Content

You can go to the IRS website and they have a tax withholding estimator where you can figure out what you should be withholding. I recommend going this route to figure out what to withhold, according to the IRS it’s the most accurate.

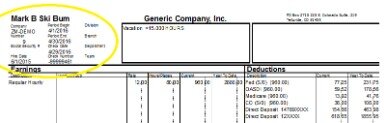

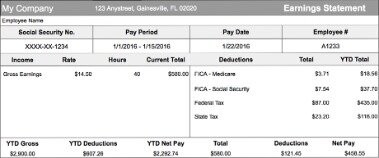

Some people get monthly paychecks , while some are paid twice a month on set dates and others are paid bi-weekly . The frequency of your paychecks will affect their size. The more paychecks you get each year, the smaller each paycheck is, assuming the same salary. A financial advisor can help you understand how taxes fit into your overall financial goals. Financial advisors can also help with investing and financial plans, including retirement, homeownership, insurance and more, to make sure you are preparing for the future.

You Are Leaving H&r Block® And Going To Another Website

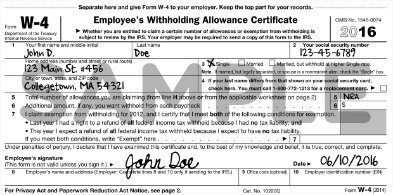

If you determine that you are eligible to claim exempt status, you can do so on line seven of Form W-4 by simply writing “exempt” in the space provided. It’s about how much of your hard earned money you will get to keep in 2021 and not get back again in 2022 as a tax refund.

Use the free 2021 W-4 Calculator for this. Simply estimate your income, dependents, tax deductions, and tax credits for 2021 when estimating the 2021 Tax Return. Based on these results, adjust your paycheck withholding – up or down – for the pay periods in 2021. The new 2020 and 2021 W-4 Form no longer has Allowances.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your company’s health plan, you can see the amount that is deducted from each paycheck.

Why Does My Employer Withhold So Much From My Paycheck?

You’ll probably qualify to increase your withholding allowances. Note, however, that you can claim only the number of allowances to which you are entitled. You can’t claim lots of allowances you don’t qualify for simply because you don’t want to have taxes withheld. The United States has a “pay as you go” federal income tax.

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. If you have a family member in prison, tax time may be complicated.

Audit services constitute tax advice only. H&R Block prices are ultimately determined at the time of print or e-file.

Tax Bracket Calculator

That’s where our paycheck calculator comes in. Use SmartAsset’s paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes.

The other option is to offer to pay in monthly installments and send the first installment with your offer. You’ll continue to send monthly payments until you get word from the IRS that your offer has either been accepted or declined.

- We applied relevant deductions and exemptions before calculating income tax withholding.

- Claiming exemption from income taxes throughout the year is not the same as requesting taxes stop being withheld for personal reasons for a period of time.

- Here’s a discussion that Dave Ramsey had with a caller on his show recently about adjusting tax withholdings by updating your W-4.

- Then, compare that amount to the amount that’s withheld from your first paycheck of the year once you get it and make any necessary adjustments from there.

- There’s nothing like getting your first real paycheck.

The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money. The tax refund you may receive at the end of a tax year is not free money. When you receive a check or your direct deposited refund, you are receiving money that was rightfully yours to begin with. Optimize your withholding using our free calculators and keep more of your paycheck each pay period. Use that extra money to pay off any debts instead of relying on a big check in April.

You can ask your human resources department when you can sign up next, then use our calculator to see how much money you should set aside in a flex account. Say you make $40,000 this year and contribute $2,000 of your salary to your 401. Instead of owing taxes on the full $40,000, you’re taxed only on $38,000. Your 401 contributions are taken off the top before the government dips in.

You have to fill out this form and submit it to your employer whenever you start a new job, but you may also need to re-submit it after a major life change, like a marriage. As a wage earner, you determine the amount of money you ask your employer to take out or withhold from each paycheck or pay period as taxes or tax withholding with the W-4 Form. This amount is an important factor on whether you will owe taxes or get a tax refund when you e-File your next tax return.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Tools, such as withholding tax calculators, can help you figure out what to fill in on the various steps of Form W-4. You’ll have to answer questions about your tax situation before the calculator will tell you how to fill out your Form W-4.

But some people prefer to have more taken out of each check so they get a hefty refund in mid-April. They can then use that money for vacations or special purchases. To have more taken out, they simply enter fewer numbers on their W-4. You may not realize it, but you have a small amount of control over how much is withheld from each paycheck. The W-4 Form you completed when you started your job determines, in part, how much is taken out. The IRS directs taxpayers to a calculator to help guide them on what they should claim to get an accurate amount taken out of each check. However, if you want to have less withheld from your check, all you have to do is change the number of allowances you’re taking.

You’ll have to meet the IRS’s qualifications and make a proposal for how much you’ll pay, but if you’re approved, you’ll be able to offer the IRS a smaller amount than you owe. When you make your offer, you’ll have two options. The first is to submit an initial lump-sum payment equal to 20 percent of the initial offer amount. If your offer is then accepted, you’ll receive written notice.

The table is broken down based on your pay, the pay period (i.e. weekly, bi-weekly, semi-monthly), and the information on the Form W-4 you completed. Remember, these amounts—your withholding and your tax liability—are approximate. You’re close to where you need to be if they’re not too far apart. You’re free to change your withholding at any time during the tax year if a change in your circumstances would result in a tax increase or decrease. He previously worked for the IRS and holds an enrolled agent certification.

New Withholding Form

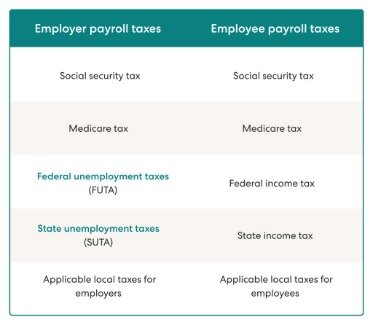

Few things are quite as disheartening as working long hours, only to see a big chunk of your hard-earned money taken out in federal and state taxes. While paying taxes is an inevitability for the majority of taxpayers, there are circumstances when workers can choose not to have federal and state taxes out. Because of the nature of tax law and requirements, it’s best to check with your state’s tax board, or a tax professional for more direction. Find common tax questions below accompanied by details answering them. Get a better understanding of how to withhold money from your paycheck each month and try to be as tax balanced as possible. Then, prepare your taxes with eFile.com and see how well your withholding practice worked out. Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee’s paycheck.

If you’re told you owe $5,000 due to your reduced withholdings during the year, you may find that you simply don’t have enough in the bank to pay it. In that case, the IRS urges you to file anyway. Failure to file comes with a much harsher penalty than failing to pay, so if you file now and pay later, you’ll be able to at least reduce the amount you’ll owe. The failure-to-file penalty is 5 percent of the amount you owe for every month your taxes are late.

However, there’s nothing safe about letting the IRS hold your money for a year or more completely interest-free. The small investment of time to make sure your income tax withholding is correct is well worth it.