The IRS free online tool guides you through completing the application and files it for you. You’ll receive an email alert when your application has been submitted. These are religious-based organizations whose members pledge to pay one another’s medical bills. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

And don’t worry about knowing the health care laws for taxes.TurboTax has you covered and will help you easily report your health care status when you file your taxes. Insurance providers have been required to send out 1095-B forms since the 2015 tax year. Some people covered by employer-sponsored insurance might receive a copy of a similar form, the 1095-C, rather than the 1095-B. This form provides substantially the same information to taxpayers as the 1095-B but it is generated by large employers who have 50 or more full time employees. Depending on how their employers’ coverage is set up, some taxpayers may even receive both tax forms. The Affordable Care Act is designed to ensure everyone has health insurance and imposes tax penalties on those who don’t. But the law recognizes there are legitimate reasons people may be exempt from this rule.

They are also barred from obtaining health insurance through the online insurance marketplaces set up under the Affordable Care Act. The Affordable Care Act, or Obamacare, is an individual mandate that requires all eligible Americans to have some form of basic health coverage. For tax years prior to 2019, those without insurance will receive a penalty when they file their tax returns – that is, unless they have an exemption. Currently, there are about 30 reasons someone may be exempt from penalty for not having health insurance. Those who have medical expenses they couldn’t afford don’t have to pay the penalty. For example, low-income individuals who aren’t required to file an income tax return don’t have to pay the penalty.

However, insurers and lawmakers feared that this would produce a situation in which many people wouldn’t buy health insurance at all—until they got sick. • Members of recognized religious groups that object to insurance for religious reasons. The objection must be to all forms of insurance, including social insurance programs such as Social Security and Medicare, not just health insurance or Obamacare. The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice.

Estimate Your Income

For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Leave out information on your unmarried partner if that person doesn’t require health insurance. Any children belonging to your unmarried partner, unless they are your dependents, are not included. Parents and relatives who live with you but are not considered dependents should be excluded as well.

On the other hand, if the amount paid to your insurer actually exceeded your credit, you would have to pay back the difference with your tax return. Whichever option you choose for taking the Premium Tax Credit, you claim it by filing Form 8962 with your tax return.

What Qualifies As Minimum Essential Coverage?

Your insurer can also tell you whether your plan provides minimum coverage. Beginning in 2019, the shared responsibility payment will no longer be assessed. 2.5 percent of your household income above the threshold of your filing status. Tax penalties for lack of coverage began accruing in 2014, and they were to phase in over a three-year period. Taxpayers are penalized for lacking coverage for themselves and for their dependents. The Interior Department currently recognizes 566 Native American and Alaska Native groups.

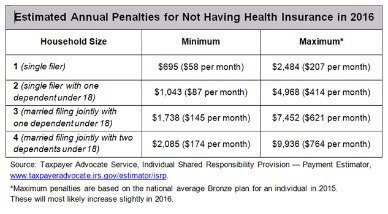

In fact, an estimated 20 million Americans may qualify to waive the tax penalty this year. The penalty you pay for not having health coverage is either a dollar amount or a percentage of family income, whichever is greater. But to stay in business, a health insurance company needs to collect more money in premiums than it pays out in benefits, and that means healthy people have to buy insurance, too. That’s where the individual shared responsibility provision comes in. For the law’s first year, 2014, the law set the annual penalty at $95 per adult and $47.50 per child, up to a maximum of $285 per family—or 1 percent of family income, whichever is greater. For 2015, the penalty was set at $325 per adult and $162.50 per child, up to a maximum of $975 per family—or 2 percent of family income, whichever is greater.

If you bought your plan there, you should get a Form 1095-A, also called the “Health Insurance Marketplace Statement.” The IRS also gets a copy of the form. The form provides information about your insurance policy, your premiums , any advance payment of premium tax credit and the people in your household covered by the policy. If penalties are not paid with your tax return, they can be withheld from tax refunds in the current year or, if a taxpayer has a balance owing, from refunds in future years. Changes to income may alter your eligibility for health coverage subsidies for existing qualified coverage. New U.S. citizens are also eligible for enrollment at any time under qualifying life event provisions.

The start of your health care coverage depends on when you enroll. To navigate the Health Insurance Marketplace, you have to know what you want from a health plan. Have your previous plan handy to make comparisons, as well as household and income information. If this is your first health plan, be aware of your needs and know your tax situation. Eligibility depends on the size of your family and combined income from all sources. The ACA introduced an annual contribution cap limit of $2,500 for Flexible Spending Accounts . Contributing to an FSA through your employer’s plan allows you to divert pre-tax income, resulting in lower taxable income for a tax year.

You still have time to enroll for health insurance for 2017. The credit is based on your household income and number of people in your family. In many cases, the credit enables you to have health insurance at a lower cost than paying the penalty, so don’t miss out on checking out healthcare.gov or your state Marketplace during open enrollment.

Like any other tax, it’s deducted from your refund or added to your balance owing. However, unlike other outstanding taxes, the IRS is limited in the actions it can take to recover health insurance fees. See “Are You Exempt From Health Care Coverage?” to help determine whether you might be eligible to waive the tax penalty entirely and apply for a health care exemption. “Your income determines any tax credits you may be eligible for, such as the premium tax credit that can help with the cost of your insurance,” advises Bill Symons, president of Computer Accounting Systems in Oswego, N.Y. “Be sure to include any and all sources of income you receive. And, add the total income from your spouse if you file jointly, along with your dependents who earn enough to file a return.”

Tax Tips From Turbotax

If you are uninsured for only part of the year, the penalty is prorated to cover only your uninsured months. You’re not assessed a penalty for a gap in coverage less than three months long. This is called a “short gap.” However, you are only allowed one short gap per year. For 2014, the penalty was set at 1 percent of income or $95 per uninsured adult and $47.50 per uninsured child under 18 . Penalties for 2015 rise to 2 percent of income or $325 per uninsured adult, and in 2016 the rates climb to 2.5 percent of income or $695 per uninsured adult.

No tax filing requirement—having an income below the Internal Revenue Service’s filing threshold exempts you from the coverage requirement. Unaffordable care—if minimum coverage would cost more than 8 percent of your household income, you may qualify for an exemption. An employer-sponsored plan, including retiree insurance and healthcare continuation under the Consolidated Omnibus Budget Reconciliation Act. If you used your credit to reduce your premiums, Form 8962 will tell you if you have any of the credit left over, in which case you could use it to reduce your taxes.

There is no health insurance penalty for 2019, so it does not ask. You only have to enter a 1095A if you had Marketplace insurance . Her success is attributed to being able to interpret tax laws and help clients better understand them. Lisa also has been a TurboTax product user for many years and understands how the software program works. In addition to extensive tax experience, Lisa also has a very well-rounded professional background. She has held positions as a public auditor, controller, and operations manager. Prior to becoming the TurboTax Blog Editor, she was a Technical Writer for the TurboTax Consumer Group and worked on a project to write new FAQs to help customers better understand tax laws.

Get Your Maximum Tax Refund With Turbotax Today

Congress changed the penalty for not having health insurance to $0, and TurboTax moved the entry screens. If you have a 1095-A you will still need to enter it in the program. Wasted my time filing early when they can’t accurately fill them out. I shouldn’t have to be a tax expert to file my taxes without extra hassle.

- Those who have health insurance that meets the standards of the law may receive Form 1095-B directly from their health care insurer and from employers who have less than 50 full-time employees .

- The Affordable Care Act prohibits health insurers from denying people coverage based on their medical history—for example, because they have a pre-existing condition or a family history of a particular ailment.

- The penalty rates increased each year until 2016, after which penalties have been indexed with inflation.

- If you’re uninsured, using the IRS free online tool now to determine whether you qualify for an exemption is a smart decision.

- Unaffordable care—if minimum coverage would cost more than 8 percent of your household income, you may qualify for an exemption.

- Use the credit to reduce your insurance premiums in advance when you pay the insurance premiums.

Use the credit to reduce your insurance premiums in advance when you pay the insurance premiums. Your income has to be within a certain range to qualify for the Premium Tax Credit. That income range is between 100% – 400% of the federal poverty level. As of 2020, the federal poverty level for most of the United States was $12,490 for a single person. Government health care plans such as Medicare Part A, Medicare Advantage, Medicaid, the Children’s Health Insurance Program, Tricare for military members, veterans medical benefits and plans for Peace Corps volunteers.

She could also be seen helping TurboTax customers with tax questions during Lifeline. For Lisa, getting timely and accurate information out to customers to help them is paramount. The penalty for 2017 is 2.5% of your total household adjusted gross income, or $695 per adult ($347.50 per child), whichever is higher (with a maximum of $2,085 adjusted for inflation). For instance, a family of 4 making $70,000 would would pay $2,085.