If you don’t use a separate phone or phone line while working, you can still claim a percentage of your personal phone expenses as a business deduction. And like all good tax deductions, all you need to do is keep track of those receipts.

So whether it’s Uber, Lyft, or another rideshare, any 1099 Form you receive should list all of the fees and commissions that were taken out of your fares. If you opt for paperless tax documents, you can also find that information in your driver dashboard or online account. And there’s no reason you should pay taxes on money you didn’t receive. At Picnic Tax, we connect you to experienced online accountants who can make sure your tax returns are complete, claiming all of the deductions for which you are eligible. This means that you can deduct your business expenses in order to determine your actual income from ridesharing. There are specific tax deductions that are particularly important when paying Lyft or Uber taxes because you rely so heavily on the use of your car. A growing number of people across the country are bringing in extra income as drivers for ridesharing apps like Uber or Lyft.

Taxslayer Support

The mileage deduction will likely be your largest tax deduction. It’s important to carefully track your miles because the IRS requires a mileage log.

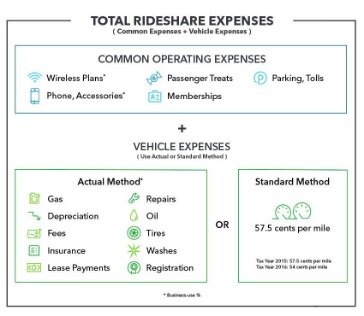

If you want to claim a deduction based on the standard mileage rate, you must do so in the first year you use your car for business. In later years you can choose to switch back and forth between the methods from year-to-year without penalty. You might decide to itemize specific costs in later years if your vehicle costs get unusually high. You may also want to deduct other expenses like snacks for passengers, USB chargers/cables, or separate cell phones for driving. If you don’t take these deductions, more of your income will be subject to income and self-employment taxes. Learn how to file like a pro — hear from Lyft drivers and our partners at Everlance. In 2019, the IRS set its standard mileage reimbursement rate as $.58 per mile.

Since Uber reports this income information directly to the IRS, you don’t have to include the actual 1099 forms with your tax return. Schedule C can also be used to list your business-related expenses. It also might be the first time you’ve had to report self-employment income on your tax returns. Follow these tips to report your Uber driver income accurately and minimize your taxes. Other work-related expenses such as drinks and snacks you buy for riders are also deductible. You can deduct the standard mileage rate or actual expenses, whichever method produces more savings to you, but you can’t do both.

Whether you pay rent or own your home, a portion of those expenses are tax deductible. Since you have to drive your own car for work, your car expenses are tax deductible. That’s why it’s so important to stay on top of expense tracking!

If discussions of standard deductions, depreciation methods, mileage tracking, IRS mileage rates, and business expense tracking makes your head spin, don’t be concerned. You don’t have to be a math genius, tax lawyer, or a CPA to track mileage like a professional, there are apps for that on both the Android and IOS platforms.

Tax Bracket Calculator

Even if you don’t receive the 1099-NEC, you’ll likely still have to file taxes. Drivers who earned at least $20k and had 200 total transactions from passengers in the past year. Even if you don’t receive the 1099-K, you’ll likely still have to file taxes.

The main thing that sets it apart is its ability to integrate with your Uber, Lyft, Postmates, Instacart, Lyft, and Uber Eats accounts. It can pull your income data from each and show you tax estimates. This tax calculator feature is something that other apps just can’t match. That being said, the free version does lack some helpful features like automatic mileage tracking. To get the auto-track function, you’ll need to pay $7.99 per month for the Premium version.

You need the car for your work, so you can write off a portion of those costs in proportion to your business use of the car as you drive for uber. You can calculate your estimated tax rate each quarter with form 1040-ES, and then you’ll use the complete form 1040 to report your income on your final yearly return. You’ll specifically use 1040 Schedule C to report the profit or loss from your rideshare business activity. Each Lyft and Uber driver has to file their own tax return as an independent, self-employed individual. Some recent California laws have mandated that rideshare companies employ drivers directly.

Dependents Credit & Deduction Finder

Discover 14 easy Lyft and Uber tax write-offs you can take advantage of. Let’s break that down—when Uber and Lyft issue 1099-K forms to drivers, these forms include ALL of the money passengers paid—including Uber or Lyft’s cut . Uber requires its drivers to produce an approved vehicle inspection and background check. While they are both similar in that they reduce the amount of tax you owe, the method in which they go about it differs. While tax deductions work to lower the income you are taxed on, tax credits work to lower the amount you are being taxes dollar for dollar.

This might include a trip to the bank to make a business-related deposit, or to a retail establishment to purchase supplies. The IRS can make you forgo the deduction if you don’t keep a mileage log. You can also find more information at the IRS Small Business and Self-Employed Tax Center.

- Apps can make tracking tax deductions much simpler, especially when tracking mileage.

- Although you don’t get reimbursed for the miles you drive by the company you work for, the IRS does allow you to write your driving costs off as a business expense.

- The 20% deduction is phased out if your income exceeds these limits.

- Alternatively, the standard mileage deduction offers a flat rate of compensations based on every mile traveled.

This deduction is taken on your Form 1040, not your Schedule C. Deducting it in the wrong place can cause problems for you during an audit. When you’re headed into tax season, try to avoid sticker shock when you’re told you’ll need to pay extra to report your rideshare income. In reality, you can deduct your mileage on the way to the first passenger, between passengers, and on the way home at the end of the day. As an independent contractor, you are responsible for paying these taxes. This is why it is important to work with a tax advisor who specializes in the sharing economy. Self-employed taxes also provide an above the line deduction.

If you made more than $600 in non-driving income like bonuses, referral fees and other awards, you may also receive a 1099-MISC to cover this income. It is important to understand that you need to report your income even if it does not rise to the level of receiving a 1099 form.

It’s meant for both independent contractors like Uber and Lyft drivers as well as for employees who need to track their mileage expenses so that their employer can reimburse them. It allows you to track an unlimited number of trips, calculate fuel economy, and even track other expenses. The only downside to the free version is that it does not include automatic mileage tracking.

This is a great way to know the exact locations as it will be listed out for you. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Steven Melendez is an independent journalist with a background in technology and business. He has written for a variety of business publications including Fast Company, the Wall Street Journal, Innovation Leader and Ad Age.

How To Claim Tax Write Offs

You’re also responsible for sending quarterlyestimated taxesto the IRS as someone who makes their living through independent contract work. Again, this is something the employer would handle if you work as an employee. You would only pay half of those Social Security and Medicare taxes if you’re an employee—your employer would pay the other half. If you took your car in for maintenance or saved the receipts from the gas station, you will want to keep the records for reference so that you can figure out your total mileage.