Content

And if you use a spot in your home exclusively for work, you can take the home office deduction (Full-time workers who are telecommuting do not get that tax break). If you do itemize deductions, and those write-offs include donations, be aware that the IRS knows how much taxpayers at various income levels typically donate. So if your charitable-contribution deduction is high relative to your income or in comparison to your income peers, look out.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. In Section 11 B of the Central Excises Act, 1944 which is also applicable in the cases of Service Tax . A dependent is a person who entitles a taxpayer to claim dependent-related tax benefits that reduce the amount of tax the taxpayer owes. If you had to travel away from home on a temporary assignment for your work, you may be able to deduct related travel expenses.

The IRS sends out refunds within a few weeks after receiving your return; the process is faster if you e-file. A U.S. federal law signed in 1996 contained a provision that required the federal government to make electronic payments by 1999. Treasury Department paired with Comerica Bank to offer the Direct Express Debit MasterCard prepaid debit card. The card is used to make payments to federal benefit recipients who do not have a bank account. Tax refunds, however, are exempt from the electronic payments requirement. However, many U.S. states send tax refunds in the form of prepaid debit cards to people who do not have bank accounts. Something that every taxpayer should take into account is whether or not they should itemize deductions.

Reducing Taxes Owed With Credits

Learn about the best online tax software you can use to file this year, based on fees, platforms, ease-of-use, and more. The government wants to make sure that it gets its cut of your money before you have a chance to spend it. This is why your employer is required to withhold tax from your paycheck. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

For example, the EITC is worth as much as $6,660 for a family with three or more children or up to $538 for taxpayers who do not have a qualifying child. With changes to income and other life events for many in 2020, tax credits and deductions can mean more money in a taxpayer’s pocket and thinking about eligibility before filing can help make tax filing easier. At the start of the following year, you prepare a tax return to figure out how much tax you actually owed for the previous year. On the return, you add up all your income from wages, investments, self-employment and other sources. For tax years up until 2017, you can subtract personal exemptions.

Can I Include Social Security Withheld As A Deduction?

A change in income could make a person eligible for the Recovery Rebate Credit. For example, some people may have received less than the full Economic Impact Payments because their incomes were too high in 2019 and they can claim the Recovery Rebate Credit based on 2020 income. Economic Impact Payments are commonly referred to as stimulus payments. Economic Impact Payments were based on a taxpayer’s 2018 or 2019 tax year information. The Recovery Rebate Credit is similar except that the eligibility and the amount are based on 2020 information on a person’s tax return. To avoid refund delays, taxpayers should file a complete and accurate return that includes any unemployment compensation received in 2020. If you have a business or you operate as an independent contractor, the IRS allows you to deduct legitimate expenses against your income.

You can even claim exemption from taxes if you have valid grounds to do so. If you have had a more than necessary amount of taxed withheld from your regular paycheck, you will receive a refund after filing your tax return. Itemizing deductions allows some taxpayers to reduce their taxable income, and thus their taxes, by more than if they used the standard deduction. Tax-deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income.

Most early EITC/ACTC filers should see an update to WMR by February 22. If you work as a freelancer, or don’t receive a regular paycheck from your employer, you’re not subject to federal withholding. Instead, you pay estimated taxes in quarterly installments in April, June, September and January. If your estimated payments are higher than the tax you owe, then you will receive a refund of the difference after filing a return. Alternatively, you can also claim zero allowances for maximum withholding or ask that additional money be withheld from the check, if you expect to owe taxes on other income. For example, if your spouse is self-employed, you can arrange for additional withholding from your own paycheck to avoid the inconvenience of your spouse making quarterly estimated tax payments.

Most taxpayers either hope to pay as little income tax as is legally possible or try to receive the most money back on their income tax return. However, when tax season comes around, some taxpayers have not researched how they can minimize their income taxes. It’s possible that they may end up paying more in taxes than is required by the Internal Revenue Service . A tax return is a form or forms filed with a tax authority that reports income, expenses, and other pertinent tax information. Tax returns allow taxpayers to calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

The Sections Of A Tax Return

Child and dependent care credit is a non-refundable tax credit for unreimbursed childcare expenses paid by working taxpayers. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. In addition, you may be able to deduct some or all of the student loan interest that you paid. Taxpayers are eligible to deduct up to $2,500 of student loan interest. However, this deduction cannot be claimed if you are married but don’t file jointly, or if you or your spouse are claimed as a dependent on someone else’s return.

LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS. The Tax Counseling for the Elderly program offers free tax help for all taxpayers, particularly those who are 60 years of age and older.

The bottom line is that you should never try to cheat on your taxes, experts say. For example, as with any business you operate, your personal cell phone probably isn’t used exclusively for professional reasons. Only the portion used for business counts as an expense for tax purposes. Again, though, if you have the documentation to back up your business expenses, you should be in the clear if the IRS does reach out for proof. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors.

The IRS recommends that you complete a new W-4 annually or whenever your life circumstances change, to prevent having tax deducted at an unrealistic rate. You can request a tax refund from the government by filing an annualtax return. This document reports how much money you earned, expenses, and other important tax information. And it will help you to calculate how many taxes you owe, schedule tax payments, and request a refund when you have overpaid. In general, the IRS paid interest on individual 2019 refunds on returns filed by July 15, 2020. The interest covered the time from April 15, 2020 until the date of the refund.

- The process determines whether you owe additional taxes beyond what you’ve already paid, or if you’re owed a refund of the taxes that have been withheld.

- Those things fall short of an official audit, which the IRS generally gets three years to initiate after the challenged return is filed.

- “Rentals seem to be where folks try to write off a lot of cash expenses, but they can’t really prove the expenses if they are audited,” Collins said.

- In some cases, taxpayers may be eligible for a refund even if there were no taxes withheld from their income for the year as a result of these tax provisions.

- Some people may find that they’re newly eligible for certain tax credits, such as the Earned Income Tax Credit or the Recovery Rebate Credit.

The IRS cannot answer refund status inquiries unless it has been 21 days since the tax return was filed electronically. That 21-day time frame begins on February 12 or when the IRS accepts the tax return, whichever is later. on IRS.gov or the IRS2Go app for a personalized refund date as soon as 24 hours after the tax return is electronically submitted.

You may also need to make estimated tax payments if you expect to owe $1,000 or more when you file. This might happen if you are sole proprietor or partner in a business, or if you are a gig economy worker. The IRS cannot answer refund status inquiries unless it has been 21 days since a taxpayer filed a tax return electronically. Also, taxpayers should take into consideration the time it takes for the financial institution to post payments to an account or to receive a check in the mail. Most financial institutions do not process payments on weekends or holidays, which can also affect timing for any payments.

How To File Taxes As An Independent Contractor

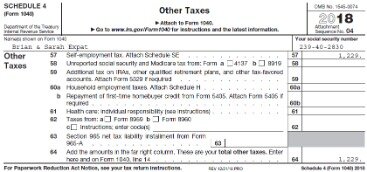

The Social Security tax is calculated as 6.2% of your earnings, and the Medicare tax is calculated as 1.45% of your earnings. Before you’ve even begun to pay your income taxes, 7.65% of your income has been withheld. That’s because your employer isn’t just withholding for federal income tax. They’re also withholding for Social Security tax, Medicare tax, and state income tax. Income deferral is another way to increase this year’s refund, while providing for yourself down the road. Qualified retirement accounts are a common way to accomplish this.

Refund anticipation loans are a common means to receive a tax refund early, but at the expense of high fees that can reach over 200% annual interest. Now more than ever, the IRS urges people to check and see if they qualify for credits and to claim them when they file. People can use the IRS Interactive Tax Assistant to help determine if they’re eligible to claim certain credits and deductions. Individuals must file a federal income tax return — even if they aren’t otherwise required to file — and specifically claim certain credits. Under the federal tax system, your employer withholds money from each paycheck and sends it to the IRS to pay the taxes that you owe for the current year. When you file a return the following year, you calculate how much tax you owe for the entire year, using deductions, exemptions and credits to lower the bill. If you’ve paid too much, you get a refund; the amount of the refund depends on your particular circumstances.

Most businesses – and all employers – need an Employer Identification Number, or EIN, in order to file taxes. Armed Forces have special tax situations and benefits – including access to MilTax, a program that generally offers free tax return preparation and filing. We offer tax information for members of the military to help you understand how those provisions affect you and your taxes, whether you are active duty, reserve, or veteran. If you e-file your tax return, you will usually receive your tax refund within 3 weeks of the date we receive your return – even faster if you choose to have your refund deposited into your bank account.

On that form, you indicated the amount of taxes that needed to be withheld from each paycheck. But for many taxpayers, there is a light at the end of the tunnel in the form of a tax refund.

Individuals are encouraged to use the IRS interactive tool – Are Payments I Receive for Being Unemployed Taxable? – and answer questions about unemployment benefits to help them determine if they’re taxable. Sign Up NowGet this delivered to your inbox, and more info about our products and services. “If you claimed one child last year and this year you claim four, it might get attention from the IRS,” Collins said. “Of course, it could be true — you could have married someone with three children.”

IRS Free File & How to Get Free Tax Preparation or Free Tax Help in 2021 by Tina Orem Here’s where to get free tax software, free tax preparation and free tax help this year. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. , which are a record that some entity or person — not your employer — gave or paid you money. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

Those things fall short of an official audit, which the IRS generally gets three years to initiate after the challenged return is filed. On top of figuring out how Covid relief might affect their return, those complications could result in more taxpayers making mistakes and hearing from the IRS, experts say. And depending on the specifics, it could mean a smaller refund or a larger amount due than anticipated. A tax refund or tax rebate is a payment to the taxpayer when the taxpayer pays more tax than they owe.

Taxpayers may itemize deductions or use the standard deduction for their filing status. Once the subtraction of all deductions is complete, the taxpayer can determine their tax rate on their adjusted gross income .