Content

Follow the country’s practice for entering the postal code and the name of the province, county, or state. For all taxpayers who are bona fide residents of the Commonwealth of the Northern Mariana Islands, Guam, Puerto Rico, or the U.S. 570, Tax Guide for Individuals With Income From U.S. Possessions. You’re financially unable to pay the liability in full when due.

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

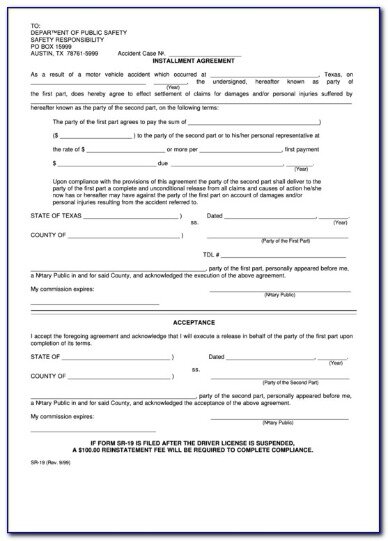

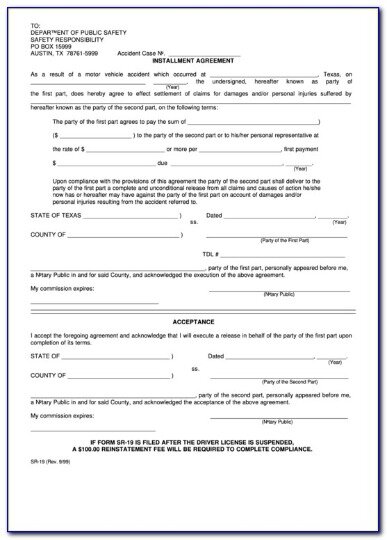

The IRS will let you know whether you qualify for the reduced fee. If the IRS doesn’t say you qualify for the reduced fee, you can request that the IRS consider you for “low-income” status using Form 13844, Application For Reduced User Fee For Installment Agreements. If you’re in bankruptcy or we have accepted your offer-in-compromise, don’t file this form. Instead, call to get the number of your local IRS Insolvency function for bankruptcy or Technical Support function for offer-in-compromise. Who owes an individual shared responsibility payment under the Affordable Care Act (this payment won’t be assessed for months beginning after December 31, 2018). You agree to pay the amount you owe within three years.

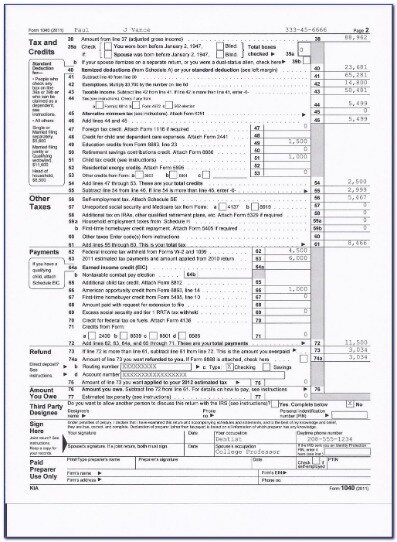

Generally, repayments are required to be completed within 72 months or less, depending on how much you owe. In either case, penalties and interest on the overdue balance will still accrue until you pay it off. Complete lines 21 and 22 relating to income earned by your spouse if you are married and meet either of the following conditions. The account number can be up to 17 characters . Include hyphens but omit spaces and special symbols.

Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN. Additional fees and restrictions may apply. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state.

, earlier, for details on what to write on your payment. You may be entitled to file an appeal through the Collection Appeals Program before and after the NFTL is filed. You are entitled to file an appeal through Collection Due Process after an NFTL is filed.

The electronic government charge installment framework may likewise be utilized . Decide the day you want to make your payments for each month. You can choose any day from the first day of the month through the 28th. Write the chosen date on line 10. Generally, the printable IRS Form 9465-FS should be filed as an accompaniment to the Individual Income Tax Return, so it is to be attached to such forms as Form 1040 and Form 941.

Privacy Act And Paperwork Reduction Act Notice

A low-income taxpayer is a taxpayer with adjusted gross income, for the most recent tax year available, at or below 250% of the federal poverty guidelines. For more information on how to determine if your adjusted gross income is at or below 250% of the federal poverty guidelines, see the instructions for Form 13844. However, before requesting a payment plan, you should consider other alternatives, such as getting a bank loan or using available credit, which may be less costly. If you have any questions about this request, call .

Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. Emerald Card Retail Reload Providers may charge a convenience fee. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank®. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000.

- The IRS response is immediate in most cases, so the delay associated with filing Form 9465 is eliminated.

- In general, installment plans must be completed within 72 months or less, depending on how much you owe.

- Options are available to help you out.

- The form can also be submitted by itself.

- However, before requesting an installment agreement, the IRS recommends using other alternatives, such as getting a loan or using a credit on a credit card.

- Don’t enter any other information on that line, but also complete the spaces below that line.

Attach Form 9465 to the front of your return and send it to the address shown in your tax return booklet. You agree to provide updated financial information when requested. We will usually let you know within 30 days after we receive your request whether it is approved or denied. However, if this request is for tax due on a return you filed after March 31, it may take us longer than 30 days to reply. If we approve your request, we will send you a notice detailing the terms of your agreement and requesting a user fee. Your business is still operating and owes employment or unemployment taxes. Instead, call the telephone number on your most recent notice to request an installment agreement.

Your request for an installment agreement will be denied if any required tax returns haven’t been filed. Any refund will be applied against the amount you owe. If your refund is applied to your balance, you’re still required to make your regular monthly installment payment. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules.

Hello, I’m Jill from Turbo Tax with some information about paying your income tax bill in monthly installments. Have you ever finished your tax return only to discover that the refund you anticipated was actually a tax bill? If this ever happens and you are unable to pay the tax in full, you should consider requesting an installment agreement so you can make monthly tax payments. If electing to make your monthly tax payments by electronic funds withdrawal, you must also provide your bank account and routing numbers. In addition, your request for the installment agreement must be out of necessity rather than preference and your current tax debt must be $10,000 or less. As part of the guaranteed acceptance, you cannot take more than three years to pay off your taxes and you must agree to comply with all tax laws for the duration of the agreement. This means that even while you are making monthly payments, you must ensure that you file all future tax returns and pay your taxes by the deadline each year.

How Do I File Form 9465?

Then, write the name or names of the tax filers on line 1 exactly as they appear on your Form 1040. If you filed a joint return, you must include both your name and your spouse’s name and both Social Security numbers. Firstly, write the type of tax form you filed and what year that form was from on the small line directly above Line 1 of the form. You have an existing monthly payment plan with the IRS. Read our article to find out as we explain what the form is and the form 9465 instructions to file it.

For details, see the table below. If your balance due isn’t more than $50,000, you can apply online for a payment plan instead of filing Form 9465. If you establish your installment agreement using the OPA application, the user fee that you pay will be lower than it would be otherwise. If the Installment Agreement Request is approved, a notice with the terms of new agreement will be given to an applicant. The notice will also specify whether an applicant is qualified for the reduced fee or not. You should also know that regardless of the IRS decision, you may still have to pay the fine for failure to pay taxes in a timely manner. If the agreement is signed, the applicant undertakes to make monthly payments instead of paying the entire amount of debt at once.

In addition, interest and penalties are applied to the unpaid balance until it is paid off. If you want to make your payments by payroll deduction, check the box on line 14 and attach a completed and signed Form 2159. Ask your employer to complete and sign the employer’s portion of Form 2159. You can choose the day of each month your payment is due.

Ensure that the Federal has a green check mark underEF Statuswhen youCalculatethe return. An IRS Online Payment Agreement can be requested online at the IRS website. This is a friendly notice to tell you that you are now leaving the H&R Block website and will go to a website that is not controlled by or affiliated with H&R Block. This link is to make the transition more convenient for you. You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Eligible individuals can also get a six-month extension for filing their tax returns and possibly paying their tax bills if they are under certain financial hardships. Payments can be made between the first and 28th of each month.

Who Should Not File Form 9465: Installment Agreement Request

Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period.

A partial payment plan can be set up for a longer repayment term, and the IRS might file a federal tax lien to protect its interests. You might have to provide pay stubs and bank statements to support your application and substantiate any equity you have in owned assets. The terms of the agreement will be reviewed every two years in case you can make additional payments. Every year, a huge number of Americans file their tax returns. A good number of them find out that they owe the government a big amount of income tax. Usually, it is more than they can afford to pay immediately. Moreover, many taxpayers owe back taxes and have no idea how they can pay those extraordinary amounts.

If you don’t, the IRS can cancel your installment agreement and request full payment. If you got a tax bill when you were expecting a refund, try our TurboTax W-4 Calculator at TurboTax.com.

Make sure you print a copy before deleting screen 9465. On the EF screen, check the 9465 only box. In the Select Form section, check the 9465 box. If IRS Payment Record is present in the return, then Form 9465, line 8, ‘PaymentAMT,’ must be equal to ‘PaymentAmount’ in IRS Payment Record. If there are no other message pages, only the 1040 appears when the return is selected for e-file, but the 9465 is sent with the 1040. You can also verify this on the EF Status page in view mode. This applies starting in Drake19.

Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Satisfaction Guaranteed — or you don’t pay. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Our legal right to ask for the information on this form is sections 6001, 6011, 6012, 6109, and 6159 and their regulations. We will use the information to process your request for an installment agreement. The reason we need your name and social security number is to secure proper identification. We require this information to gain access to the tax information in our files and properly respond to your request. You aren’t required to request an installment agreement. If you do request an installment agreement, you’re required to provide the information requested on this form.

Each month, we will send you a notice showing the remaining amount you owe, and the due date and amount of your next payment. But if you choose to have your payments automatically withdrawn from your checking account , you won’t receive a notice. Your checking account statement is your record of payment. We will send you an annual statement showing the amount you owed at the beginning of the year, all payments made during the year, and the amount you owe at the end of the year. Attach this form to the front of your form 1040 if you are sending the form immediately when filing your taxes.

Video: What Is Irs Form 9465 Installment Agreement Request?

He submits Form 9465 with his return and establishes a 36-month installment payment plan. If the federal funds rate is 3%, the IRS will charge Fred a 6% interest rate on the outstanding balance. Individuals who should also call instead of filing Form 9465 include those who are in bankruptcy and want to make an offer-in-compromise.