubt you’d do and not making mistakes which anyone can do) then you are in a win-win situation. I see that I am not the only one with a hugh problem with DeductionPro. This is my first try to use this program in connection with H&R Block Deluxe Tax Program. I entered Deduction Pro from the tax program and set up an account saving the data and disabled the pop-up Blocker as required. I entered about half of the items and saved using the save button and closed out for the night. Frustrated, I started over and entered new account information and began to enter the items.

Or you can print a summary of the total value for your donations, but without itemization. TurboTax ItsDeductible is easy to navigate, with intuitive links and drop-down selection lists. The service does not support uploading digital images as evidence of non-cash donations, however. Therefore, you may want to save photos like these on your own to prove the condition of the goods. According to the IRS, a charitable contribution is a voluntary gift made to a qualified organization, without anything of value expected in return.

Itsdeductible Vs Deductionpro For Valuing Donations

Also the program is known as “TurboTax ItsDeductible 2006”, “TurboTax ItsDeductible 2005”, “TurboTax ItsDeductible 2004”. Our built-in antivirus checked this download and rated it as virus free. When I went to enter new cash donations, it got worse!!! First it didn’t bring up the current date, requiring you to go through the calender for each donation. Deduction Pro used to be a PC based production free with the H&R Tax Software, now called, At Home.

Does anyone know of any contact to get information as to how to retrieve the saved file? I am beyond frustrated and don’t look forward to spending another 4 hours only to save it and not be able to find it. Bottom line, if the PC version Deduction Pro saved me a couple of hours a year when preparing my tax return, I spent over 8 hours this year in fixing the web based version file.

I figured it would be tedious to enter everything in, but I also figured that it might end up being worth the trouble, so I logged in and got started. This article/post contains references to products or services from one or more of our advertisers or partners. We may receive compensation when you click on links to those products or services. Our website provides a free download of TurboTax ItsDeductible 10.0.

Right after our moving sale, I hauled several loads of stuff to the Goodwill donation center, including tons of kids clothing, a decent amount of adult clothing, toys, random housewares, etc. We also made another donation run right at the end of the year . You may want to check out more software, such as TurboTax 2017, TurboTax or TurboTax Home & Business, which might be related to TurboTax ItsDeductible. ItsDeductible10.exe, ItsDeductible9.exe and ItsDeductible8.exe are the most common filenames for this program’s installer. TurboTax ItsDeductible lies within Business Tools, more precisely Finances. The actual developer of the free program is Intuit.

I really need the deductions this year and will be giving up hundreds due to the difference. There’s no way a $12 meduim quality item is worth $4 in perfect shape this tax season. I may have to resort to manual itemization I guess.

- In the case of an audit, you’ll wind up getting paid some of your tax money back since the IRS will actually owe you money.

- If you donate time by traveling to see patients for free, this will at least help you get the tax write-off for your mileage.

- Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

- I believe it did for a few years, but not sure if it still does.

- That’s great because if you’re like me, you don’t have a clue as to how to value those items.

There is no reason I can think of for passing this by. If you are really crafty, you might even consider using this software to launch your own business and run these reports for others who aren’t as savvy as you. It doesn’t get publicized much because audits are a pain in the butt process to go through, but you know that after the audit you will have everything correct. If you missed something, an audit will bring it up and you may wind up with more money. I would like to purchase the “ItsDeductible” workbook for tax year 2010.

Track Deductions On The Go And On Your Time With Our Mobile App

The TurboTax community is where you can ask questions and get tips relevant to the software. Answers and tips are provided by other ItsDeductible users and specialists. Because ItsDeductible bases its calculations in real-world transactions, it allows you to estimate fair-market values that comply with IRS guidelines. , indicated that the app’s privacy practices may include handling of data as described below.

Wealth Pilgrim and Wealth Resources Group are affiliated companies. In accordance with FTC guidelines, we state that we have a financial relationship with some of the companies mentioned in this website. This may include receiving payments,access to free products and services for product and service reviews and giveaways.

If you are paying an advisor a percentage of your assets, you are paying 5-10x too much. Learn how to find an independent advisor, pay for advice, and only the advice.