Content

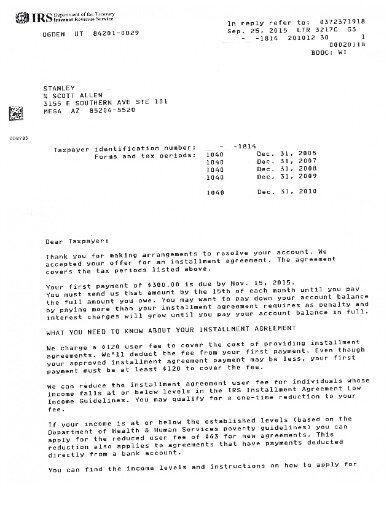

Taxpayers may be able to schedule an appointment at a Taxpayer Assistance Center (“TAC”). At the appointment, the IRS employee can generally provide account transcripts, tax return transcripts, and basic tax information. Once the tax balance is obtained the next step is to analyze which payment plans are available. IRS installment agreements or payment plans are generally available to most taxpayers.

Interest and late payments will continue to accrue. When you owe taxes, your best option typically will be to work directly with the IRS rather than hiring a tax settlement company. Although plenty of firms claim they can reduce your tax debt or stop wage garnishment, the Federal Trade Commission warns that most taxpayers won’t qualify for the programs they advertise.

Financial Services

The IRS payment plan interest rate is lower than the penalty interest rate charged for not paying your tax bill. You’ll be charged a reduced 0.25% interest during the installment agreement. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied.

Receiving a tax due notice from the IRS that you owe taxes can be stressful. Fortunately, you have the option to resolve the debt by taking action to pay off your taxes by arranging a repayment plan. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500.

- The tax identity theft risk assessment will be provided in January 2019.

- The answer may not be one-size-fits-all but there is still an answer.

- Refer to the IRS’ Booklet 656-B, “Offer in Compromise” , for details on the application procedure.

- If you did not receive the letter option for online access but you received an urgent IRS notice about a balance due or problem with your payment plan, please call us at or .

- The short-term plan allows you to repay your taxes within 120 days.

Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Currently not collectible status can allow you to defer paying your tax bill for a time, if you qualify. Learn how to get CNC status from the experts at H&R Block. Learn about the IRS option to “settle” tax debt, called the offer in compromise. Lots of factors can affect the type of installment agreement you qualify for, and the one that best meets your needs.

Standard ability To Pay Installment Agreement

Likewise, if you are self-employed, you must be current on your quarterly estimated tax payments for the current year. Finally, if you have employees, you must be current on payroll tax deposits and Form 941 filings to get an IA.

You (and your spouse if you’re married) haven’t filed a late return or paid late in the previous five years. You can set up a short-term or long-term plan, depending on whether you can afford to pay the IRS within 180 days. You may also be eligible for an offer in compromise, or OIC, where the IRS agrees to settle your debt for a reduced amount. This isn’t an option if you’re currently in bankruptcy. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. You generally will not have to pay a failure-to-file or a failure-to-pay penalty.

tax transcript, Identity Protection PIN or another online payment agreement, you probably can log in with the same user ID and password. For more information on how to deal with the IRS to work out a payment plan, see Stand Up to the IRS, by Frederick W. Daily .

$10,000, $25,000, And $50,000 Or Less Owed

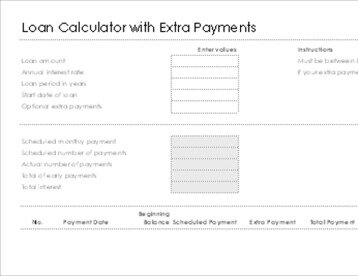

That is, the IRS will ask you what you can afford. However, if you’re on a long-term payment plan, you must choose a payment amount that will pay off your debt within 72 months. There are different IRS payment plans, and you can get on an installment plan on your own — maybe even for free.

Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit.

With this installment agreement, you’ll generally be allowed to have expenses over the IRS financial standards. That means your monthly payment may be less, but you’ll still have to pay your full tax balance within six years, or by the collection statute expiration date . Can’t afford to pay your income taxes?

This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

On Form 433-A, you’ll have to provide detailed information on your investments, assets, income and bank accounts. With a streamlined plan, you have 72 months to pay. For balances above $10,000, you may have to provide additional information in order to qualify. If not using direct debit, then setting up the plan online will cost $149. The IRS will ask you what you can afford to pay per month, encouraging you to pay as much as possible to reduce your interest and penalties.

Even if you get an extension, you still have to pay at least 90% (80% for eligible 2020 returns) of your balance due to avoid a late tax payment penalty. Receive a copy of your penalty details results via email. You will also receive helpful tips on how to file on time or pay taxes owed. If you do hire a tax-relief company to help you settle your debt, you may have to give it power of attorney to apply for an IRS payment plan on your behalf. And proceed with caution, as the Federal Trade Commission warns on its website. an online tool that lets you change your monthly payment amount, change the monthly due date, sign up for automatic withdrawals and reinstate a payment plan you’ve fallen behind on. However, that works only if you’re not making payments through direct debit.

Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice.

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details. If H&R Block makes an error on your return, we’ll pay resulting penalties and interest. Emerald Cash RewardsTMare credited on a monthly basis.

Pay

The next step toward being able to calculate your minimum IRS payment amount is determining how much you owe the IRS. For taxpayers that only owe for one tax year this is easy, simply reference the most recent IRS tax bill. For others, it can be time consuming to uncover the total amount owed. However, recent strides have been made that streamline the process of gathering tax information with the IRS. They can then take advantage of the variety of payment options that the federal government provides.