Content

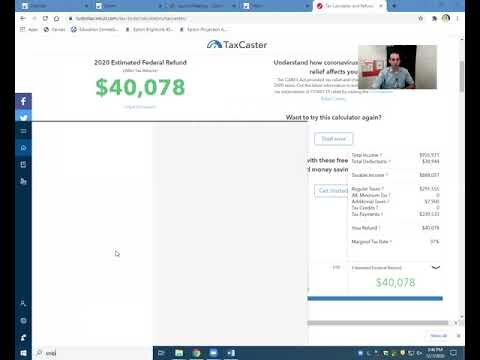

Too little paid in could result in a larger taxes due bill come tax season, and possible underpayment penalties. Too much paid in will put that extra cash in Uncle Sam’s pocket so that he gets all the interest earned on your overpayment instead of you. Below we also offer quick links to several options for calculating taxes including our simple tax estimator tool for fast results. A super great tidbit about the TurboTax TaxCaster is that this tax calculators doesn’t require any personal identity information.

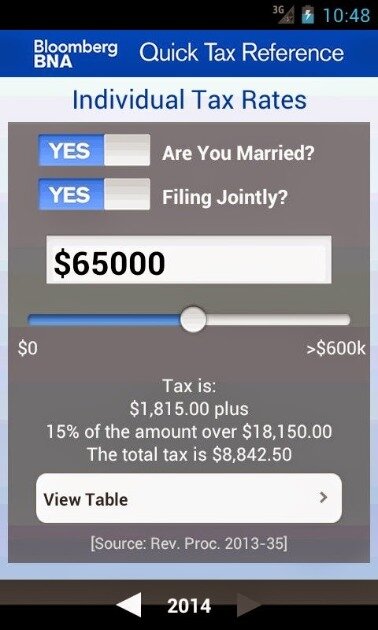

Adjust the sliders to match your taxable income, federal and state withholding and unemployment income, if any. Keywords & ASO Track keywords & positions in search results, monitor organic downloads and conversion rates, get high-level analysis of organic traffic, gain insights from ASO of your competitors. Downloads & Revenue Monitor downloads, re-installs, uninstalls, revenue, and refunds of your apps & games. Integrations Process critical app data on reviews, ratings, and ASO in email, Slack, Zendesk, Webhook, and 33 more services. The TurboTax TaxCaster downloadable app for your Smartphone operation offers real easy handling that keeps you from pulling your hair out. With easy slide-bar operation you can enter your tax data in a flash and go back to make adjustments as needed. If you aren’t entering all of your tax deductions, proper amount of withholding you’ve had deducted from you paycheck, or accurate income figures, obviously it won’t be that accurate.

Ratings & Reviews Performance For Taxcaster: Tax Calculator

To get a read on where you stand with the IRS and your taxes in order to plan better for setting aside funds needed to pay your taxes, or, planning on what to invest in with your refund. Take a look at our checklist for what’s needed when you sit down using TaxCaster to estimate income taxes and determine what Uncle Sam will be requesting from your piggy bank. Home ownership happens to be one of the most commonly applied form of tax deductions used in the United States. It offers a substantial variety of advantages for lowering your tax bill based on something that make your everyday living more comfortable and secure. Now we move on to the tax breaks screen to take advantage of opportunities available for lowering taxable income and taking advantage of deductions.

- Additional tax deductions in the TurboTax TaxCaster tax breaks screen section include charitable contributions, and IRA, retirement fund contributions.

- The TurboTax TaxCaster is only as accurate as the information you plug into it is.

- A super great tidbit about the TurboTax TaxCaster is that this tax calculators doesn’t require any personal identity information.

- The review screen will show you how your data has been tallied up and the result of those calculations.

- The TaxCaster start screen as seen here, walks you through a series of questions designed to get to the nuts and bolts of what personal tax filing status you should be using and what tax laws may effect you.

- Most income is taxable, whether you earn it or are paid as a return on your investment.

Enter miscellaneous income, Social Security benefits, interest, dividends and other requested income types. The account won’t have any apps, integrations or keywords, you will need to add everything from scratch.

Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. RestartEnter your and your spouse’s estimated or reported income from all jobs and income sources.

Taxcaster: Tax Calculator

It’s a super convenient feature to be able to see what’s ahead for tax planning purposes. The future forecast screen compares the results from your current calculations to a projection for the following year to see how next years tax bill stacks up against your current tax year.

I love that they put the “looking at 2018” estimate on hear as well. You can see home the new tax bill will affect your bottom line next year. TurboTax TaxCaster gathers this income data while it starts applying your counter balancing data in order to lower your overall taxable income. You probably noticed your tax refund changing based on the life events you selected from the tax calculator. Different life events from getting married, going back to school, or growing your family can increase or decrease your taxes.

This should be an easy fix for any developer as soon as they read this review. How they did not catch this bug themselves before release is surprising. How fast they will respond will be an indicator if their professionalism. Additional tax deductions in the TurboTax TaxCaster tax breaks screen section include charitable contributions, and IRA, retirement fund contributions. For charitable contributions another top notch tracking tool is theTurboTax ItsDeductible App. And anIRA Contribution Calculator can help you determine how much you can invest tax free in your retirement account. Your W-4 employee withholding is governed by the W-4 withholding form your employer has that dictates how many exemption you claim in order to lower the amount of taxes you pay from each paycheck.

Tax breaks can come in a variety of forms, such as claiming deductions, taking advantage of credits, or excluding income from your tax return. Tax credits are more beneficial than tax deductions since they are applied directly to reduce your gross income . You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. The purpose of tax deductions is to decrease your taxable income, which then decreases the amount of taxes you need to pay to the federal government.

Tax calculators usually don’t ask detailed questions, so they might not take into account things such as detailed deductions and expenses for your business. These free tools are designed only to provide a basic estimate of your expected refund or money owed. It doesn’t account for ACA healthcare and federal discounts received, which was the crucial thing I needed it for. Discounts are granted based off estimated AGI at the start of the year, if your AGI ends up higher at the end of the year, you have to pay back the discount at tax time. And If you are over the amount to qualify, you pay it ALL back and end up owning THOUSANDS of dollars on your tax return. That single aspect can swing your tax refund in a huge way, and it’s not included in this app as far as I can tell.

For tax purposes, your adjusted gross income or AGI is essentially your total or gross income minus eligible deductions. You can use ourAGI calculatorto estimate your adjusted gross income using the most common income and deductions for US taxpayers.

Well, Non-taxable wages are wages an employee or individual receives without any taxes being withheld. The IRS definition of a non-taxable wage and tax-exempt income is quite narrow. Our new review of the updated 2020 TurboTax TaxCaster begins with an introduction into using this tax calculator app, and it includes some Hot Tips on how to get the most out of this tax time tool. Keep in mind, if you compare different 2020 Tax Calculators and get different results, it’s most likely due to different data entered by the user. In comparison, a higher estimated tax refund does not mean that the estimated results are correct. Contact one of our Taxperts and discuss all your tax questions via your Personal Tax Support page. The first step in preparing your federal tax return is determining your filing status.

I’ve used this app for years and I find it very useful in planning my taxes. In one occasion, regarding 2018 changes, they immediately responded to my email and provided an excellent explanation. Downloaded last year to estimate my tax return and understand what how my deductions worked. I downloaded it again this year and within 2 minutes had a rough estimate it was quick and easy. As the first question posed what are your total taxable wages you have to wonder what are none taxable wages?

Get More With These Free Tax Calculators And Money

This is a great way to get a heads up on future tax liability as well as encourage good tax planning practices. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor.

To help you reduce your taxable income, we aggregated ahuge list of deductionsmany people often overlook or aren’t sure how to use them to their advantage. Based on your information, it looks like you only have Social Security income and if this is correct, you generally will not owe taxes or get a refund and may not need to file a tax return. When getting ready to file your taxes, it’s a good thing to pay attention to your adjusted gross income . It can directly impact the how eligible you are for certain deductions and credits, which could reduce the amount of taxable income you report. Most income is taxable, whether you earn it or are paid as a return on your investment.

Not owing too much, or getting to big of a refund — which means you gave Uncle Sam an interest free loan. A dependent is a person who entitles the taxpayer to claim a dependency exemption. Each dependency exemption decreases the amount of income subject being taxed. The term “dependent” means a “qualifying child” or a “qualifying relative.”

To get an access to your organization’s account with all the data, request an invite. As your income increases into each higher tax bracket, that portion of income falling within the next tax bracket is taxed at that higher tax bracket rate. It is then added to the previous tax calculations from the lower tax brackets to determine overall tax liability.

With Family Sharing set up, up to six family members can use this app.

The Difference Between Federal Taxable Income And Federal Adjusted Gross Income

Both personal and dependent exemptions lower the amount of your taxable income. That ultimately reduces the amount of total tax you owe for the year. Credits differ from deductions and exemptions because credits reduce your tax bill directly. After calculating your total taxes, you can subtract any credits for which you qualify. Some credits address social concerns for taxpayers, like The Child Tax Credit, and others can influence behavior, like education credits that help with the costs of continuing your education. Click “Next” to review your results and see your refund or taxes owed.

All of your tax filing information will be in one place and the tax calculations will be more accurate with this full feature calculation. You may not need to file your taxes until mid-April, but if you want to know what you owe right now, you can use an online tax calculator. Several online calculators, such as those offered by TurboTax and H&R Block, can help you determine if your business will owe money or if you’ll be getting a refund.

Tax Breaks And Deductions

It’s super easy to use and helps me track where I might end up tax wise at the end of the year. I still have mine professionally done, but love to get a conservative view of where I am likely to land. This is where the meat and potatoes come into play to help get that tax bill whittled down as much as possible. Tax breaks are all those little things, “and sometimes substantial things” that really do add up to a lot when it comes to cutting taxes. Exemptions are used in combination to claiming dependents. By doing this the exemptions balance out the the tax advantage you get from having dependents so that your tax bill comes out close to even at year end.

, indicated that the app’s privacy practices may include handling of data as described below. For more information, see the developer’s privacy policy. TaxCaster is ready for tax year put on your favorite tax cardigan, sit back, and let the planning begin! We’ve updated the app with all of the latest 2020 tax laws. Send your TaxCaster data over to TurboTax to pre-select questions and start filing. See how easy it is to estimate your tax savings based on your yearly work-related expenses.