Content

Forms being received now will refer to RMD requirements in 2016 and list your IRA balance as of December 31, 2015. You can potentially score a tax break for the previous tax year as long as you make a contribution to a traditional IRA before Tax Day. So if you open an IRA by December 31, don’t forget to find out whether you can deduct that contribution on your tax return that’s due in April. Only employers can claim a tax deduction for the SEP-IRA and SIMPLE IRA contributions listed on Form 5498. If you own your own business, there are rules regarding how much you can deduct. Having a SEP-IRA may limit your ability to claim a deduction for making traditional IRA contributions. Box 1 – located on the right side of the form – will list the total amount of contributions you’ve made to a traditional IRA.

- Generally, contributions the taxpayer make to their Archer MSA are deductible on Form 8889 and employer contributions are excluded from the employee’s income and are not deductible by the taxpayer.

- You should be able to calculate how much you contributed over the previous year.

- If you’re still in your working years, chances are you received a Form 5498 because you contributed to your IRA at some point during the year.

- So you don’t lose out on that opportunity to save, the IRS lets you repay those distributions you withdrew.

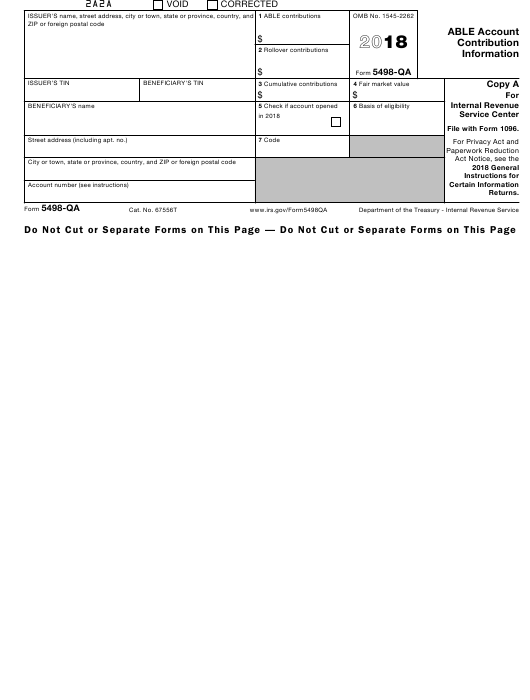

- The 5498 tax form is used to report contributions to your Roth IRA, traditional IRA, SEP IRA and/or SIMPLE IRA accounts.

None of this information is typically entered onto the tax return from this Form 5498 and instead is entered from other source documents, specifically a Form 1099-R or other records. Moreover, this form is not typically available to the taxpayer until after April 15th and is not used to prepare the tax return.

American Equity Investment Life Insurance Company® does not offer legal, investment, or tax advice. Workest is here to empower small business with news, information, trends, and community. The outlook for SMBs is beginning to brighten and many business owners are thinking about how to grow in the coming year. Audits are part of a necessary SBA process, so don’t panic if your business gets selected for one. Each week, we bring you stories and trends that impact small business owners and their workforce. Streamline onboarding, benefits, payroll, PTO, and more with our simple, intuitive platform.

What Is Tax Form 5498?

You might also want to make sure that the administrator has your correct address and that you did indeed make contributions in that tax year. Form 5498 reports IRA contributions, including those made to SEP-IRAs, Roth IRAs, inherited IRAs, and SIMPLE IRAs. Whether you can take the full deduction allowed depends on your filing status, income, and whether you or your spouse are covered by a retirement plan at work. Assume you had a flush year and so threw an extra $3,000 into your IRA. If $9,000 is reported in Box 1 of Form 5498, your deduction is still limited to $6,000 unless you’re age 50 or older, in which case it’s limited to $7,000. These limitations are subject to change periodically to keep up with inflation, but apply to tax year 2020 and are scheduled to apply to 2021 as well.

Tax form 5498— you know it, you probably don’t love it, but do you understand it? The IRS seems to use it, but it’s an unclear form full of codes and terms the average investor doesn’t really know.

On the right, you’ll see your actual IRA information listed. Your IRA firm is actually supposed to fill out two copies of the 5498 tax form.

Completing Form 5498

It is required to be sent by June 1 following the year to which the contributions relate. Taxpayers don’t have to include a copy of the form when they file taxes but should keep it with their tax records. Form 5498 lists contributions made to IRAs for the tax year of the form . Reporting applies for traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and deemed IRAs.

If you’re claiming a tax deduction on your tax return, you can use Form 5498 to verify that it’s the same as the amount you thought you contributed. Then you can figure out how much to deduct based on the kind of IRA you have, your filing status, your annual income and whether or not you have a retirement account at work.

Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books. There are limits on the amounts reported in box 1 of Form 5498 that you can deduct each year. If you’re unsure what type of IRA you have, your account administrator may indicate whether it’s a traditional, Roth, SIMPLE or a Simplified Employee Pension in box 7. Your IRA trustee or issuer—not you—is required to file this form with the IRS, usually by May 31.

Why Is There A Check In Box 11 Of Form 5498?

In that case, you can do a so-called “backdoor Roth” where you convert money from a traditional IRA into a Roth IRA. If you opt for this shell game, this is where you’ll see it reported. When you take money out of a retirement plan before you retire, that distribution may be subject to federal income tax. Putting that money into another retirement plan — a move that’s called a rollover — can help you avoid those tax implications. The 5498 tax form might look more official than your old school report card, but it’s not too complicated. On the left side, you’ll see your personal information, account information and information for the IRA trustee or issuer.

When you start taking withdrawals, you then need to report the appropriate amounts as income on your tax return and pay the appropriate amount of income tax, if necessary. This form reports the contributions and/or rollover amounts paid into a traditional IRA, Roth IRA, SEP IRA or Simple IRA for the previous calendar year as well as other relevant tax information.

Box 13: Postponed

Contribution information for all other types of IRAs must be provided by June 1, 2021. Many people just invest in the stock market through individual stocks, index funds and mutual funds for their IRAs. But if you have some other type of investments, such as real estate, nontradeable option contracts or ownership of another business, those will be reported here. Occasionally, the government lets you withdraw money from your IRA if you’re facing a hardship situation. This might happen, for example, if you’re in the military reserve and you get called up for duty — the so-called “qualified reservist” exception. So you don’t lose out on that opportunity to save, the IRS lets you repay those distributions you withdrew. If you took advantage of this opportunity, you’ll see those numbers reported here.

iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). If Box 11 is checked, this is where you’ll find the information about how much to take out and when. Box 12b will tell you how much you need to take out, and Box 12a will tell you the deadline for withdrawing it. If you don’t withdraw the specified amount by the deadline date, you will have to pay a hefty penalty tax — 50% of the amount not withdrawn. If you paid premiums for life insurance last year, you may have calculated your IRA deduction by subtracting part of those premiums from the amount you’re allowed to contribute to your IRA. If that’s the case, the amount to subtract appears in this box.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992. Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092. The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances. Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC.Equal Housing Lender. Individual Income Tax Return and IRS Publication 590, Individual Retirement Arrangements , give additional information on reporting requirements for your IRA. By May 31, you’ll receive a separate Form 5498 from Pershing, LLC (the custodian for TIAA-CREF Brokerage IRAs).

You should not submit Form 5498 along with your income tax return. The IRS will receive its own copy of the form from your IRA trustee. If you need Form 5498, your trustee must send it to you by May 31.