Content

Sales tax and discretionary sales surtax are calculated on each taxable transaction. Florida uses a bracket system for calculating sales tax when the transaction falls between two whole dollar amounts. Multiply the whole dollar amount by the tax rate and use the bracket system to figure the tax on the amount less than a dollar.

A second usually occurred in October, for energy-efficient home appliances with the Energy Star certification. There were no sales-tax holidays in 2010 and 2011, but they were reinstated in 2012 after the worst of the late-2000s recession had passed. The answer to this question comes down to whether your stimulus check increases your “provisional income.” President Biden and Senate Democrats agreed on a new third stimulus check plan that would reduce the number of people eligible for a $1,400 payment. Take a look at our list to find out which states will nickel-and-dime you the most on everyday purchases.

For example, in the capital city of Topeka, retailers must collect 6.5% for the state, 1.15% for Shawnee County, and 1.5% for the city, for a total rate of 9.15%. District of Columbia, has a sales tax rate of 5.75% as of October 1, 2013. The tax is imposed on sale of tangible personal property and selected services. Portions of the hotel and restaurant meals tax rate are allocated to the Convention Center Fund. Groceries, prescription and non-prescription drugs, and residential utilities services are exempt from the district’s sales tax. City taxes range from an additional 0.25% to 3.5% and county taxes could be as much as 3.25%. Including city and county taxes, the highest sales tax rate is 11.625% in the portions of Mansfield that are in Scott County.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them

Cuyahoga County has the highest statewide sales tax rate (8%). Tax increments may not be less than 0.25%, and the total tax rate, including the state rate, may not exceed 8.75%. County permissive taxes may be levied by emergency resolution of the county boards of commissioners. Transit authority taxes must and county permissive taxes may be levied by a vote of the electors of the district or county. The city of Chicago has one of the highest total sales tax of all major U.S. cities (10.25%).

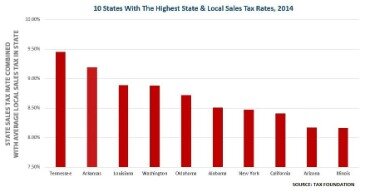

Our biggest offender clocks in at 9.55% once both state and local sales taxes are factored in (continue reading our round-up to find out which state is the priciest culprit). This is largely due to Salt Lake County and Salt Lake City increasing their local sales taxes by and 0.25 and 0.5 percent, respectively. A sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. Louisiana moved from third to second highest when East Baton Rouge increased its parish sales tax by half a percent. Meanwhile, a 1 percent increase in Tuscaloosa’s local sales tax helped take Alabama’s combined rank from 5th to 4th.

- Sales taxes are imposed only on taxable transfers of goods or services.

- You’ll note that none of these states also make the list for the highest state and local sales taxes, so residents do receive a little bit of a break there.

- The taxation of services (e.g., dry cleaning, carpentry work, barbershops) is more complicated.

- You’ll have to shop in states that either don’t have a sale tax, have a very low tax rate, or shop during a sales tax holiday if you don’t want to shell out a fair bit of extra money every time you approach a cash register.

- Before you embark on a shopping spree in any of the 10 worst states for sales taxes, make extra room in your budget.

- The state has reduced rates for sales of certain types of items.

Vehicles being brought from out of state are also subject to TAVT. Vehicle sales or use taxes paid to other states are not credited towards TAVT in Georgia. Shipping and delivery charges, including charges for US postage, made by a retailer to a customer are subject to sales and use taxes when provided in connection with the sales of taxable tangible personal property or services.

Where You’ll Pay The Most In State And Local Taxes

Sales tax is collected at the state level in forty-five states and in the District of Columbia. New Hampshire, Oregon, Montana, Alaska, and Delaware, otherwise known as the NOMAD states, are the only states that do not have a state-level sales tax, although some local levels in Alaska do impose a sales tax. Each state has a unique mix of taxes that affects both residents and nonresidents. This makes creating a comprehensive ranking of overall tax burdens an even more difficult undertaking and one that can be looked at in several ways. The U.S. Census Bureau’s quarterly data report helps provide insight on total tax revenue, which takes into account taxes paid by residents and nonresidents. See Navistar International Transportation Corporation v. State Board of Equalization, 8 Cal.4th 868 , cited in Hellerstein, page 710. The Court held that Navistar’s sale of intellectual property as part of a sale of a whole division was a taxable sale.

Oral arguments were heard by the Supreme Court on April 17, 2018. During oral arguments South Dakota’s attorney general, Marty Jackley, and the U.S. Solicitor General’s representative, Malcolm L. Stewart, both posited that if the Court overturns the Quill decision that the ruling must be retroactive and not merely prospective.

These credits or rebates usually are set at a flat amount per family member. As noted, credits are less expensive than a full exemption but also less effective at protecting low-income families from the impact of the tax. (See Figure 3.) Most recently, Tennessee cut its sales tax on food to 4 percent from 5 percent in 2017; Arkansas cut its rate to 0.125 percent from 1.5 percent in 2019. The state has relatively high corporate income taxes and imposes additional taxation on specific distributors of goods and services, allowing the state to have a 0% property tax and sales tax. but each state has its own regulation on excise taxes, income taxes, and taxes imposed on tourist locations – as well as local sales taxes that may be imposed by cities or municipalities. Colorado has the lowest state general sales tax rate (2.9 percent).

California, from 1991 to 2012 and since 2017, has a base sales tax of 7.25%, composed of a 6% state tax and a 1.25% uniform local tax. California is ranked as having the tenth highest average combined state and local sales tax rate in the United States at 8.25%. As of July 2019, the city’s rates vary, from 7.25% to 10.5% . Sales and use taxes are collected by the California Department of Tax and Fee Administration . Income and franchise taxes are collected separately by the California Franchise Tax Board.

Individual And Consumption Taxes

Few states, however, tax customized software or computer programming services. Contrast legal treatment as a license of software to the Federal income tax treatment as sale of a copyrighted item. Some states have adopted similar views for sales tax treating sales of software the same as sales of books. In January 2018, the Supreme Court agreed to hear the case South Dakota v. Wayfair, Inc. in its 2018 term.

Because of this, some sources will describe California’s sales tax as 6.0 percent. Sales taxes are just one part of an overall tax structure and should be considered in context. For example, Tennessee has high sales taxes but no wage income tax, whereas Oregon has no sales tax but high income taxes. While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts. Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain. State and local governments should be cautious about raising rates too high relative to their neighbors because doing so will yield less revenue than expected or, in extreme cases, revenue losses despite the higher tax rate. State & Local Sales Tax Rates, As of January 1, 2020 City, county and municipal rates vary.

This change only applies to transactions beginning and ending within state lines and does not apply to other states. Additionally, Washington started collecting taxes from online retailers that have voluntarily agreed to start collecting the sales tax in return for not being sued for back taxes. Motor vehicle sales are subject to a 6% purchase or use tax. Gasoline is taxed at 20 cents per gallon, plus an amount equal to 2% of the average statewide retail price.

The tax on lodging and prepared food is 8% and short term auto rental is 10%. A use tax applies to purchases made from out-of-state online retailers and catalogs.

New Jersey municipalities are known for having the highest property taxes at a median rate of 1.89% as of 2021, and Louisiana has the lowest at 0.18%. Residents of Colorado Springs, Colorado voted to increase their city sales tax to 3.12% effective 2016 to help pay for highway and road maintenance, but Colorado still remains on the short list of low-taxed states overall. Also among the five highest combined state and local taxes are Arkansas at 9.47%, Louisiana at 9.52%, Alabama at 9.22%, and Washington at 9.21%, all as of 2020. The combined state and local rates reach a whopping 9.53% in some areas of Tennessee—the highest combined rate in the country.

When Local Taxes Are Added In

However, taxation of services is the exception rather than the rule. Few states tax the services of a doctor, dentist, or attorney. Services performed in connection with sale of tangible personal property are often taxed.

The PLCB always charges sales tax directly to the purchasing entity. The PLCB charges an additional 18% levy on liquor and wine, but this tax is always included in the price regardless of the purchasing location. Ohio law requires virtually every type of business to obtain an Ohio Sales Tax Certificate Number. If someone sells goods on eBay or the internet and ships them to someone in the state they reside, then they must collect sales tax from the buyer and pay the collected tax to the state on a monthly or quarterly basis. If someone sells less than $4 million in annual sales, they do not have to collect or pay sales tax on out-of-state sales. The measure states that any online retailer that generates more than $10,000 in sales via in-state sales affiliates must collect New York sales tax.