Without depreciation, a company would incur the entire cost of an asset in the year of the purchase, which could negatively impact profitability. Accumulated depreciation is dependent on salvage value; salvage value is determined as the amount a company may expect to receive in exchange for selling an asset at the end of its useful life. Since the salvage value is assumed to be zero, the depreciation expense is evenly split across the ten-year useful life (i.e. “spread” across the useful life assumption). Suppose that a company purchased $100 million in PP&E at the end of Year 0, which becomes the beginning balance for Year 1 in our PP&E roll-forward schedule. Starting from the gross property and equity value, the accumulated depreciation value is deducted to arrive at the net property and equipment value for the fiscal years ending 2020 and 2021.

- The balance rolls year-over-year, while nominal accounts like depreciation expense are closed out at year end.

- Like most small businesses, your company uses the straight line method to depreciate its assets.

- Now, let’s calculate the depreciation expense for Asset B by using the Diminishing or Declining Method.

- Company ABC purchased a piece of equipment that has a useful life of 5 years.

For example, Company A buys a company vehicle in Year 1 with a five-year useful life. Regardless of the month, the company will recognize six months’ worth of depreciation in Year 1. Under the sum-of-the-years digits method, a company strives to record more depreciation earlier in the life of an asset and less in the later years. This is done by adding up the digits of the useful years and then depreciating based on that number of years. In our PP&E roll-forward, the depreciation expense of $10 million is recognized across the entire forecast, which is five years in our illustrative model, i.e. half of the ten-year useful life. Alternatively, the accumulated expense can also be calculated by taking the sum of all historical depreciation expense incurred to date, assuming the depreciation schedule is readily available.

Where Is Accumulated Depreciation Recorded?

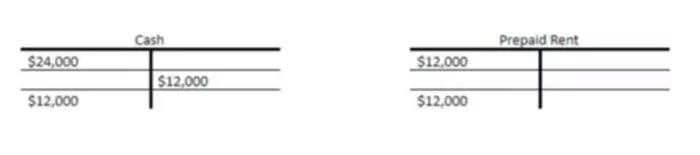

Each year, check to make sure the account balance accurately reflects the amount you’ve depreciated from your fixed assets. Accumulated depreciation is recorded in a contra asset account, meaning it has a credit balance, which reduces the gross amount of the fixed asset. Accumulated depreciation is a repository for depreciation expenses since the asset was placed in service. Depreciation expense gets closed, or reduced to zero, at the end of the year with other income statement accounts. Since accumulated depreciation is a balance sheet account, it remains on your books until the asset is trashed or sold.

Fixed assets also do the same things; they are reported at the net of accumulated depreciation in the balance sheet at the end of the specific date. We will also discuss how the accumulated depreciation is calculated for these two methods. Subsequent years’ expenses will change based on the changing current book value.

Depreciation Expenses: Definition, Methods, and Examples

An asset’s carrying value on the balance sheet is the difference between its historical cost and accumulated depreciation. At the end of an asset’s useful life, its carrying value on the balance sheet will match its salvage value. In most cases, fixed assets carry a debit balance on the balance sheet, yet accumulated depreciation is a contra asset account, since it offsets the value of the fixed asset (PP&E) that it is paired to. Small businesses have fixed assets that can be depreciated such as equipment, tools, and vehicles. For each of these assets, accumulated depreciation is the total depreciation for that asset up to and including the current accounting period.

It is credited each year as the value of the asset is written off and remains on the books, reducing the net value of the asset, until the asset is disposed of or sold. Depreciation expense is considered a non-cash expense because the recurring monthly depreciation entry does not involve a cash transaction. Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations. The methods used to calculate depreciation include straight line, declining balance, sum-of-the-years’ digits, and units of production. Your accounting software stores your accumulated depreciation balance, carrying it until you sell or otherwise get rid of the asset.

Understanding Accumulated Depreciation

In order to calculate the depreciation expense, which will reduce the PP&E’s carrying value each year, the useful life and salvage value assumptions are necessary. Depreciation is a non-cash expense representing allocating an asset’s cost over its useful life. It is reported on the balance sheet as a contra-asset account, reducing the value of the corresponding asset. By subtracting the book value, determined by deducting accumulated Depreciation from the asset’s cost, businesses can accurately assess the financial outcome of the sale. It provides a realistic representation of the asset’s worth in the company’s financial statements.

Accumulated depreciation is nested under the long-term assets section of a balance sheet and reduces the net book value of a capital asset. Once purchased, PP&E is a non-current asset expected to deliver positive benefits for more than one year. Rather than recognizing the entire cost of the asset upon purchase, the fixed asset is incrementally reduced through depreciation expense each period for the duration of the asset’s useful life. Total accumulated depreciation at the end of the period is not generally reported in the face of financial statements. For year five, you report $1,400 of depreciation expense on your income statement. The desk’s net book value is $8,000 ($15,000 purchase price – $7,000 accumulated depreciation).

Accumulated Depreciation

It is presented on the balance sheet, typically as a deduction from the corresponding asset. Depreciation expense, which contributes to the accumulation of Depreciation, is included in the operating activities section of the statement of cash flows as a non-cash expense. This calculation aids in evaluating the financial impact of asset transactions and assists in strategic decision-making. The book value represents the remaining value of an asset after accounting for accumulated Depreciation. If there is no opening of accumulated depreciation, then the ending balance is equal to the amount charged during the year. For the next of years, we apply the same percentage on the booked of written down value of the asset, but the value of the percentage is not given in the data we have.

Accumulated depreciation is a contra asset that reduces the book value of an asset. Accumulated depreciation has a natural credit balance (as opposed to assets that have a natural debit balance). However, accumulated depreciation is reported within the asset section of a balance sheet. Under the double-declining balance (also called accelerated depreciation), a company calculates what its depreciation would be under the straight-line method.

A Small Business Guide to Accumulated Depreciation

The accumulated depreciation account is a contra asset account on a company’s balance sheet. Accumulated depreciation specifies the total amount of an asset’s wear to date in the asset’s useful life. Depreciation expense is recorded on the income statement as an expense or debit, reducing net income.