Content

Even if not, the increased basis can limit the taxable portion of the sale price. The credits were good through 2016, except for the solar credits which are good through 2019 and then are reduced through the end of 2023. One of the best ways to lower your taxes is to take advantage of energy tax credits by installing qualified energy generating systems. But the deduction amounts must be reasonable, given their medical purpose, and expenses incurred for aesthetic or architectural reasons cannot be deducted. There are a number of ways that you can use home renovations and improvements to minimize your taxes. In the event you operate an enterprise at home or lease part of your house to someone else, you might be qualified to discount a part of your home’s adjusted basis via depreciation. In the event you do so, whenever you sell the property, you can’t leave out the sum of depreciation you took under the $250,000/$500,000 profit exclusion break.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Barring any unforeseen circumstances, Best Egg loans have a minimum term of 36 months and a maximum term of 60 months. We encourage everyone to consult a tax professional for all of their tax questions. For more information on tax implications and homeownership, visit IRS.gov. Monica Dillon has more than 10 years experience in real estate sales, marketing, investing and appraising.

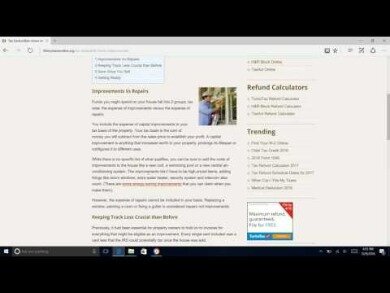

Any upgrades you’ve made to your home’s plumbing system qualify as a deductible home improvement. For example, if you’ve added a septic system or a water filtration system, these would qualify. A water conserving toilet or a piping system upgrade would qualify, however. If you’ve upgraded your boiler for one that’s more energy efficient include it as a deduction. If you’ve lived in your house for many years, and area housing prices have been gradually going up over all those years, a portion of your gain on sale could be taxable.

How To File Taxes Online Using H&r Block

But for tax purposes, plenty of other upgrades will serve to increase your capital improvements, including upgraded appliances and home additions. You might not get quite as big of a return, but you will add to the pool of profit that the IRS can’t touch. As you’ve probably noticed, a majority of the most valuable home improvements are centered on the exterior of your property. What makes these improvements such value drivers is that they have the biggest returns—meaning you recoup the most amount of money in direct comparison to what you spend. Home improvements, on the other hand, are things that you do to your home to increase its value. The goal with home improvements it to increase the market value of your property through changes that make it better than it was before.

And the best way to do that is to make sure that you safely store all receipts related to associated expenditures, and that you keep them organized so you can easily pull them out when you need them. This is especially true for capital improvement gains, since it may be many years before you get the tax benefit.

Prepare a separate file to keep all invoices and details for all upgrades that you make to your property. But that big of an exemption is probably not sufficient to protect the gain in a property that you’ve owned a long period of time. Once you make a home improvement, like putting in central air conditioning, installing a sun-room, or upgrading the roof, you are not able to deduct the expense during the year you spent the funds. Learn more about your options to save on taxes in Nolo’s section on Homeowners Tax Deductions and Tax Credits. For tax purposes, a home improvement includes any work done that substantially adds to the value of your home, increases its useful life, or adapts it to new uses. These include room additions, new bathrooms, decks, fencing, landscaping, wiring upgrades, walkways, driveway, kitchen upgrades, plumbing upgrades, and new roofs.

Using Your Mortgage To Make Home Improvements

There’s no need to turn off the computer in disgust and walk away just yet. Although the cost of regular, humdrum improvements isn’t deductible on your return, there really are some clever ways to recoup a few of your home costs by knowing the ins and outs of a tax return. From energy efficiency upgrades to improving the parts of your house you use as a home office, we might just find a deduction for the work you’ve put into your place. The way you pay for home improvements, could be the way to save on your taxes. If you’re planning on making improvements on a home you bought this year, you may be able to roll the expense into your mortgage.

As a homeowner, you might be asking yourself, are home improvements a tax deduction? Either way, you will need to track your expenses for any home improvement. These credits apply to improvements like solar panels, wind turbines, fuel cells, geothermal heat pumps, and solar-powered water heaters. The solar credits, though, were extended to 2019 and then are available on a reduced basis until 2021. There are both tax credits and deductions that can be taken when the purchase was made or afterwards. Usually, you can’t expect to deduct anything from your Federal tax return just because you decided to make changes to your home. The term, amount and APR of any loan we offer to you will depend on your credit score, income, debt payment obligations, loan amount, credit history and other factors.

Home Renters Improvement Tax Deduction

If you opt to factor in depreciation, you will not be able to exclude the depreciation amount you took under the gain exclusion tax break. However, any repairs you made to the portion of the home used for business or rental purposes may be tax deductible. Either way, it is still good practice to keep the receipts because for high-income taxpayers and real estate investors adding home improvements can have a big impact on the tax basis. This tax deduction cannot be used when you spend the money, but they can be used to reduce your taxes in the year you decide to sell your house. Whenever you make a home improvement, such as replacing the windows or installing a brand-new HVAC system, you may be able to use those investments to claim a home improvement tax deduction. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc.

Here’s an overview of how home improvements can affect your taxes. As with property taxes, you can deduct the interest on your mortgage for the portion of the year you owned your home. Want a full rundown of all the deductions (as well as tax exemptions or other write-offs) at a home seller’s disposal? You should only file for deductions if you kept the certification statement issued by the manufacturer.

- If you plan well, you could qualify for some of the benefits listed below.

- For sales tax deductions, you’ll also need to maintain the same receipts.

- Her work has also appeared in the “Journal Of Progressive Human Services.”

- Whenever you make a home improvement, such as replacing the windows or installing a brand-new HVAC system, you may be able to use those investments to claim a home improvement tax deduction.

- From energy efficiency upgrades to improving the parts of your house you use as a home office, we might just find a deduction for the work you’ve put into your place.

While some of the tax benefits for energy efficiency improvements expired in 2013, there are a couple of ways to reduce your energy footprint while getting a bit of tax savings. Not every home renovation can be written off on your taxes but there are some clever ways that home improvements can provide tax benefits. If you make repairs to a qualifying home office—for example, if you fix the wiring on a burned out light fixture—that repair is deductible as a business expense. As it stands, you can deduct 100% of the money you spend on making repairs to your home office, though again, to do so you must meet the standard qualifications for the home office deduction. Remember, TurboTax Deluxe can help you find every tax deduction and credit you’re entitled to, including those related to improving your home.

He has written tax and finance related articles for twelve years and has published over 1000 articles on leading financial websites. Make a special folder designed for the receipts and records relevant to your property. If you inherited the property, you should also keep the records of your parents and grandparents. To determine the size of the profit, your goal should be to increase the basis as much as possible. This does not only include the purchase price, but any additional fees involved in buying the home. If you have lived in a home for two of the past five years before the sale, the first $250,000 of profit is tax-free if you happen to be a single taxpayer.

Renovation of a home is not generally an expense that can be deducted from your federal taxes, but there are a number of ways that you can use home renovations and improvements to minimize your taxes. These include both tax deductions and tax credits for renovations and improvements made to your home either at the time of purchase or after. Although not directly related to renovations, it’s important for homeowners to remember that they can deduct their property taxes on their returns. Now, remember that property tax isn’t going to show up on your W-4; usually, folks include their property tax in mortgage payments, so only the bank or lender is handling the money. But if you itemize your deductions, it’s certainly worthwhile to add your property tax payments from the given year to your write-offs. For those folks who need to make home improvements or adjustments to accommodate a disability or medical condition, you’ll be pleased to know that the government offers a bit of tax relief for your project. If you need to make changes to your home to improve access or to alleviate exacerbating medical issues, you can absolutely deduct the costs on your tax return.

If you use your home purely as your personal residence, you cannot deduct the cost of home improvements. For example, you will be unable to add a repaired windowpane, painting a room, or fixing a gutter onto your tax basis. Other types of capital improvements include storm windows, an additional water heater, an intercom, and home security systems.

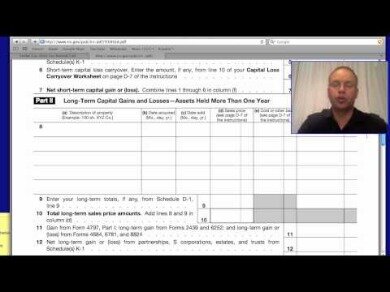

Your tax basisis the amount you’ll subtract from the sales price to determine the amount of your profit. Finally, look for the rules of this exemption to possibly change in a future tax bill.

Although you can’t deduct home improvements, it is possible to depreciate them. This means that you deduct the cost over several years–anywhere from three to 27.5 years. To qualify to depreciate home improvement costs, you must use a portion of your home other than as a personal residence. Home improvements are the most common way homeowners increase their basis. However, your home’s basis does not include the cost of improvements that were later removed from the home. For example, if you installed a new chain-link fence 15 years ago and then replaced it with a redwood fence, the cost of the old fence is no longer part of your home’s basis.

What About Other Home Related Deductions?

The realtor.com® editorial team highlights a curated selection of product recommendations for your consideration; clicking a link to the retailer that sells the product may earn us a commission. To make matters a tad more complicated, those figures changed once again in 2020, increasing to $12,400 for individuals, $18,650 for heads of household, and $24,800 for married couples filing jointly.