Content

I work for a small law firm and just received the most amazing $25,000 bonus. This is why you’ll often get one paycheck with your salary and a separate paycheck with your bonus. At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. You also need to choose your state from the drop-down menu to generate the right amount of tax withholding for your area. As such, the bonus you issue to your employee will ultimately not be $1,000, but instead $1,000 minus $342.80, which equals $657.20. Product and service reviews are conducted independently by our editorial team, but we sometimes make money when you click on links.

If you issue bonuses via paychecks that are entirely separate from your employees’ usual paychecks, you withhold taxes at the federal 22% flat rate. If you add your employees’ bonuses to their next regularly scheduled paycheck, you use the aggregate method. We’ll explain more about each of these methods below. Regardless of the bonus tax withholding method you use on supplemental wages, please note that they are still subject to social security, Medicare, and FUTA taxes. Both methods require a little extra math, so we recommend using a payroll bonus calculator to make sure you’ve got your withholdings correctly calculated. The IRS says all supplemental wages should have federal income tax withheld at a rate of 22%.

I think people are getting confused with “Withholding” versus “Actual tax” being paid in April. It is true that the Withholding may be higher depending on how the company processes it, but at the end you pay the same amount of tax. I recently got a bonus and was worried, but when I checked my W2, Box 1 was just salary+bonus-deductions. So you are absolutely right, that the bonus actually gets taxed at the same Income Tax rate. Thanks for the clear and helpful answer to my question!

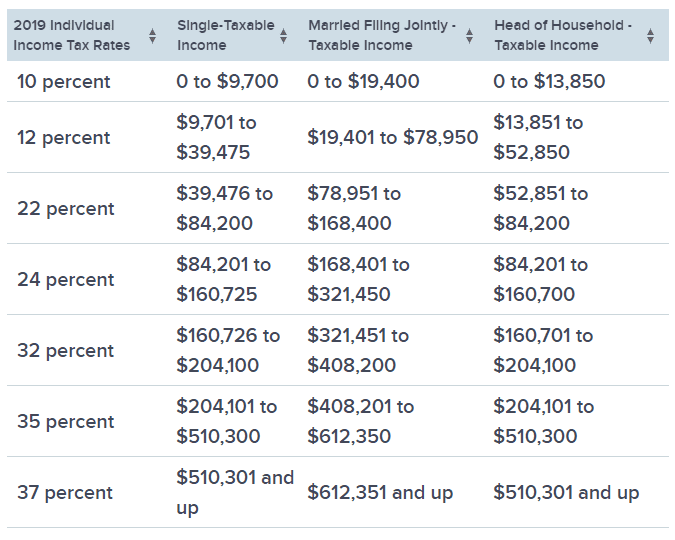

What Are The 2020 Federal Tax Brackets?

Next, multiply the gross amount by 7.65 percent to calculate Social Security taxes. Basically, the payroll software has decided to ‘start’ with the salary income and ‘finish’ with the bonus income. I just experienced this with my first “real” bonus and I was blown away by the 25% withheld. I’m a layman when it comes to this stuff…for the most part. So, whether it’s a withholding or a tax rate, it’s still a huge chunk of money that is going to the federal government and not my bank account. I’m one of the “bemoaners” that you mentioned and to me it’s all the same, just different terminology. Is there legislation that put this into place that could possibly be changed?

To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. Troubled by the idea of claiming and reporting a bonus on your taxes—or do you have general bonus tax questions? Use tax-filing products from H&R Block to help. If your employer will not provide a correction, you can still appropriately report your bonus for tax purposes.

He’s also published articles on payroll, small business funding, and content marketing. Line balance must be paid down to zero by February 15 each year.

Read on to learn how much tax you can expect to pay on your bonus—and for tips on reducing your tax liability. In this case, if your company is withholding your RSUs at 22% instead of a weighted blend of 32-35%, you’re going to end up needing to make up that difference at tax time.

This category of gifting is often referred to as “de minimis fringe benefits” and is excluded from your income. Signing bonus taxes would fall in the above category if received via cash gift. How long do you keep my filed tax information on file? If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account? What if I receive another tax form after I’ve filed my return?

What Is Your Bonus Tax Rate?

You should know that we do not endorse or guarantee any products or services you may view on other sites. For your protection, take a moment to carefully review their policies and procedures, as they may not be the same as those of H&R Block. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. estern Governors University is a registered trademark in the United States and/or other countries. H&R Block does not automatically register hours with WGU.

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation.

Report the wages shown on the 1099-MISC on line 1 of your Form 1040 and supply Form 8919 to report your uncollected Social Security and Medicare tax. The de minimis fringe benefit rules don’t apply to gifts of cash or cash equivalents. Therefore, the rules discussed above in the “cash bonuses” section apply to any gift of cash received by an employer. If you receive a non-monetary gift from your employer every year — a holiday ham, ornament, or even a theater or sporting event ticket — you likely will not be taxed on this gift.

If you don’t have enough tax withheld throughout the year, you may find yourself owing when tax time arrives and you file your tax return. The system is progressive, meaning your income could fall into more than one tax bracket and be subject to more than one rate. “Marginal tax rate” refers to the highest rate that applies to your income. Our flat bonus calculator can help you find the correct amount of federal and state taxes to withhold. Simply enter your employees’ gross bonus amount below and we’ll do the work.

All prices are subject to change without notice. What are the differences between real estate taxes and property taxes? Learn more from the tax experts at H&R Block. If an employer reports your bonus on a 1099-MISC, you should immediately request a cancellation of the 1099-MISC and a corrected W-2. Although a cash bonus may receive a different withholding treatment, it should still be reported on your W-2.

Your Form 1040 tax return would show an overpayment of taxes, just as it would if you overpaid through withholding from your regular wages. The IRS refunds any difference between the balance you paid in over the year and what your tax return determines that you actually owe. The total—your bonus plus regular wages—is subject to withholding just as though it was all your regular pay in this case. These two methods are used to calculate federal tax. Your bonus and any other supplemental wages you receive are subject to Social Security, Medicare, and FUTA taxes. The percentage method, also called the flat rate method, is the easiest way for employers to calculate taxes on a bonus. It often results in more money in your pocket, at least initially.

When you are paying employee bonuses, it is important to understand how they should be taxed. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply; seeAccurate Calculations Guaranteefor details.

Just as your employer holds back a portion of your regular paycheck to prepay your taxes, it must take money out of your bonus check, too. These funds are sent to the IRS on your behalf. This process is known as tax withholding. Employers pay bonuses to provide incentives for workers and to reward valued employees for superior performance. Many companies follow this practice because a bonus is a proven way to recruit, retain and motivate people. A bonus is money paid over and above an employee’s normal wages or salary. The Internal Revenue Service classifies bonuses as supplemental wages, similar to commissions.

Tax Treatment Of Huge Bonuses

But it does mean that you could see less of the cash from your bonus upfront. The percentage method is simplest—your employer issues your bonus and withholds taxes at the 22% flat rate—or the higher rate if your bonus is over $1 million. If you receive a very large bonus—over $1 million—some of it will be taxed at a higher rate. You’ll have 22% federal tax withheld on the first million, then 37% on bonus funds above the first million. Working hard all year to help your company meet its annual goals deserves a reward, and you’ve definitely earned that bonus. But bonuses count toward your income for the year, so they’re subject to income taxes.

Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. Our experts have been helping you master your money for over four decades.

Understanding how bonuses are taxed can help you be prepared when filing your income taxes. Now let’s say your employer pays you a generous 5% bonus during the tax year. That extra $1,950 increases your total income for the year to $40,950. But before you get too worked up, keep in mind that the 22% rate will only apply to the portion of your income over $39,475, which in this case would be $1,475. The calculation method your employer chooses, along with your tax bracket, determines whether your bonus gets taxed at a higher rate or at a rate lower than the one on your regular salary.

This can be avoided, but it’s a bit of a pain. If he knows when he will be paid a bonus, he can go in and manually adjust his W4 so a lower total percentage of income will be withheld in that pay period. This post is already super long, so I won’t go into detail on this, but it’s 100% possible, 100% legal, but also a 100% a hassle and for most people not worth bothering with.

On top of that 22%, you’ll need to deduct the typical Social Security and Medicare taxes and federal unemployment taxes . And the state tax rate for bonuses varies across the country, so make sure to select your state from the calculator’s drop-down menu to calculate state tax withholding correctly. Let’s again say your company operates in a Colorado jurisdiction with no local bonus tax. In this case, you calculate the federal bonus tax using the percentage method. Most, but not all, states assess taxes on bonuses.

In addition, many workers’ paychecks are subject to maximum federal income tax rates of 10 or 12 percent. At 22 percent, the bonus tax rate is higher and applies to the entire bonus amount with no exclusions. This is why it seems bonuses are taxed at higher rates. Supplemental wages also includes awards, prizes, severance pay, overtime pay, payment for accumulated sick leave and retroactive pay increases. All supplemental wages are taxed the same way as regular pay. When an employee files her tax return, supplemental wages are lumped together with regular pay and are subject to the same taxes and tax rates.

- Here’s an explanation forhow we make money.

- Optional Supplemental Flat tax rate is 22% for Federal & 6.6% for the State of California.

- The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

- Let’s again say your company operates in a Colorado jurisdiction with no local bonus tax.

- Additionally, in Maryland, you’ll need to add your local tax rate to the 5.75% state bonus tax rate before calculating how much state bonus tax you must withhold.

The author is clearly confused about the difference between withholding and the actual amount of taxes you pay. Since your employer may withhold more or less than the actual amount you will pay, this will get sorted out when you pay your taxes. If you look at any recent bonus payment, it’s highly likely you’ll see that your federal withholding on your bonus payment is exactly 22%.

Make Payroll A Breeze

Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage.