Content

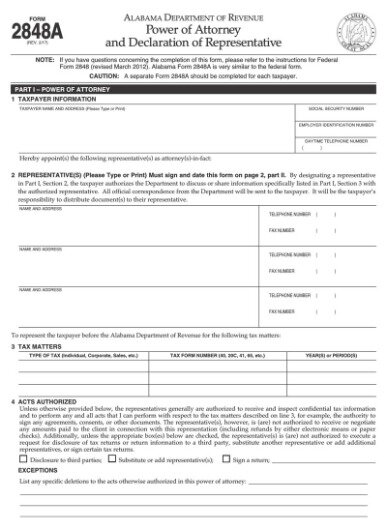

Signing the form does not grant authority to do everything when it comes to your taxes on your behalf. At the same time, the IRS isn’t able to share that information with others either. The agency can only share it with a third party if you authorize it to do so. You may, for example, hire a tax attorney to represent you in an audit. Read on to understand what signing Form 2848 allows someone representing you to do. If you need help dealing with an IRS notice, you don’t have to handle it on your own.

An additional fee applies for online. State e-file not available in NH. Additional state programs are extra.

- Completing the CAPTCHA proves you are a human and gives you temporary access to the web property.

- We want to ensure that you are kept up to date with any changes and as such would ask that you take a moment to review the changes.

- This includes copies of tax return transcripts and IRS notices.

- A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

Description of benefits and details at hrblock.com/guarantees. Requesting your tax transcripts is the best way to research your IRS tax account.

Revoking A Power Of Attorney

There are a number of reasons this type of representation may be necessary. Maybe your client is out of the country during tax season or they are limited in their ability to communicate because of a medical condition. Maybe you represent a corporation or individual with unresolved tax debt.

State e-file available for $19.95. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

Enter the name in the Power of Attorney name field. Once these two pieces of information are entered, the 8453 will appear in View mode. mailed to the IRS with Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return. This process uses a Paper Document Indicator , to alert the IRS that you will mail a supporting document after the e-filed return is accepted. Form 2848 is available in all return types in Drake Tax. Set a time for one of our product specialists to give you a guided tour practice.

You can also authorize your tax pro to communicate with the IRS for you. Small Business Small business tax prep File yourself or with a small business certified tax professional. Something went wrong while submitting the form. Cool features, outstanding customer service, constantly updating to make it better. I love that I can upload files easily to a secure client portal and we don’t have to email files anymore.

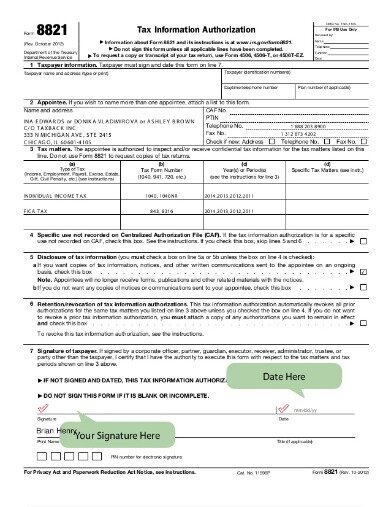

Form 2848 And Form 8821

Submit this form, and we will be in touch soon to give you a custom demo. We are committed to the security of your data. Canopy uses 128-bit encryption to secure personal information and stores all sensitive data using Amazon Web Services. An audited SOC2 report is available upon request.

OBTP# B13696 ©2018 HRB Tax Group, Inc. How long do you keep my filed tax information on file? How do I update or delete my online account? A successfully filed 2848 also gives a tax professional the authority to receive confidential tax information for their client, including tax returns, transcripts, and IRS notices.

Filing Form 2848 does not revoke the authority to see tax information that you gave by filing Form 8821. This might be the case if you apply for a mortgage and need to share your tax information with the lender, for example. Endorse or negotiate a refund check, or direct that a refund be deposited electronically into the agent’s account. Signing Form 2848 and authorizing someone to represent you does not relieve a taxpayer of any tax liability. Form 2428 allows tax professionals, such as an attorney, CPA or enrolled agent, to represent clients before the IRS as if they were the taxpayer.

You may authorize a student who works in a qualified Low Income Taxpayer Clinic or Student Tax Clinic Program to represent you under a special appearance authorization issued by the Taxpayer Advocate Service. Use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS.

Most state programs are available in January. Release dates vary by state.

A PIN is unnecessary because the printed form is signed by the taxpayer. IRS form 2848 is designed to give attorneys, CPA’s, and enrolled agents authority to receive confidential tax documents and represent their client before the IRS. Form 4506 is an IRS document that is used to request exact copies of prior years’ tax returns. Federal law requires the IRS to keep confidential all of the information that you supply on your tax return.

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards. Emerald Card Retail Reload Providers may charge a convenience fee. Any Retail Reload Fee is an independent fee assessed by the individual retailer only and is not assessed by H&R Block or MetaBank®. Emerald AdvanceSM, is subject to underwriting approval with available credit limits between $350-$1000. Offered at participating locations.

Additional qualifications may be required. Enrollment restrictions apply.

Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. Valid for an original 2019 personal income tax return for our Tax Pro Go service only.

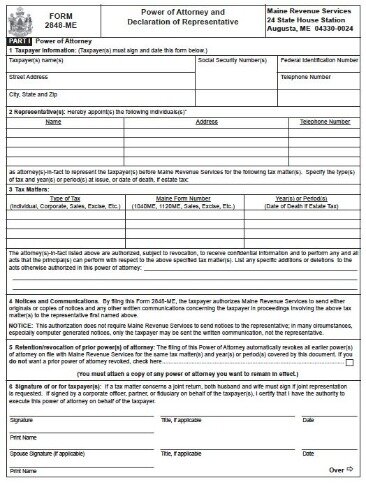

How To Get Power Of Attorney

H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice.

It’s important to realize that you can’t simply sign a return for that person. Form 2848 cannot be e-filed and there is no provision for using a PIN on Form 2848 at present.

More In Forms And Instructions

For starters, you need to be your parent or loved one’s power of attorney or court-appointed conservator or guardian. Then you’ll need to include Form 2848 when filing a federal tax return for that person. If you are the financial caregiver for a parent, grandparent or other family member, you likely are in charge of filing that person’s tax return.

H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns. Available only at participating H&R Block offices. H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

Learn the three main benefits of engaging a power of attorney to research your IRS account and resolve your tax problems. Get the facts from the experts at H&R Block. Authorized individuals can include attorneys, certified public accountants, enrolled agents, general partners, full time employees, family members, and others. A Power of Attorney allows a third party to represent you before the IRS. The authorized individual can advocate, negotiate, and sign on your behalf. They can argue facts and the application of law. POAs can receive copies of notices and transcripts of your account.