Content

The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

Interest income from Treasury bills, notes and bonds – This interest is subject to federal income tax, but is exempt from all state and local income taxes. Treasury bonds and savings bonds is taxable on your federal return, but it’s usually tax-free at the state level. And this works in reverse as well—interest on municipal bondsis tax-free at the federal level. Municipal bond interestis also often tax-free at the state level if you invest in a bond that’s issued in the same state where you reside. Most interest income is taxable as ordinary income on your federal tax return, and is therefore subject to ordinary income tax rates. There are a few exceptions, however. Interest income is the amount of interest that has been earned during a specific time period.

Box 5: Investment Expenses

Money market fund distributions are generally reported as dividends, not interest. Municipal bond interest is exempt from taxation of any kind unless the alternative minimum tax applies. A payor must file Form 1099-INT with the IRS, and send a copy to the recipient by January 31 each year.

Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. The tax identity theft risk assessment will be provided in January 2019.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. This box reflects tax-exempt interest that is subject to AMT. This amount is also included in Box 8. If the foreign country has a tax treaty with the United States, this tax is usually either a deduction or a tax credit. The total amount of backup withholding on your interest income. The income in this box is separate from the income in Box 1.

How Are Yields Taxed On A Certificate Of Deposit (cd)?

TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice.

Interest on some bonds used to finance government operations and issued by a state, the District of Columbia, or a U.S. possession is reportable but not taxable at the federal level. Reporting tax-exempt interest received during the tax year is an information-reporting requirement only and doesn’t convert tax-exempt interest into taxable interest.

FidSafe is not a Fidelity Brokerage Services LLC service. FidSafe is a service of Fidelity Wealth Technologies LLC, a Fidelity Investments company, located at 245 Summer Street, V8B, Boston, MA 02210. Gain an understanding of two of the most asked-about tax topics. Interest on the value of gifts given for opening an account.

Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

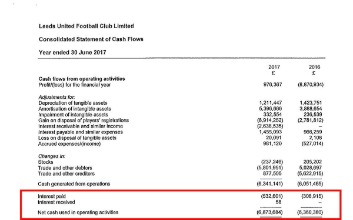

Distributions commonly known as “dividends” on deposit or share accounts in credit unions, cooperative banks, and other banking associations. Obligations bought at a discount; bonds bought when interest defaulted or accrued. Interest income is recorded within the interest income account in the general ledger. This line item is typically presented separately from interest expense in the income statement. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites.

The total amount of early withdrawal penalties from CDs or other securities you paid during the year. Anyone who pays interest of $10 or more must send a 1099-INT to the recipient by January 31 each year. Tax laws change periodically and the above information might not reflect the most recent changes. Please consult with a tax professional for the most up-to-date advice.

When your normal tax bracket changes, the amount of tax you pay on interest income changes along with it. To make sure you’re in the good books with the IRS, make sure you know the thresholds for reporting interest income when you’re filing your tax return.

How We Make Money

Box 2 reports interest penalties you’re charged for withdrawing money from an account before the maturity date. Want to make ETFs a part of your investment portfolio? These top accounts may appeal to you. Curious about how your mortgage payments can be deducted from your taxes?

Some bonds issued by government entities have special tax treatment. Say you earned $1,000 in interest on a CD . If your tax rate is 25 percent, you’ll owe $250 in taxes from that income. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Box 8 relates to interest-bearing investments you hold with state and local governments, such as municipal bonds.

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.

- See instructions in IRS Publication 550 on how to report interest in this situation on your federal income tax return.

- Fidelity disclaims any liability arising out of your use of these Intuit software products or the information or content furnished by Intuit.

- 1099-OID reports any taxable OID and is also included in your Fidelity tax reporting statement; be sure to add these amounts to your taxable interest.

- When your normal tax bracket changes, the amount of tax you pay on interest income changes along with it.

- A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return.

It is also important to report all federal tax withheld reported in box 4 in the “payments” section of your return. Doing so will either reduce the amount of tax you’ll owe with your return or will increase your refund. Although the tax-exempt interest reported in box 8 of the 1099-INT isn’t taxable, you still must report it on the “tax-exempt interest” line of your tax return for informational purposes. All amounts reported in box 1 must be reported on the “taxable interest” line of your tax return and are taxed in the same way as the other income you report on the return. Box 1 of the 1099-INT reports all taxable interest you receive, such as your earnings from a savings account.

Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. The interest you earn on federal bonds, mutual funds, CDs, and interest-bearing accounts is all taxable.

A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018.

Available only at participating H&R Block offices. CAA service not available at all locations. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply.

Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation.

U.S. government obligations are taxable at the federal level only. See the first bullet below for information about an exclusion from income for interest redeemed from certain Series EE and Series I bonds if you meet certain requirements. Tax-exempt municipal bond interest is reported on Line 2a of the 2020 Form 1040.