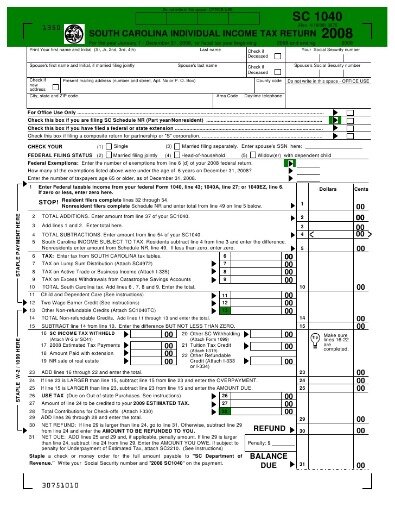

The form determines if additional taxes are due or if the filer will receive a tax refund. Please include your name, address, a contact number and the last four digits of Social Security number on all correspondence. Be sure to include your full Social Security number on tax returns. If you do not already have Adobe Acrobat Reader installed on your computer, you will need to do so in order to view tax forms, instruction guides, and other .PDF files on our Web sites. Visit any of our taxpayer service offices to obtain forms.

(See the instructions for Form 1040 for more information on the numbered schedules.) For Schedule A and the other lettered schedules, see Schedules for Form 1040. Used to request a taxpayer identification number for reporting on an information return the amount paid. Taxpayers in certain situations may need to file a different variant of the 1040 form instead of the standard version. Taxpayers who receivedividendsthat total more than $1,500, for example, must file Schedule B, which is the section for reporting taxable interest andordinary dividends. Form 1040 needs to be filed with the IRS by April 15 in most years. You are being directed to a third party site to submit this form electronically. By clicking continue you consent to being directed to this third party site.

Please read the Electronic Record and Signature Disclosure you must agree to in order to proceed to understand how the information you provide will be treated by this third party. If you have already agreed to this disclosure, you can view the statement under the “Other Actions” tab. File my taxes as an Indiana resident while I am in the military, but my spouse is not an Indiana resident. If you are having difficulties to open any of the forms with the viewer (e.g. MAC PDF Preview) or browser (e.g. Google Chrome/or Edge), please do the following. The following instructions explain how to download a file from our Web site and view it using ADOBE Acrobat Reader.

You have incurred a delinquent tax liability that has resulted in an assessment. Local Tax Rate Changes – For tax year 2019 Caroline County has increased its rate to 3.2%. If you are a nonresident, you must file Form 505 and Form 505NR.

“Victims of Texas winter storms get deadline extensions and other tax relief.” Accessed Feb. 25, 2021. The new tax legislation eliminated many deductions, including for unreimbursed employee expenses, tax-preparation fees, and moving for a job . Married filing jointly, $1,300 for each spouse who is 65 or older or blind. To purchase Virginia Package X , complete and mail the Package X order form. If you are working with DOR on an active case and need access to a Tax Amnesty 2015 form, pleasecontact DOR. The Office of Tax and Revenue Walk-In Center, at th Street, SW, is closed.

Tax Bracket Calculator

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Form 1040-A of the Internal Revenue Service was a simplified version of current Form 1040, and used by U.S. taxpayers to file an annual income tax return. This form is used to figure and pay estimated quarterly taxes. The estimated tax applies to income that isn’t subject to withholding, which includes earnings from self-employment, interest, dividends, and rents.

You can also print out the form and write the information by hand. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process. You can also file your Maryland return online using our free iFile service. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Most taxpayers use Forms 1040, 1040A or 1040EZ to report their taxable income to the IRS each year prior to 2018.

Due to heavy submissions volume and tax season opening two weeks later than usual, ADOR technical staff are actively working towards accepting and processing individual income tax returns as soon as possible. We will inform you when your return has been accepted for processing. Thank you for your patience and we apologize for any inconvenience. Below you will find links to individual income tax forms and instructions from tax year 2010 through the current year. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

Special Tax

If you encounter this problem, you must first download and save the file to your computer before viewing it. Upon saving the file to your hard drive, you may view the file by opening it with the Adobe Acrobat Reader software. We are no longer automatically sending you a paper coupon booklet for Sales and Use Tax returns. You can file your Sales and Use tax returns through our bFilesystem. If you would like to continue receiving paper coupons you can request them by e-mailing or you can mail your request to Comptroller of Maryland Revenue Administration Division P.O. Box 1829 Annapolis, MD, 21404. Your residency status largely determines which form you will need to file for your personal income tax return.

The form also asks about full-year health coverage and whether the taxpayer wishes to contribute $3 to presidential campaign funds. The 1040 form for the tax year 2020, to be filed in 2021, includes two pages to fill out. Have more time to file my taxes and I think I will owe the Department. If you don’t have enough assets or income to pay the full amount, you must include with Form MD 656 a complete financial statement, Form MD 433-A for individuals and/or Form MD 433-B for businesses. You must be current with respect to all returns filed or required to be filed to the Comptroller’s Office.

If you have an older operating system, platform or browser, or are having problems downloading older forms, you may download older versions of Adobe Reader from the Adobe Web site. Please verify that you satisfy all of the eligibility requirements above before completing the required forms. If this relates to a business tax, the business must have been closed for at least two years. You either are without resources or unable to apply present and/or future resources to paying the outstanding tax liability. Two years must have passed since you became liable for all taxes due.

You should file Form PV only if you are making a payment with your extension request. If you’re working as an employee, your employer is required to send you a W-2 form by the end of January in following the tax year.

If you operate a business as a sole proprietor, you must attach a Schedule C to separately report your business earnings and deductions. Regardless of the form, you must fully report your income and deductions on one of them. Below is a general guide to what Schedule you will need to file.

Form 1040nr

Form 1040 is the standard Internal Revenue Service form that individual taxpayers use to file their annual income tax returns. The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will receive a tax refund. The new 1040 uses what the IRS terms a “building block” approach and allows taxpayers to add only the schedules they need to their tax return. Many individual taxpayers, however, only need to file a 1040 and no schedules.

Use Shift + Tab to accept the field change and go to the previous field. Please see Where to File For Form 1040 the for the latest filling address for current and prior filing years. Use this form to apply for an employer identification number .

If you lived in Maryland only part of the year, you must file Form 502. When you are finished filling out the form, use your mouse to select an area of the form outside of a form field before printing your form. If the fill-out form is displayed within your web browser’s window be sure to use the print button on the Acrobat toolbar menu to print the form instead of your web browser print function. Use the Tab key to accept the field change and go to the next field.

Employers must file a Form W-2 for each employee from whom Income, social security, or Medicare tax was withheld. You may file Form 140 only if you are full year residents of Arizona.

The hand cursor will allow you to move the form around on your screen when you click and drag. When you position the hand cursor on the form and click, the I-beam cursor will appear. The I-beam cursor allows you to select a field, a check box, a radio button, or an item from a list. Use this form to order a transcript or other return information free of charge, or designate a third party to receive the information.

Individual

If you are a nonresident and need to amend your return, you must file Form 505X. When you click on your selected form, the file will open in Adobe Acrobat and you will see a cursor that is shaped like a hand.

Form 1040 is used by U.S. taxpayers to file an annual income tax return. Annual income tax return filed by citizens or residents of the United States. Note that in light of the winter storms that hit Texas in February 2021, the IRS has shifted the deadline for individual and business tax filings—as well as tax payments—from April 15, 2021, to June 15, 2021. Everyone who earns income over a certain threshold must file an income tax return with the IRS . If you need to make certain changes to your original Maryland return that has already been filed and processed, you must file Form 502X for 2019 to amend your original tax return. If you owe additional Maryland tax and are seeking an automatic six-month filing extension, you must file Form PV along with your payment by April 15, 2020.

The days of waiting for the IRS to mail you the tax forms you need to complete your return are long gone. Now it’s possible to access your forms and to complete your entire tax return on your computer using sophisticated income tax software. For example, TurboTax offers user-friendly software that allows you to quickly prepare your tax returns. The software can even e-file your return which reduces the amount of time you have to wait to receive your refund.

- The form contains sections that require taxpayers to disclose their taxable income for the year to determine whether additional taxes are owed or whether the filer will receive a tax refund.

- Have more time to file my taxes and I think I will owe the Department.

- This website provides information about the various taxes administered, access to online filing, and forms.

- You may file Form 140 only if you are full year residents of Arizona.

- The form also asks about full-year health coverage and whether the taxpayer wishes to contribute $3 to presidential campaign funds.

Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. You must have the Adobe Acrobat Reader 4.1 , which is available for free online.

Employers who withhold income taxes, social security tax, or Medicare tax from employee’s paychecks or who must pay the employer’s portion of social security or Medicare tax. Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax. If a filer makes a mistake or forgets to include information on any 1040 form, Form 1040X is used for making changes to previously filed 1040s. Form 1040 prompts tax filers for information on their filing status, such as name, address, Social Security number (some information on one’s spouse may also be needed), and the number of dependents.

However, if your income was less than $100,000, you take the standard deduction and you done have any dependents, you may be eligible to use the simpler Form 1040EZ prior to 2018. This is a statement accompanying a taxpayer’s payment for any balance on the “Amount you owe” line of the 1040 or 1040-NR. Similarly, those who want to claim itemized deductions on their 1040 have to complete Schedule A. The IRS also has several worksheets to help taxpayers calculate the value of certain credits or deductions. A filer also needs to report wages, salary, taxable interest, capital gains, pensions, Social Security benefits, and other types of income.